What are the Differences Between Cost Price and Invoice Price?

- 21 Nov 25

- 7 mins

What are the Differences Between Cost Price and Invoice Price?

Key Takeaways

- The difference between cost price and invoice price helps businesses understand true production cost versus selling price.

- Cost price includes direct and indirect manufacturing expenses, while invoice price adds loading, overheads, and profit margin.

- Loading explains why the invoice price is higher than the cost price, especially in consignment accounting.

- Understanding the difference between cost price and invoice price improves GST calculation, pricing strategy, and profitability analysis.

- In consignment, adjusting loading ensures accurate profit reporting and highlights the difference between cost price and invoice price clearly.

Ever wondered why the price on an invoice is often higher than the actual cost of a product? That difference is not a mystery; it is a deliberate accounting practice called loading.

In fact, understanding the difference between cost price and invoice price can help Indian businesses better track profits and manage consignment sales. With India’s average gross profit margin at 36.56%, grasping this concept could directly impact your financial decisions.

So, let us break it down with practical examples and insights tailored for Indian businesses.

4 Key Differences Between Cost Price and Invoice Price

| Features | Cost Price | Invoice Price |

| Focus | It is the total amount of money that a businessperson spends on the manufacture or production of an item. | An invoice price is the final price that a buyer is due to pay to a seller, whether it is for B2C or B2B. |

| Components | It comprises of all direct and indirect expenses that a manufacturer incurs at time of production. | Invoice price consists of all the expenses incurred in various departments of a business, including their additional profit margins. |

| Need | This helps a businessperson to determine their actual cost of making an item. | This helps a business person to determine the amount of profit they are making while selling that item. |

| Loading Price | There is no loading price in the cost price of making an item. | Invoice price consists of a loading price. It is the actual difference between cost and invoice prices. |

💡Use the PICE App for your invoice generation needs

Differentiating Between Cost Price and Invoice Price With an Example

After understanding the difference between cost price and invoice price, below is an example for you to have a clear idea about both.

Imagine Mr. X, who is in a manufacturing business, makes headphones. Now, his Cost price or CP for making headphones comes to ₹600 / unit. Now, he sells his goods at a profit of ₹100/ unit. There is an additional handling cost of ₹20 and a marketing cost of ₹30/ piece. What would be his invoice price?

Now, cost price + loading price = Invoice price.

Hence, CP = ₹600

Loading Price ₹150 (20+30+100)

Hence, Invoice Price = ₹750 (600+150)

Key Takeaways from This Example

- CP or cost price equals a sum of indirect and direct manufacturing costs.

- Loading price is the cost of other expenses (not related to manufacturing purposes) along with the profit margin.

- Invoice price is the sum total of all direct and indirect expenses and their profit.

Why This Difference Matters for Indian Businesses

In India, it is important to understand this difference for the following reasons:

1. GST Compliance

Goods and Services Tax (GST) is charged on the transaction value, i.e., invoice price, not the cost price. This affects:

- GST liability

- Calculation of input tax credit

- Pricing strategies

For example, a manufacturer has set a selling price of ₹1,000 and place a margin of 30%. Invoice price is ₹1,300. GST @18% is levied on ₹1,300, not ₹1,000.

This affects pricing competitiveness and working capital directly.

2. Consignment Accounting

In India, most businesses, particularly in textile, pharma, and FMCG businesses, are on a consignment basis. Here:

- The consignor dispatches goods at invoice price (incorporates presumed profit).

- The goods are sold by the consignee, and actual proceeds are paid.

- The invoice price minus the cost price is referred to as "loading".

- This "loading" is reversed in the books for accounting for actual cost and proper profit.

Example:

ABC Textiles (Ludhiana) dispatches 1,000 sarees to a Mumbai retailer on consignment:

- Cost Price: ₹500

- Invoice Price: ₹650

- Loading: ₹150 per saree

When 600 sarees are disposed of, ₹90,000 (600 x ₹150) loading must be undone in the books of the consignee to equate cost with actual profit.

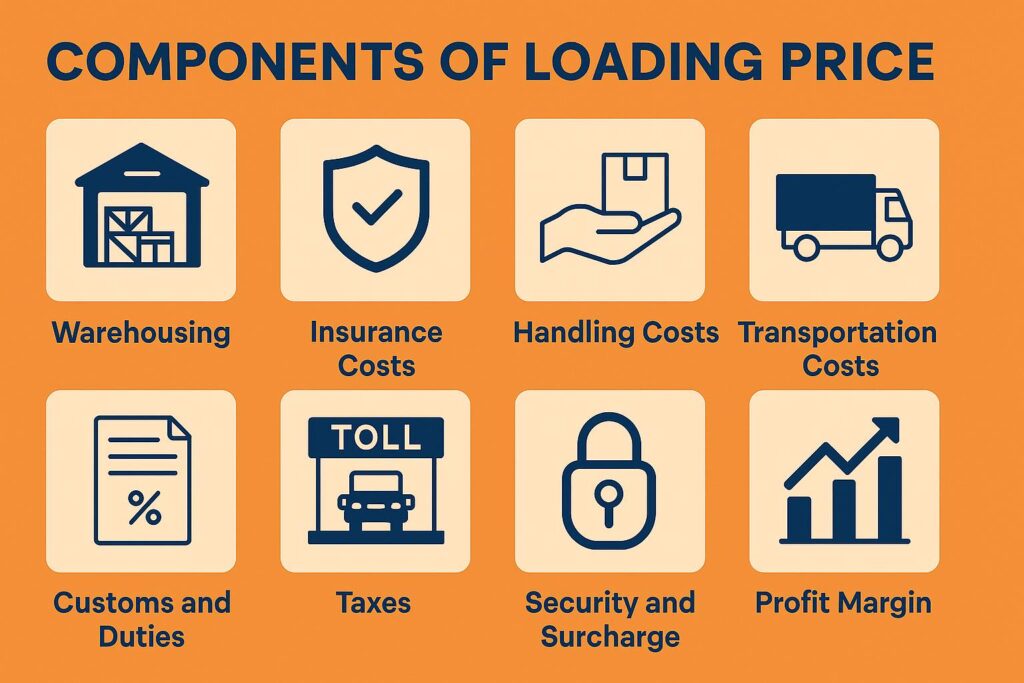

Components of Loading Price

All kinds of expenses that are not directly or indirectly related to the loading price are a part of the loading price, along with the additional profit margin and commission of a seller. Here is a detailed distinction on various components of a loading price.

- Warehousing: Once the manufacturer makes a product, it needs warehousing. However, it is not a part of production costs. Hence, it counts as part of the loading price.

- Insurance Costs: Business people often insure their raw materials to stay safe from threats on the roads, like accidental damage, theft or burglary.

- Handling Costs: Handling costs are a fee for loading and unloading goods in ports or any other transportation sites.

- Transportation Costs: It is the cost of transporting goods from one place to another in trucks.

- Customs and Duties: If you are transporting your goods into international lands. You will have to pay customs duty while exporting your items. This adds to the loading price.

- Taxes: Trucks have to pay toll plazas multiple times on highways during transportation. This adds to the loading costs.

- Security and Surcharge: It is the fees that businesspeople pay to individuals whom they hire to ensure the security of their products at transportational junctions like airports or docks.

- Other Fees: Other fees can include documentation costs or any other additional costs during transportation or marketing.

- Profit Margin: Finally, the businessperson sets a price after adding a profit margin to it. Often, the loading costs cut down the profit. For instance, banks see the highest profit of 100% gross, however, receive only 30.89% net (even though it's a service sector and they do not need to deal with real goods)

What is the Stock Reserve in a Consignment?

A stock reserve consignment is a balance sheet that acts as a contra-asset account. People use this accounting to protect themselves from losses due to dead stock. Most businesses are left with a part of their stock at the end of a financial year.

They do not sell for various reasons, such as expiry, being outdated, a change in trends, etc. Businesses protect themselves from these losses by adding a line to the income statement called "stock reserve A/c."

Now, as the invoice price is already set, this reserve acts as a buffer against abnormal losses to the remaining stock and offers financial stability.

Conclusion

Most businesses do not want to expose their direct profit from the items they sell. This is why they use the concept of loading price, which is a combination of profit margin and all other costs except for manufacturing costs. To use this concept, you must understand the difference between the cost price and the invoice price.

This system also helps you to keep track of your product manufacturing costs specifically, and helps you think of innovative ways to lower the manufacturing costs.

By

By