YES BANK Credit Card: Types, Fees & Charges, How to Apply Online

- 21 Nov 25

- 10 mins

YES BANK Credit Card: Types, Fees & Charges, How to Apply Online

Key Takeaways

- A YES BANK credit card offers a wide variety of more than 20 personal and business card options suited for different spending styles.

- Benefits range from luxury perks like lounge access and concierge services to everyday rewards, cashback, and digital-first features.

- Multiple cards come with zero joining or renewal fees, making the YES BANK credit card range highly affordable.

- Eligibility depends on age, income, and ITR requirements, with options available for both salaried and self-employed individuals.

- Customers can easily apply online and pay bills through various channels, ensuring seamless management of their YES BANK credit card.

Digital payments have become a key part of our everyday lives. According to the Reserve Bank of India, credit card spending has seen year-over-year growth of 14.5%, reaching ₹1.89 trillion in May 2025.

Amidst this surge, choosing the right credit card isn’t easy. With more than 20 types of personal and corporate credit card options, YES BANK has struck the right chords of innovation, affordability and versatility.

Whether you are looking for premium perks or exciting rewards on every spend, there is a YES BANK credit card that will suit your needs.

Scroll down to find the best card matching your spending style!

10 YES BANK Personal Credit Cards with Exciting Features

From complimentary lounge access to an additional 7.5% discount on all Swiggy food orders up to ₹100, perks on every swipe of a YES BANK credit card are never-ending.

Here is a list of all the credit cards, along with their top features, to help you find what’s best for you:

- YES Private Credit Card

Key Benefits:

- Access to a network of 10000+ globally renowned medical experts.

- Complimentary visit to 850 international lounges with 12 guest visit access per calendar year across 400+ cities in more than 120 countries.

- Pay for 2 nights and get a 3rd complimentary night on suites at Oberoi Hotels and Resorts.

Say yes to the world of luxury with the YES Private credit card. This invite-only card offers 12 complimentary green fees per year, granting members access to international and domestic golf privileges.

The exclusive International Concierge Services of this let cardholders indulge in features such as unlimited lounge access, a dedicated personal health advisor, and more.

Note: 1 Reward point equates to INR 0.25

- MARQUEE Credit Card

Key Benefits:

- 4 Green Fee reversed at selected golf courses in India.

- Get an annual complimentary ET subscription worth ₹4500 on joining.

- Enjoy movies at your nearest theatre with the BookMyShow buy 1 get 1 offer.

The Marquee credit card sits just below the super premium tier. With 6 quarterly domestic lounge visits and unlimited international lounge access for primary and add-on cardholders, this YES BANK credit card is the ultimate getaway to luxury.

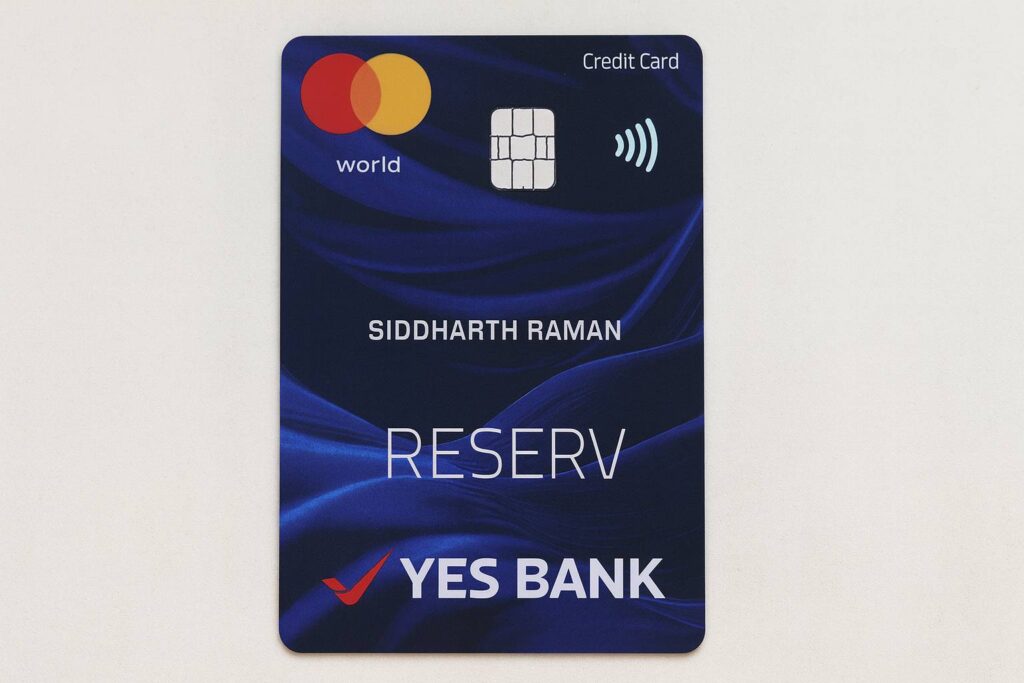

- RESERV Credit Card

Key Benefits:

- Get an instant 25% discount on movie tickets purchased through BookMyShow.

- 3 cumulative quarterly domestic lounge visits for the primary and the add-on cardholder.

- 6 complimentary visits to international lounges per calendar year to primary and add-on cardholders.

Adding value to every penny you spend, the YES BANK Reserv credit card offers comprehensive benefits along with luxurious privileges. Shop with this card and get 6 months of insurance coverage for digitally purchased mobiles and electronics up to ₹50,000.

- Elite+ Credit Card

Key Benefits:

- 4 Green Fee waived at selected Indian golf courses.

- 2 complimentary domestic lounge visits for the primary cardholder per calendar quarter.

- Get 12 YES Rewardz for every ₹200 spent online.

Missing out on all the rewards from your spending? Then, get the YES BANK Elite+ credit card to earn 3X or 5X rewards on every transaction. With the exclusive Rewards Subscription Plan, now you can choose the quantity of your rewards.

- ACE Credit Card

Key Benefits:

- Get 8 YES rewardz on every digital spend of ₹200 and more.

- 1% surcharge is waived on fuel transactions between ₹400 and ₹5000.

- The Purchase Protection Plan offers insurance coverage up to ₹50,000 for 6 months on virtually purchased mobiles and electronics.

This credit card is designed exclusively for high spenders who enjoy entertainment and dining at an affordable annual cost. Ideal for frequent travellers and business owners who maintain a perfect balance of financial flexibility, the YES BANK Ace credit card elevates your lifestyle with every swipe.

- RuPay Credit Card

Key Benefits:

- Earn 6 reward points on an e-commerce transaction of ₹200 and 3 reward points on other spends.

- 1% surcharge up to ₹250 is reversed on every transaction at fuel stations across India.

- Get 1.5% of cashback on every offline spend.

According to the Economic Times recent research, RuPay accounts for 16% of digital credit card spending in India, and the YES BANK RuPay credit card is one of the key reasons behind this. This no-cost virtual card gives you optimum financial empowerment and fail-safe protection against fraud.

Being a co-branded collaboration between YES Bank and Paisabazaar, this credit card is designed for the digitally active members. Virtual shoppers can earn 3% of cashback on every digital retail transaction.

- Wellness Plus Credit Card

Key Benefits:

- The primary cardholder can enjoy 2 complimentary lounge visits per quarter across 300+ lounges nationwide.

- Get 24x7 consultation with specialists, nutritionists and general practitioners through the IRIS by YES BANK app.

- Annual health check-ups of around 31 parameters, including eyes and dental.

This card is designed for individuals and families, focusing on comprehensive health and wellness lifestyles. Not only does it help you save on healthcare and wellness expenses, but it also offers 12 complimentary fitness sessions, including yoga, Zumba, and gym classes.

- YES Prosperity Business Card

Key Benefits:

- Earn 10,000 YES Rewardz on yearly spends of ₹600,000 and more.

- Travel comfortably with 1 domestic lounge visit per quarter.

- Get 1 golf lesson along with 4 additional sessions with a Green Fee waiver at selected golf courses in India.

YES Prosperity is an advanced business card that balances convenience with exclusive corporate privileges. Ideal for small to medium business owners, this card ensures seamless management of operational payments.

- YES First Business Card

Key Benefits:

- Get 2 domestic lounge visits per quarter.

- Enjoy 1 golf lesson with 4 additional green fee waiver sessions every calendar month at selected golf courses.

- MasterCard and VISA owners can get 6 complimentary international lounge accesses.

The YES First Business card is for business owners who seek a high credit limit and premium perks. Get 1% waiver of fuel surcharge on transactions between ₹400 and ₹5000 across all fuel stations in India.

Fees and Charges of YES BANK Credit Cards

Struggling to manage a credit card with charges?

Then, opt for a YES BANK credit card with zero joining and renewal charges. Here is a tabulated illustration explaining the fees of YES BANK credit cards to help you find a suitable one:

| YES BANK Credit Cards | Joining Fees (Excluding Taxes) | Renewal Fees (Excluding Taxes) |

| Private Credit Card | ₹50000 | ₹10000 (waived on ₹25,00,000 annual spending) |

| MARQUEE Credit Card | ₹9999 | ₹4999 (reversed on ₹10,00,000 on annual retail spend) |

| RESERV Credit Card | ₹2499 (waived on ₹40,000 retail spend in the first month) | ₹2499 (waived on ₹3,00,000 of annual retail expense) |

| Elite+ Credit Card | ₹999 (waived on spending ₹20,000 within the first month) | ₹999 (reversed on ₹2,00,000 annual spending) |

| ACE Credit Card | ₹499 (waived on ₹5000 retail spend in the first month) | ₹499 (waived on ₹50,000 retail spend in 12 months) |

| RuPay Credit Card | NIL | NIL |

| Paisabazar Paisasave Credit Card | NIL | ₹499 (Waived if you spend ₹120,000 annually) |

| Wellness Plus Credit Card | ₹1499 | ₹1499 |

| YES Prosperity Business Card | ₹499 (waived on the expense of ₹10,000 in the first month) | ₹499 (waived on the expense of ₹100,000 before the card anniversary) |

| YES First Business Card | ₹999 (reversed on spending ₹20,000 in the first month) | ₹999 (reversed on spending ₹300,000 yearly before card renewal) |

Disclaimer: The charges mentioned above are as of 30th Oct’25. Kindly visit the official website of YES BANK or visit your nearest branch to learn more about recent updates.

Eligibility Criteria for YES BANK Credit Cards

Interested individuals, whether salaried or self-employed, are eligible to apply for personal YES BANK credit cards between 21 and 60 years of age. However, each card comes with a minimum income or ITR requirement. Take a look:

| YES BANK Credit Cards | Minimum Monthly Salary Requirement (₹) | Minimum ITR Requirement (₹) |

| MARQUEE Credit Card | 300,000 | 3,600,000 |

| RESERV Credit Card | 200,000 | 1,800,000 |

| Elite+ Credit Card | 100,000 | 900,000 |

| ACE Credit Card | 25,000 | 750,000 |

| Paisabazar Paisasave Credit Card | 25,000 | 750,000 |

| Wellness Plus Credit Card | 20,000 | 750,000 |

| YES Prosperity Business Card | NA | 750,000 |

| YES First Business Card | NA | 10,00,000 |

Please note: All VISA and MasterCard holders of YES BANK are eligible to apply for the YES BANK RuPay credit card.

How to Apply Online for YES BANK Credit Cards?

- Step 1: Visit the official YES BANK Credit Card website.

- Step 2: From the credit card dropdown, choose your preferred card based on features and eligibility.

- Step 3: Click on ‘Apply Now’ and you will be directed to an eligibility assessment page.

- Step 4: Fill out the form and click on ‘Submit’.

- Step 5: You will receive an OTP on your registered mobile number. Verify the OTP, and if you are eligible, you will need to provide additional personal information, including your name on the card, address, occupation, etc.

- Step 6: Then, complete the verification process via video KYC.

- Step 7: Once validated, the system will generate an acknowledgement number that will help you track your YES BANK credit card status online using your application reference number.

YES BANK Credit Card Payment Methods

YES BANK provides multiple convenient payment options for all customers. YES BANK account holders can pay their credit card bills via:

- YES BANK NetBanking

- iris by YES BANK (mobile application)

- Standing instruction

All the other customers can complete the payment via:

- NEFT / IMPS / RTGS

- NetBanking

- Cheque or cash deposit at the nearest branch

- YES ROBOT

- YES PAY

💡If you want to pay all your credit card bills in just one click, then choose Pice.

It lets you pay and manage multiple credit card bills in a single app. You will also receive instant updates on payment reconciliation status, knowing if bills are paid or pending.

Conclusion

A YES BANK Credit Card offers much more than just credit; it is a gateway to lifestyle rewards, financial flexibility and digital convenience. Whether you are a business owner and frequent traveller, YES BANK's credit card range ensures a perfect fit for every user.

By

By