IDBI Lifetime Free Credit Cards List: Everything to Know

- 1 Dec 25

- 5 mins

IDBI Lifetime Free Credit Cards List: Everything to Know

Key Takeaways

- The IDBI Lifetime Free Credit Card comes with zero joining and renewal fees, making it a cost-effective choice for all users.

- IDBI offers two lifetime-free options: Royale Signature and Aspire Platinum, both packed with rewards and benefits.

- With an IDBI lifetime free credit card, users can enjoy reward points, lounge access, fuel surcharge waivers, and insurance coverage.

- Eligibility for an IDBI lifetime free credit card includes being an Indian resident aged 21–60 (65 for self-employed) with valid KYC and income documents.

- You can apply for an IDBI lifetime free credit card online via the bank's website or offline by visiting any IDBI branch.

Finding a credit card with no joining or renewal fees is a real win in a country where more than 111 million credit cards are already in use. The IDBI Lifetime Free Credit Card stands out for its great benefits without any hidden fees.

This makes it perfect for smart spenders who want to save money and make things easier. IDBI Bank makes it easy to have a premium, fee-free experience, whether you apply online or in person.

So, read on to learn more about its features and who can use it.

List of IDBI Lifetime Free Credit Cards

IDBI Bank offers two different types of lifetime free credit cards. Let’s explore those cards below:

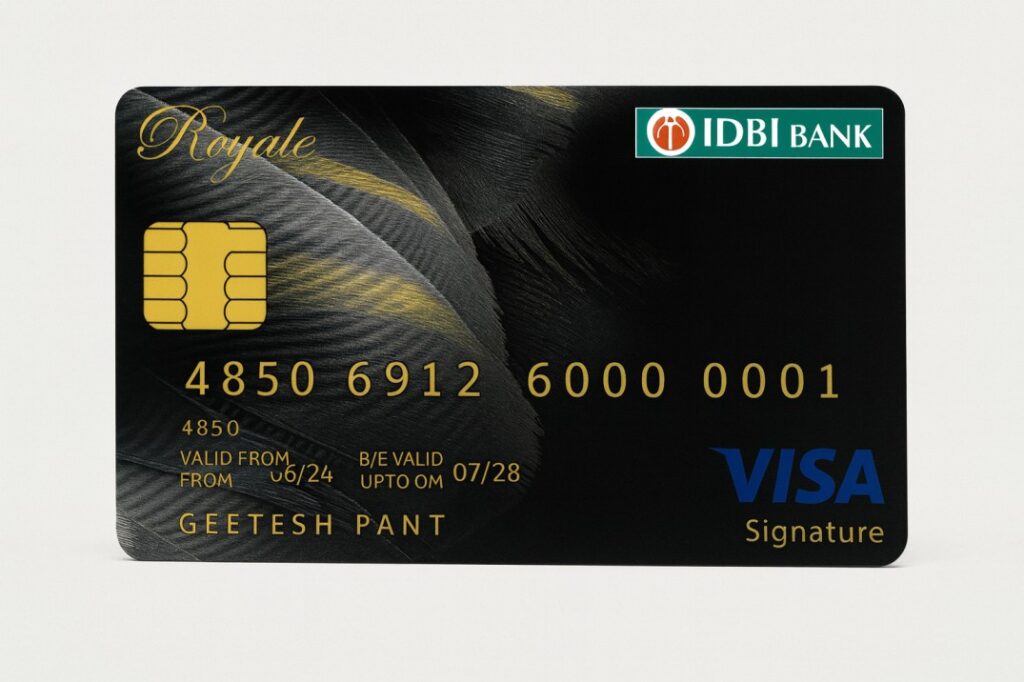

- IDBI Bank Royale Signature Credit Card

Features and Benefits

- Earn 3 Delight Points per ₹100 spent on travel, dining, and shopping.

- Get 750 Delight Points for spending ₹1,500 within 30 days (400 points if within 31–90 days).

- Enjoy up to 48 interest-free days on purchases.

- Get 1% fuel surcharge waiver (₹400–₹5,000 transactions; max ₹500/month).

- 1 free domestic airport lounge visit per quarter + ₹25 lakh air accident cover.

- Accepted at 9 lakh+ merchants in India and 29 million worldwide (Visa network).

The main feature of the IDBI Bank Royale Signature credit card is that it is an entry-level yet privilege-based card with no entry or renewal fees to the principal cardholders. It is indeed a lifetime free card under several listings. It aims specifically at cardholders who are willing to receive minimal luxury benefits (such as lounge access and insurance coverage) without paying the annual membership fee.

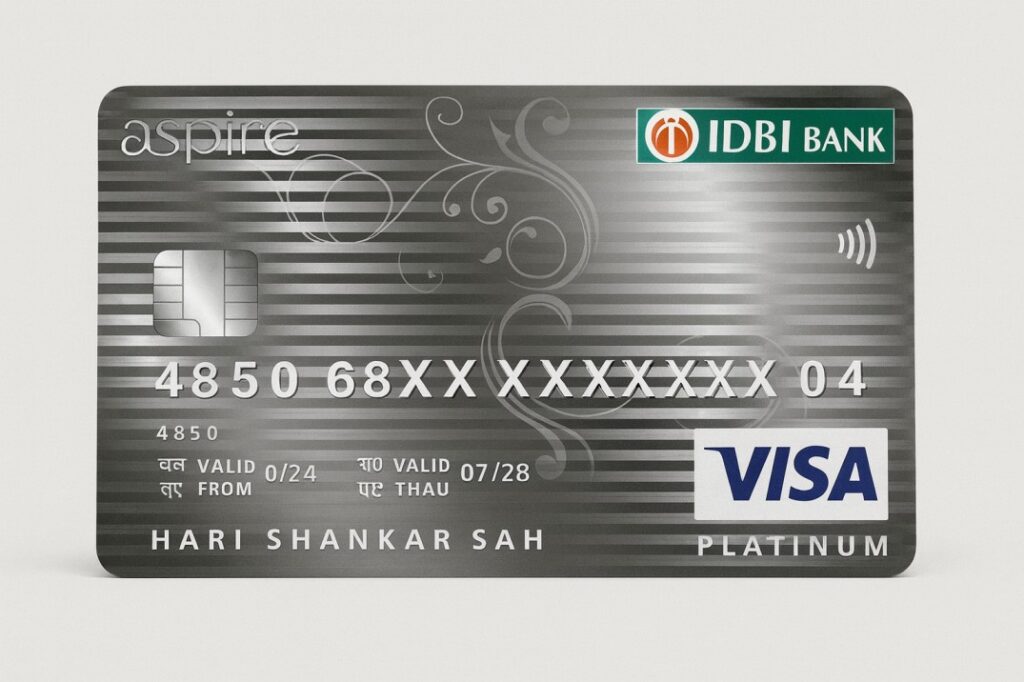

- IDBI Bank Aspire Platinum Credit Card

Features and Benefits

- Earn 2 Delight Points every ₹150 spent on purchases (shopping, dining, movies, travel).

- Earn 500 Delight Points when you complete a transaction of ₹1500 or more in the first 30 days of card issuance, and 300 points when you do so in the 31-90 days.

- Receive interest-free credit up to 48 days on purchases as long as you pay on the due date.

- Waiver of 1 per cent of fuel bill transactions between ₹400 and up to ₹4,000, with a maximum waiver of ₹300 per month.

- Acceptable across 9 lakh+ merchants in India and 29 million+ worldwide; also includes zero lost-card liability (within one month of loss reporting).

Another lifetime-free card of IDBI Bank is the IDBI Bank Aspire Platinum credit card. This card is aimed at users who are new to credit cards or who do not require an annual reward. It is characterised as medium pay, and fuel benefits are included in the package. Choose any of the two IDBI Lifetime Free Credit Cards and enjoy seamless, fee-free transactions.

💡Pay your credit card bills in an easy and secure way with the PICE App.

Eligibility Requirements of IDBI Lifetime Free Credit Cards

Individual cardholders opting for IDBI Lifetime Free credit cards should meet the following eligibility criteria. IDBI lifetime free credit card eligibility conditions include:

- Cardholder aged between 21 years and 60 years (65 years applicable for self-employed individuals)

- Must be a resident of India

- An add-on cardholder must be aged 18 years and above

Documents Required for IDBI Lifetime Free Credit Cards Application

Here are the documents mandatory to present during the application process of IDBI Lifetime Free Credit Cards:

- ID Proof: Driving license/Voter ID/Passport/PAN Card/Adhaar card

- Residence Proof: Telephone Bill/Electricity Bill/Aadhaar card/Election card/Passport

- Recent passport-sized photograph

- Income Proof: Latest bank statement for the last 3 months/ Salary slips for the latest 3 months / Form 16/ Income Tax Returns (ITR)

How to Apply for IDBI Lifetime Free Credit Cards Online and Offline?

IDBI's lifetime free credit card application process is simple and hassle-free. Follow the step-by-step procedure below for easy application:

Online Application

Step 1: Navigate to the ‘Credit Cards’ section located on the official website of IDBI Bank and then provide your contact details.

Step 2: A bank representative will approach you for verification to guide you further through the application procedure.

Step 3: Keep the KYC documents and income proof ready. Submit it as necessary.

Offline Application

You can also visit the nearest IDBI Bank branch, fill out the application form, submit relevant documents and continue following the bank’s process.

Conclusion

Choosing an IDBI Bank lifetime free credit card is a smart way to save money on annual and renewal fees while still getting great benefits. The IDBI Royale Signature and Aspire Platinum Cards let you join for free for life, earn great rewards, and use them all over the world. Always read the terms and conditions, because the benefits and waivers may change.

Make sure the card works with your spending habits, lifestyle, and financial goals. Apply now and make all your payments easier with the PICE App, your one-stop shop for safe, simple transactions.

By

By