Know the Ultimate List of Battery Charger GST Rates

- 18 Aug 24

- 18 mins

Know the Ultimate List of Battery Charger GST Rates

- Applicability of GST on Batteries

- Input Tax Credit (ITC) Availability

- Place of Supply for Batteries

- Invoicing for Batteries under GST

- GST Rate and HSN Code for Different Types of Batteries

- Input Tax Credit (ITC) Availability on Batteries

- E-Way Bill Requirements for Batteries

- Modes of E-Way Bill Generation

- GST Implications on Batteries Used for Exempt Supplies

- GST on Sale of Batteries to End Users

- Overview of the Electricity Market

- Conclusion

Key Takeaways

- Energy Charges Influence Cost: Energy charges, calculated based on units of energy consumed, significantly affect operational costs across industries.

- Service Charges Cover Maintenance: Service charges encompass expenses related to the maintenance of electrical infrastructure and customer services.

- Technological Advances Boost Efficiency: Innovations in energy conversion technologies like static converters and electrical transformers optimize energy efficiency and supply.

- Compliance is Crucial: Adherence to regulatory and compliance requirements is essential for maintaining efficient and environmentally sustainable operations in the electricity market.

- Battery Technology is Transformative: Advances in battery technology, especially lithium-ion cells, are revolutionizing energy storage and consumption, impacting a range of sectors from automotive to consumer electronics.

The Goods and Services Tax (GST) has significantly reshaped the tax framework in India, simplifying the taxation system by amalgamating a multitude of central and state taxes into a unified system. This article dives deep into the nuances of GST as it pertains to batteries, a crucial component in various sectors ranging from automotive to electronics. Knowing the GST implications is essential for businesses and consumers alike to ensure compliance and optimal tax benefit.

Applicability of GST on Batteries

The Goods and Services Tax (GST) applicable to batteries for electric vehicles (EVs) in India has undergone significant changes to encourage the adoption of electric mobility. Here’s an outline of the current GST applicability, rates, and related regulations for electric vehicle batteries.

GST Rates for Electric Vehicle Batteries

Initially, batteries for electric vehicles, like lithium-ion battery packs, attracted a higher GST rate. However, in efforts to boost the electric vehicle market, the GST rate for batteries used specifically in electric vehicles has been significantly reduced from higher rates to 5%.

GST on Electric Vehicles and Related Equipment

- Alongside the reduction in GST rates for batteries, the overall GST on electric vehicles themselves was reduced from 12% to 5% to make these vehicles more affordable and competitive against traditional fuel-based vehicles. This change took effect on August 1, 2019, as part of a broader move by the Indian government to promote eco-friendly transportation.

- GST on chargers and charging stations for electric vehicles was also reduced from 18% to 5%, aligning with the incentives provided for the vehicles themselves.

Input Tax Credit (ITC) Availability

There is availability for input tax credit for businesses involved in the EV market, particularly those setting up charging stations or using EVs for business purposes. This measure helps reduce the overall cost of setting up infrastructure or a fleet that supports electric mobility.

- Supporting Policies and Incentives

The central and state governments have both implemented a number of additional financial incentives and subsidies to support the adoption of electric vehicles. These include subsidies on purchases, support for installing charging infrastructure, and other fiscal benefits aimed at reducing the operational costs of electric vehicles and their components.

- Market Impact and Future Prospects

The reduced GST rates have already begun to positively impact the electric vehicle market in India. Lower tax rates on essential components like batteries are likely to support a more affordable EV market's continued expansion. This supports the government’s objective of reducing carbon emissions and promoting local manufacturing under the ‘Make in India’ initiative.

Place of Supply for Batteries

The place of supply for batteries, particularly those used in electric vehicles, is determined based on several key principles outlined under the IGST (Integrated Goods and Service Tax) Act. Here's a detailed look at these principles, focusing on different scenarios:

- General Rule for Goods

The place of supply for goods is typically where the goods are delivered at the end of their movement. This holds true whether the goods are moved by the supplier, recipient, or third party.

- Bill-to and Ship-to Scenarios

When goods are supplied based on the directions of a third party (known as the 'bill-to, ship-to' model), the place of supply is the location of the third party directing the transaction, which could be different from the location where the goods are delivered.

- Goods not Moved

If during a transaction the goods are not moved either by the seller or the buyer (e.g., sales from a warehouse), the place of supply is the location of the goods at the time of delivery to the buyer.

- Installation or Assembly

For goods that require assembly or installation at a specific location, that location becomes the place of supply.

- Goods on a Conveyance

When goods are supplied to a recipient on board a conveyance (such as a ship, aircraft, or train), the place of supply is considered to be the location where the goods are taken on board.

- Import and Export

For imported goods, the place of supply is the location of the importer in India. For exported goods, the place of supply is considered outside India, typically where the goods are delivered.

These principles help in determining the GST implications of a transaction involving batteries, especially for electric vehicles, ensuring that the tax liability is correctly assigned based on the location of the transaction. This is crucial for both compliance and for businesses to plan their logistics and tax strategies effectively.

Invoicing for Batteries under GST

Invoicing for batteries under the GST system in India, particularly for electric batteries, requires adherence to specific standards to ensure compliance and facilitate the proper claiming of input tax credit (ITC). Here's a detailed overview of the invoicing requirements:

- Invoice Essentials

- A GST invoice must include the GSTIN of the supplier, the name and address of the supplier, and, if applicable, the GSTIN of the recipient.

- The invoice must provide the unique invoice number and date of issue.

- Details of the goods (like HSN code) or services (like SAC code), quantity, and total value must be clearly specified.

- The taxable value of the supply, the tax rate applied (CGST, SGST/UTGST, IGST, and cess, if any), and the tax amount must also be clearly detailed.

- E-Invoicing Requirements

For businesses with a turnover exceeding Rs. 5 crore, generating an electronic invoice (e-invoice) is mandatory. This involves the electronic authentication of invoices via the GST portal, which simplifies the verification process and integrates the data with the GST system..

- Place of Supply

The invoice must state the 'place of supply' along with the name of the state, which is crucial for determining the type of tax applicable (inter-state or intra-state)

- Export Invoices

For exports, the invoice should include a declaration stating that the goods or services are intended for export. This helps in distinguishing them from regular domestic supplies and enables businesses to claim refunds on the tax paid towards exports.

- Additional Invoice Details

If the invoice is issued under a reverse charge mechanism, it must be indicated.

The delivery address should be included if it differs from the billing address, which is especially relevant for the delivery of physical goods.

- Duplicate and Triplicate Copies

For goods, three copies of the invoice must be issued: the original for the recipient, a duplicate for the transporter, and a triplicate for the supplier to maintain as a record.

For services, two copies should be issued: the original for the recipient and a duplicate for the provider.

- Credit and Debit Notes

When adjustments to a previously issued invoice are required, credit or debit notes must be issued. These should contain details mirroring the original invoice to ensure consistency and accuracy in records.

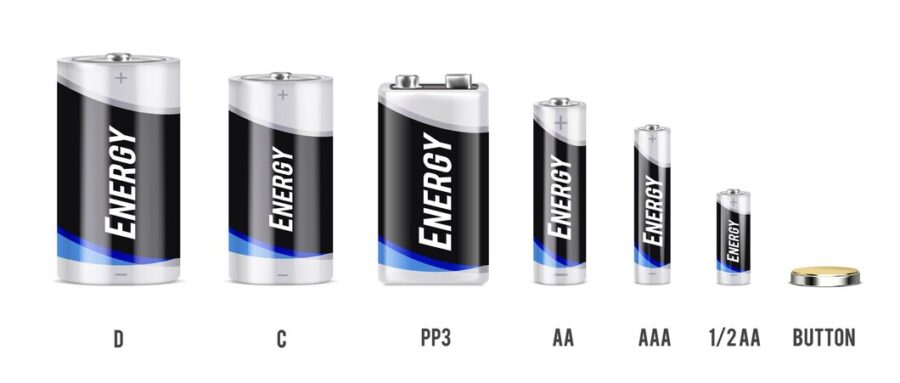

GST Rate and HSN Code for Different Types of Batteries

The GST rates and HSN codes for different types of batteries in India vary based on their use and type. Here is a detailed breakdown

| Battery Type | HSN Code | GST Rate |

|---|---|---|

| Primary Batteries (Non-rechargeable) | 8506 | 18% |

| Secondary Batteries (Rechargeable) | 8507 | 18% |

| Inverter Batteries | 8507 | 18% |

| Electric Vehicle (EV) Batteries | 8507 | 5% |

| Lead-acid batteries | 8507 | 18% |

| Solar Batteries | Varies | 5% |

It's important to note that these rates are subject to changes based on government policies, so it's advisable to verify the latest rates at the time of transactions. The classification under specific HSN codes helps in identifying the right GST rate for each type of battery, ensuring proper taxation and compliance.

Input Tax Credit (ITC) Availability on Batteries

The availability of battery input tax credit (ITC) under the GST regime in India has specific conditions and restrictions:

- General Eligibility for ITC

- ITC is available for business use to the extent used in making taxable supplies, including zero-rated supplies.

- Batteries used in the production of goods or for resale can avail themselves of ITC.

- Businesses must have valid tax invoices or debit notes to claim ITC.

- Conditions Specific to Batteries

- If batteries are used exclusively for taxable supplies or zero-rated supplies (like exports), full ITC can be obtained.

- If used partly for taxable and partly for exempt supplies (or non-business purposes), ITC can only be claimed proportionately based on their usage in business activities.

- ITC Restrictions

- ITC is not available for batteries used for personal purposes.

- Batteries used in making exempt supplies or where the end products are exempt from GST do not qualify for ITC.

- Documentation and Compliance

The ITC claim must be substantiated with appropriate documentation, such as GST-compliant invoices showing the GST paid on purchases.

Businesses must ensure that these invoices are uploaded by their suppliers in the GSTR-1 form, which then reflects in the buyer’s GSTR-2A, enabling the claim of ITC.

- Time Limit for Claiming ITC

ITC on batteries can be claimed up to the due date of the return for the month of September following the end of the financial year in which such invoice or invoice relating to such debit note was issued, or the date of filing the relevant annual return, whichever is earlier.

- Special Conditions

For capital goods like batteries used in machinery or for business infrastructure, ITC is available. However, if these capital goods are later sold or disposed of, the ITC claim must be reversed proportionately based on the time they have been used in the business before disposal .

- Provisional ITC Claims

Businesses can claim provisional ITC up to 10% of the eligible credit available if the details of invoices are not fully reflected in GSTR-2A. This helps manage working capital while ensuring compliance until full details are available.

E-Way Bill Requirements for Batteries

The requirements for generating an E-Way Bill for the transportation of batteries under GST in India include the following key points:

When is an E-Way bill required?

An E-Way Bill must be generated when the value of the goods being transported in a single invoice, bill, or delivery challan exceeds Rs. 50,000. This is mandatory for both inter-state and intra-state transportation of goods.

Who Should Generate the E-Way Bill?

- If the supplier is registered under GST, they must generate the E-Way Bill.

- If the supplier is unregistered but the recipient is registered, the responsibility to generate the E-Way Bill falls on the recipient.

- Transporters are also required to generate an E-Way Bill if neither the consigner nor the consignee generates it and the value of the goods transported is above the threshold.

Modes of E-Way Bill Generation

The E-Way Bill can be generated through multiple modes, including a web-based system, bulk upload facility, SMS-based facility, Android app, site-to-site integration, and via GST Suvidha Providers (GSPs).

- Information Required for E-Way Bill Generation

- Details required include the GSTIN of the consigner and consignee, the place of delivery, the invoice or challan number and date, the HSN code of the goods, and the reason for transportation.

- Transport document number and vehicle number are also required. If the vehicle number is not known at the time of E-Way Bill generation, it can be updated once the details are available.

- Special Conditions: For the movement of goods in a semi-knocked-down or completely knocked-down condition, separate E-Way Bills need to be generated for each vehicle carrying the different parts of the consignment based on delivery challans.

- Validity of E-Way Bill

The validity of the E-Way Bill depends on the distance the goods are to be transported. For every 100 km or part thereof, the validity is one day for transport by road. For air and rail, the validity is until the delivery of goods.

- Exemptions from E-Way Bill

- No E-Way Bill is required for the transportation of goods by non-motorized conveyances or for certain specified goods, which include perishables and life-saving drugs.

- Goods transported under customs supervision or under customs seal, or goods transported from a customs port, airport, or air cargo complex to an Inland Container Depot (ICD) or Container Freight Station (CFS) for customs clearance are also exempted from E-Way Bill requirements.

GST Implications on Batteries Used for Exempt Supplies

When batteries are used for making exempt supplies under GST, there are specific implications and requirements for input tax credit (ITC) and compliance. Here are the key points:

- ITC Reversal for Exempt Supplies

If batteries are used to manufacture goods or provide services that are exempt from GST, the input tax credit associated with the purchase of these batteries cannot be claimed. This is because ITC is only available for goods or services used for making taxable supplies.

- Calculation of ITC Reversal

The input tax credit attributable to the exempt supplies needs to be reversed. This includes credits on inputs, input services, and capital goods used for exempt supplies. The reversal must be calculated proportionately based on the value of exempt supplies compared to total supplies.

- Documentation and Compliance

Businesses must maintain proper records and documentation to support the calculation and reversal of ITC related to exempt supplies. This includes detailed invoices, allocation records showing the use of batteries in producing exempt supplies, and corresponding financial entries.

- Exempt Supply Notifications

Exemptions from GST for specific goods or services are usually granted through government notifications under sections of the CGST and respective SGST Acts. These notifications outline the conditions under which supplies are considered exempt and the implications for ITC.

- Supply Without Consideration

If batteries are supplied without consideration (e.g., free samples or promotional items), the input tax credit on these batteries must also be reversed, as these are considered non-business or exempt supplies under GST.

- Impact on Pricing and Compliance

The inability to claim ITC on batteries used for exempt supplies can increase the cost of production for businesses, as the GST paid on such batteries becomes a cost. This might also affect pricing strategies for the final products.

- Registration Requirements

Businesses engaged exclusively in exempt supplies are generally not required to register under GST. However, if a business deals in both taxable and exempt supplies, it must register and comply with GST requirements, including the reversal of ITC for the exempt portion of supplies.

GST on Sale of Batteries to End Users

The GST rate applicable to the sale of batteries to end users varies depending on the type of battery:

- Lead-acid batteries (including those used in electric vehicles when sold separately) are generally subject to a GST rate of 28%.

- Lithium-ion batteries, which are commonly used in portable electronic devices and electric vehicles, have seen a recent reduction in GST from 28% to 18%. This reduction aims to support the adoption and manufacturing of electric vehicles and renewable energy solutions in India. Other types of batteries, like nickel-cadmium or nickel-metal hydride, are also typically taxed at 18% under GST.

- These rates apply regardless of whether the batteries are sold for use in consumer electronics, automotive applications, or industrial settings. It's important for end users and businesses to verify the latest GST rates, as these can be subject to updates based on the decisions made in the GST Council meetings.

Overview of the Electricity Market

In the rapidly evolving electricity market, various factors influence both the production and consumption of energy. Here's an overview that integrates your provided keywords into a coherent discussion about the electricity market:

- Sale and Supply of Electricity

The electricity market is characterized by its complex structures for the sale and supply of electricity, which involve various stakeholders, including generators, distributors, and end-users. Supply and demand, legislative frameworks, and technological advancements in energy production and distribution all influence market dynamics.

- Energy charges and service charges

Energy charges refer to the costs associated with the actual consumption of electricity, which are typically calculated based on the units of energy consumed (measured in kilowatt-hours). Service charges, on the other hand, cover the costs related to the maintenance of electrical infrastructure and customer service operations provided by electricity companies.

- Impact of Electrical Energy on Consumer Products

The availability and cost of electrical energy directly affect the production and operational costs of consumer products. In industries where energy demand is high, such as in the manufacturing of electronic devices like mobile phones or the operation of battery charging stations, energy costs significantly influence the final product pricing.

- Role of Technology in Energy Conversion and Supply

Advanced technologies in energy conversion, such as the use of static converters and electrical transformers, play a critical role in ensuring efficient energy supply. These technologies help in converting the energy into usable formats while minimizing losses, thereby optimizing the overall energy efficiency of the supply chain.

- Compliance and Regulatory Requirements

Businesses operating within the electricity market must adhere to a complex set of compliance and regulatory requirements, which include direct tax compliance, secretarial compliance, and various business compliances. These regulations ensure that the operations are not only efficient but also align with national energy policies and environmental standards.

- Innovations in Battery Technology

Innovations in battery technology, particularly for electric vehicles (EVs) and mobile devices, are significantly impacting the electricity market. Developments in lithium-ion cells and other battery technologies are enhancing how energy is stored and used, leading to more efficient energy consumption patterns and supporting the growth of renewable energy implementations.

- Challenges in Energy Distribution and Transmission

The distribution and transmission of electricity involve several challenges, including energy loss during transmission and the need for robust infrastructure to handle the load. Companies like Chamundeshwari Electricity Supply Corporation highlight the ongoing efforts to improve electricity distribution to end-users efficiently.

- Future Trends in the Electricity Market

The future of the electricity market looks promising with increasing integration of renewable energy sources, advancements in smart grid technology, and more stringent regulations aimed at reducing carbon footprints. These trends are expected to reshape how energy is produced, distributed, and consumed globally.

This overview encapsulates the essential aspects of the electricity market, highlighting how various components, such as energy charges, technology, compliance, and innovations in battery technology, play pivotal roles in shaping market dynamics.

Conclusion

Understanding the GST specifics for batteries helps in correct tax application and optimal credit utilization. It's crucial for both businesses and end-users to be aware of these details to avoid any compliance issues and to budget effectively for taxes.

💡Facing delays in GST payment? Get started with PICE today and streamline your GST payments. Click here to sign up and take the first step towards hassle-free GST management.

By

By