Sales Order Vs Purchase Order Vs Invoice: Roles, Differences, Importance & More

- 27 Nov 25

- 7 mins

Sales Order Vs Purchase Order Vs Invoice: Roles, Differences, Importance & More

- Definition of a Sales Order

- Definition of a Purchase Order

- Definition of an Invoice

- Roles of Purchase Order, Sales Order and Invoice in the Transaction Process

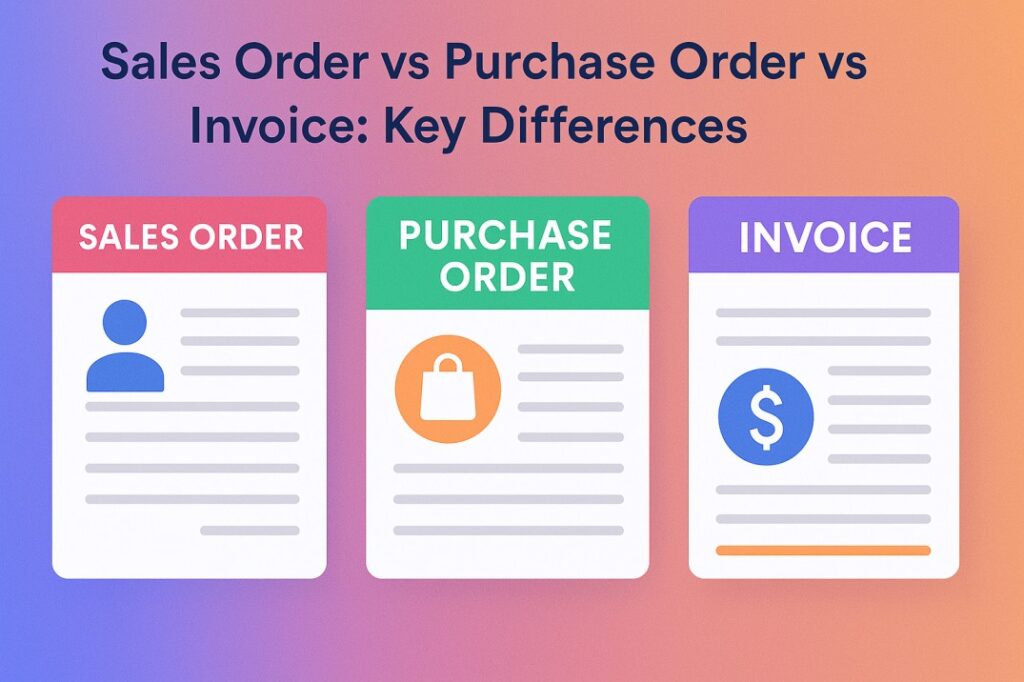

- Sales Order vs Purchase Order vs Invoice: Key Differences

- Importance of Commercial Documents in Financial Management

- Electronic Document Management in Modern Financial Operations

- Conclusion

Key Takeaways

- Understanding sales order vs purchase order vs invoice helps businesses streamline procurement, sales, and payment cycles.

- A purchase order initiates the buying process by formally requesting goods or services.

- A sales order confirms the seller’s acceptance of the purchase order and starts order fulfilment.

- An invoice is issued after delivery and serves as a formal payment request to the buyer.

- Comparing sales order vs purchase order vs invoice clarifies their unique roles in ensuring accuracy, accountability, and smooth financial operations.

Every business transaction relies on proper documentation to ensure clarity, accuracy and accountability. Among the most essential commercial documents are sales order, purchase order and invoice.

Each of them serves a distinct purpose in the transaction process. Knowing the differences between sales order vs purchase order vs invoice is critical for managing procurement, sales and payment cycles in an efficient manner.

Definition of a Sales Order

A sales order is a commercial document. It confirms the purchase of goods and services for buyers. It starts the order fulfilment process.

One important thing to note is that a sales order is not a payment request, but rather a confirmation that the order has been accepted by the seller and is being processed.

Definition of a Purchase Order

A purchase order is a commercial document that is issued by a business and sent to suppliers and vendors for placing orders. This type of order consists of details about items, quantities, prices and terms of goods. It becomes a legally binding contract when the suppliers and vendors accept the purchase order.

Definition of an Invoice

An invoice is given to the buyer by the seller to collect payment. They can be considered as payment reminders. Invoices contain details such as the name of the seller and client, invoice number, company logo, and a record of the products purchased or services rendered. It also contains other information like date, amount due and payment methods that the buyer has opted for.

Starting April 1, 2025, taxpayers with an Annual Aggregate Turnover (AATO) exceeding ₹10 crore will need to upload their e-invoices to the Invoice Registration Portal (IRP) within 30 days from the date of issue. Earlier, this time-bound requirement was applicable only to businesses with turnover above ₹100 crore.

Roles of Purchase Order, Sales Order and Invoice in the Transaction Process

The sales order system is a tangle of different components, which is simplified for businesses and clients by a simplified order tracking system. It involves purchase order, sales order and invoice. Here is an overview of the procurement process:

Step 1: Initiating with a Purchase Order

Prior to ordering products or services, a business first initiates a purchase order from the vendor or supplier. This purchase is then transmitted to the vendor via email or other digital communication mediums.

The vendor then receives the purchase order and enters it into the system. After which, the system checks the availability of goods in inventory and generates a sales order to confirm delivery.

Step 2: Confirming with a Sales Order

Then, a sales order is sent to the business as a confirmation of the purchase order. The buyer then reviews the sales order details and compares them with the terms of the purchase order to identify any potential discrepancies. After all checks are completed, the buyer sends a confirmation to the supplier regarding the delivery.

Step 3: Finalising with an Invoice

Finally, the supplier generates an invoice and sends it to the buyer. It is an important document that itemises the list of products purchased from sellers. It also provides a cost estimate to the buyers that needs to be paid.

Sales Order vs Purchase Order vs Invoice: Key Differences

It is easy to get confused between purchase order, sales order and invoice, especially if you are a new business owner. Each of the 3 components plays a different function in the procurement process.

Here is a list of key differences between the three of them based on different aspects:

1. Content Differences

| Type of Transactional Commercial Documents | Information Provided |

| Purchase Order | Date of OrderFOB Shipping InformationDiscount TermsNames of Buyer and SellerDescription of Purchased GoodsNumber of ItemsPrice of ItemsPurchase Order Number |

| Sales Order | Seller's Name and Contact InformationBuyer's Name and Contact InformationBilling and Shipping Information of BuyerInformation of Purchased ProductsPrice Before TaxesDelivery, Tax and Shipping ChargesFinal Price After TaxesApplicable Terms and ConditionsSignature |

| Invoice | Unique Invoice NumberDetails of BusinessDetails of ClientDue Date and Invoice DateDelivery DateTotal Due AmountPayment TermsMethod of Payment |

2. Sequence Differences

The procurement process of businesses begins with a purchase order. Then the buyer expresses their intent to make a purchase of goods, and the seller responds to this request by issuing a sales order. Finally, an invoice is generated and sent to the buyer for payment processing.

3. Functional Differences

A purchase order represents a request by a buyer to a supplier for goods and services. Whereas, a sales order shows a commitment from a buyer to purchase goods, detailing products and their prices. An invoice is a document issued after delivery, requesting payment to the buyer for supplied goods and services.

Importance of Commercial Documents in Financial Management

Commercial documents such as purchase orders, sales orders and invoices are important for maintaining effective financial management in business. These documents ensure a smoother flow of transactions, prevent errors and help with accurate record-keeping. All of which are crucial for the financial health of an organisation. Here are a few features of them:

1. Ensures an Accurate Procurement

Business documents for commercial transactions play a key role in the procurement process. For instance, a purchase order plays a key role in it by clearly defining what is being ordered, including its quantity, price and the terms for purchase. It helps to prevent any discrepancies between what has been requested and what is delivered.

When comparing sales order vs purchase order vs invoice, the purchase order serves as the foundation. It ensures that procurement aligns with the needs and budget of any company.

2. Facilitates the Payment Processes

In the financial workflow, business documents play an essential role in initiating and managing payments.

When considering sales order vs purchase order vs invoice, each plays a role in streamlining the payment process. This structured documentation helps prevent disputes, ensures financial accuracy and supports effective management of cash flow.

💡For your invoice generation needs, use the PICE App.

Electronic Document Management in Modern Financial Operations

The shift from paper-based systems to electronic document management has now revolutionised how businesses handle commercial documents such as sales orders, purchase orders and invoices. Digital solutions improve accessibility, reduce risk and ensure much better control over financial transactions.

Benefits of Digital Transformation

- Digitising documents enables streamlined workflows, automation and fewer chances of manual errors.

- When looking at sales order vs purchase order vs invoice, digital formats enhance visibility and traceability.

- Automation tools can help match documents, highlight discrepancies and generate real-time insights. It can drive better financial decision-making control.

Streamlining Communication

- Electronic documents facilitate seamless communication between departments and external partners.

- Everyone gets access to the same information, improving transparency.

- Reduces delays caused by manual handling.

Enhancing Accuracy and Efficiency

- About 66% of businesses say processing invoices takes them more than 5 days per month. By managing commercial documents digitally, businesses can speed up the procurement cycle.

- It also improves financial accuracy and enhances overall operational efficiency.

Conclusion

The differences between sales order vs purchase order vs invoice highlight how each has a significant role in streamlining business transactions. Each document serves a specific function in tracking, managing and validating transactions. Together, they ensure financial control throughout the transaction process.

By

By