Top 6 SBI RuPay Lifetime Free Credit Cards in India

- 19 Nov 25

- 11 mins

Top 6 SBI RuPay Lifetime Free Credit Cards in India

Key Takeaways

- There is currently no SBI RuPay Credit Card lifetime free, but many options offer low joining fees and renewal fee waivers on achieving yearly spend targets.

- SBI offers multiple RuPay cards tailored for different needs, such as, shopping, travel, UPI payments, defence personnel, and railway bookings.

- Most SBI RuPay cards provide benefits such as reward points, fuel surcharge waivers, UPI compatibility, and global acceptance.

- Some cards, like Shaurya Select, offer zero joining fee and renewal fee waivers, making them close alternatives to an SBI RuPay Credit Card lifetime free.

- Proper usage and timely bill payments ensure that rewards outweigh costs, making these cards a practical substitute for an SBI RuPay Credit Card lifetime free.

Are you looking for an SBI RuPay credit card lifetime free? While the State Bank of India (SBI) does not currently offer any RuPay credit cards that have zero joining or renewal fees, you can still enjoy similar benefits.

There are various SBI RuPay credit cards that offer minimal joining fees and a renewal fee waiver when you meet a certain annual spending limit. Such cards not only offer customers convenience and rewards but can also be easily integrated with UPI payments for a smooth digital experience.

So, let us learn about the SBI RuPay credit card list in detail and understand the benefits that you can enjoy.

Top 6 SBI RuPay Lifetime Free Credit Cards in India

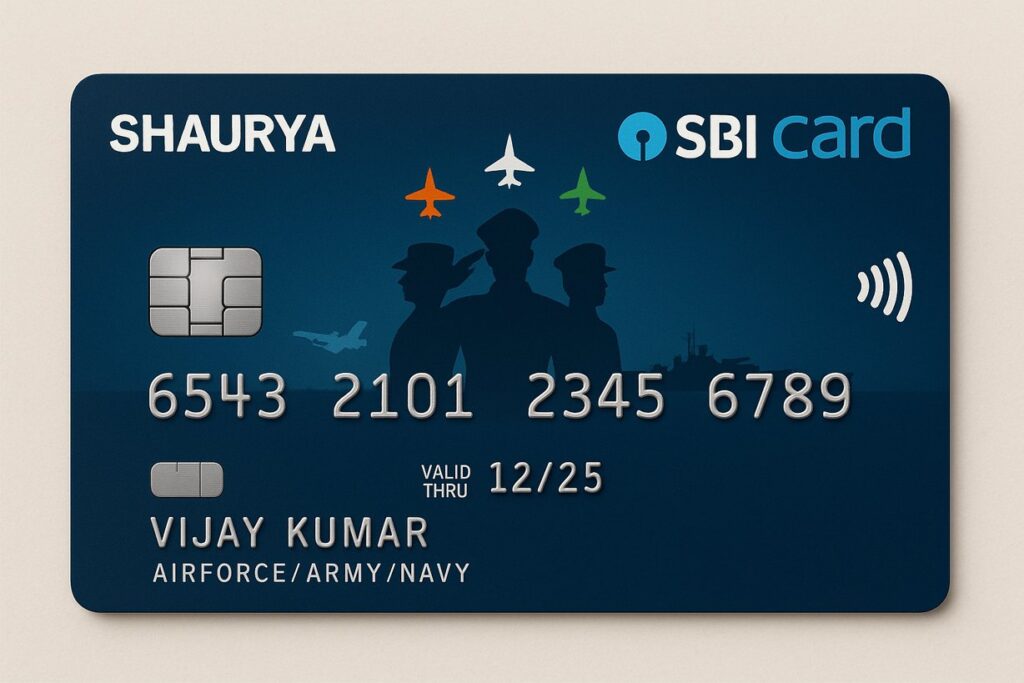

1. Shaurya SBI RuPay Card

The Shaurya SBI RuPay Credit Card is made for people in the military. It requires a nominal membership, reward points on all purchases, no fuel surcharge, and accidental death insurance. It offers secure RuPay payment options, making it a patriotic and rewarding choice for the families of Indian soldiers.

- Joining fees: ₹250

- Yearly Renewal Fees: ₹250. However, it will be waived off if you spend ₹50,000 or more on your credit card in the previous year.

Features and Benefits

- You can get 1000 reward points as a welcome gift when you pay your 1st annual renewal of the credit card.

- Earn 1 reward point every time you spend ₹100 on your Shaurya SBI Lifetime free Credit card.

- You can earn 5 reward points every time you spend ₹100 on select items, including CSD, Dining, Movies, Departmental Stores, and Grocery Spends.

- You can get a 1% waiver on the fuel surcharge at all fuel stations in India. This applies if you purchase fuel for ₹500 to ₹3,000.

- In the Shaurya SBI RuPay Card, RuPay offers complimentary Personal Accidental Insurance Cover worth ₹2 Lakh to their cardholders.

- You can use this SBI RuPay credit card lifetime free throughout the world. Its widespread network makes it available in 2 million+ ATMs worldwide.

2. SimplySave UPI SBI RuPay Credit Card

This SBI RuPay credit card takes convenience to the next level, enabling UPI payments on the card. You can link your SimplySAVE UPI SBI Card to any UPI app and enjoy free credit for everyday needs. Let us know about the features of this SBI RuPay credit card lifetime free, in detail.

- Joining Fee: ₹499/- only.

- Renewal fee: ₹499/- only. This will be waived in the next year if you spend ₹1 lakh in the previous year.

Features and Benefits

- You can link the SimplySave UPI SBI RuPay Credit Card to any UPI app and conveniently make your everyday payments.

- You can earn 2000 bonus points as a welcome bonus within the first 2 months. You just need to spend ₹2,000 within 60 days to get this.

- Earn 1 reward point every time you spend ₹150 on your credit card.

- You can earn 10 reward points every time you spend ₹150 on select items such as Dining, Movies, Departmental Stores, and Grocery Spends.

- You can get 1% fuel surcharge waiver across all fuel stations in India. This applies if you purchase fuel for ₹500 to ₹3,000.

- You can buy additional cards for your parents, spouse, children, or siblings who are 18 years of age or older.

- The SimplySave UPI SBI RuPay Credit Card is accepted worldwide at 24 million outlets.

Also Read: Best Lifetime Free Credit Cards in India

3. Reliance SBI Credit Card

The Reliance SBI credit card offers contactless payment services. You simply wave your card at a credit card reader to make your payments safely. You can get this credit card with affordable joining and annual fees, and the annual fee is waivable under certain conditions. Read more to know about it.

- Joining Fee: ₹499/- only.

- Annual Renewal Fee: ₹499/- (This amount will be waived in the next year’s renewal if you spend ₹ 1 lakh in the preceding year.)

Features and Benefits

- With this SBI RuPay credit card lifetime free, you will get a Reliance Retail Voucher worth Rs. 500/- after paying your joining fee. This means you get your joining fees back.

- Earn 1 reward point per ₹100 spent on general retail purchases except fuel, property rent, and wallet upload.

- Get 5 reward points per ₹100 spent on dining and movies.

- Earn 5 reward points per ₹100 spent on Reliance Retail Stores.

- Get 1% waiver on fuel surcharge across all petrol pumps across India. The spending amount must be between ₹500/- and ₹4,000/-, excluding GST and other additional charges.

- You can get additional benefits at participating Reliance Retail Stores. Click here to know about them in detail.

- The vast network allows you to withdraw cash at 24 million outlets worldwide.

- You can transfer the outstanding balance from other banks’ credit cards to the Reliance SBI Credit Card and pay back at lower interest rates and in EMIs.

4. Yatra SBI Card

The yatra SBI Credit card offers attractive vouchers at the time of joining that you can use while travelling. This is an ideal card for frequent domestic and international travellers. You can get this SBI RuPay credit card lifetime free at a reasonable price. Let us know about them in detail.

- Joining Fee: ₹499/- only.

- Annual Renewal Fee: ₹499/- only (This amount will be waived in the next year’s renewal if you spend ₹ 1 lakh in the preceding year.)

Features and Benefits

- The Yatra SBI card offers vouchers worth ₹8250 to its customers after they pay the joining fee. These vouchers are divided into categories of travel-related expenses. Read the T&Cs to know about them in detail.

Note: Your booking and travel must be complete before your vouchers expire.

- You earn 1 reward point for every multiple of ₹100 you spend on retail shopping except fuel purchases.

- Earn 6 reward points on every multiple of ₹100 spent on Yatra.com, Departmental stores and Grocery stores.

- This SBI RuPay credit card lifetime free offer of a ₹500 discount voucher for every ₹30000 you spend through your Yatra SBI Card.

- You get complete freedom from the fuel surcharge when you buy fuel worth between ₹500/- and ₹3,000. The maximum limit to this waiver is ₹100 per month.

5. Shaurya Select SBI RuPay Card

This SBI RuPay credit card lifetime free offers features and benefits that go well with frequent shoppers. You can attain this credit card for free. However, there is a renewal fee which is waivable under certain conditions. Read more to find the details about it.

- Joining Fee: Nil

- Renewal Fee: ₹1,499 (This amount will be waived in the next year’s renewal if you spend ₹ 1.5 lakh in the preceding year.)

Features and Benefits

- Earn 10 reward points for every multiple of ₹100 you spend on Dining, Movies, Departmental Stores & Grocery spends, including CSD canteens.

- Earn 2 reward points on every multiple of ₹100 you spend on all other spends.

- You can get a Pizza Hut e-voucher for spending ₹50,000 on your Shaurya Select SBI RuPay Card within a quarter.

- You can earn 1500 bonus reward points by paying your renewal fee.

- Get an e-Gift Voucher from Yatra or Pantaloons worth ₹7,000 on spending ₹1.5 lakh or more in a year.

- In the Shaurya Select SBI RuPay Card, RuPay offers a complimentary Personal Accidental Insurance Cover of ₹10 Lakh to its cardholders.

- Get a 1% waiver on the fuel surcharge at all petrol pumps nationwide for transactions between ₹500 & ₹4,000 only. The limit to this waiver is ₹250 per month.

- Additional benefits of this card include 24/7 concierge services. This means you can avail assistance with various items, such as gift delivery, flower delivery, restaurant referrals, etc.

6. IRCTC SBI RuPay Credit Card

The IRCTC SBI RuPay Credit Card is a co-branded card issued by SBI. Hence, you get additional benefits if you purchase tickets through the IRCTC website with this card. This credit card consists of a nominal joining and renewal fee. Read more to know about its fees and benefits in detail.

- Joining fee: ₹500/- only

- Annual Renewal fee: ₹500 only

Features and Benefits

- Earn 1 reward point for every multiple of ₹125 spent on retail expenses, excluding fuel.

- You get 350 activation bonus Reward Points as a welcome gift by making a single transaction of ₹500 or above. You need to spend this amount within 60 days of issuance, where fuel and cash spends are not admissible.

- You get 500 bonus reward points as a milestone benefit.

- Get 4 complimentary railway lounge accesses in a year. You can use your lounge access once every quarter.

- You can earn up to 10% value back as reward points when booking AC1, AC2, AC3, Executive Chair Car, or Chair Car train tickets via IRCTC using the SBI RuPay Credit Card.

- You can save 1% transaction charges on booking railway tickets on the IRCTC website with your credit card.

- Get 1% waiver on fuel surcharge across all petrol pumps in India for transactions between ₹500 - ₹3,000. The limit to this waiver is ₹100 per statement cycle.

- RuPay in this SBI RuPay credit card is lifetime free and offers great travel, golf, dining, and other entertainment options.

- You can use the Easy Bill Pay facility on this card to pay your electricity, insurance, telephone and other utility bills on time.

Other Fees and Charges of the SBI RuPay Lifetime Free Credit Card

Apart from the joining fee and annual renewal fee, you might have to pay other charges under certain circumstances, such as missing the payment due date or exceeding the limit. Here is a list of other charges on an SBI RuPay lifetime free credit card.

| Type of Charges | Amount |

| Interest on Late Payments | Up to 45% per annum |

| Late Payment Fees | ₹0 to ₹1,300, depending on the value of the overdue amount. |

| Overlimit Fee | 2.5% of the overlimit amount or ₹600, whichever is higher. |

| Cash Withdrawal Fees | 2.5% of the withdrawal amount or ₹500, whichever is higher. (The bank will charge it in the next statement.) |

| Foreign Exchange Fee (Forex Fee) | 3.5% |

| Card Replacement Fee | ₹100 to ₹250, depending on the card type |

| Payment Dishonour Fee | 2% of the payment amount or ₹500, whichever is higher. |

| Credit Card Bill Payment Fee (via cash) | ₹250 +Taxes |

| Utility Bill Payment Fee | If the utility bill amount exceeds ₹50,000, 1% of the total utility bill payment will be chargeable. |

Eligibility Criteria for SBI RuPay Lifetime Free Credit Cards

- Minimum Age: Minimum 21 years for salaried and 25 years for self-employed candidates.

- Maximum Age: 70 Years.

- Residency: Must be a resident of India.

- Income: Must have a decent and stable source of income. The specific amount depends on the type of card you will apply for.

- Credit Score: Must have a decent credit score. A credit score of 700 to 750 is ideal for having credit cards.

Steps to Apply for an SBI RuPay Lifetime Free Credit Card

Step 1: Visit the official website of the State Bank of India and navigate to its credit cards section.

Step 2: Search and choose the SBI RuPay credit card you wish to apply for.

Step 3: When you find it, click the card, then on the next screen, click “Apply Now”.

Step 4: Complete the application process by entering the required details, including personal, professional, and KYC information.

Conclusion

Overall, while currently, there are no SBI RuPay credit card lifetime free, there are several cards that come with minimal or waived renewal fees. The cards discussed above offer attractive value for frequent shoppers and travellers.

Nonetheless, late payment can turn any credit card into a financial burden. So, stay ahead of due dates effortlessly with the Pice App, which offers smart payment reminders and one-click bill settlements. It ensures you never miss a payment and always maintain a healthy credit score.

💡Visit the PICE App to find out how to pay credit card bills within minutes and experience hassle-free spending with credit cards.

By

By