Key Differences Between a Voucher and an Invoice

- 21 Nov 25

- 11 mins

Key Differences Between a Voucher and an Invoice

Key Takeaways

- The difference between voucher and invoice lies mainly in purpose. Vouchers record internal payments, while invoices request payment from customers.

- A voucher acts as proof of payment, whereas an invoice is proof of sale.

- Vouchers circulate within the business, while invoices travel from seller to buyer.

- Invoices carry legal GST implications, while vouchers are used for internal accounting control.

- Digital tools simplify creating both documents, helping businesses maintain compliance and streamline financial processes.

Both invoicing and generating a voucher are key steps to legally and safely execute a transaction between a seller and a buyer. An invoice is the first document that a seller generates whenever they sell something.

Whereas, a voucher is documentary evidence that authorises the payment of business receipts internally and helps to ease the money transfer process.

However, a noticeable number of people confuse vouchers with invoices. Well, by the end of this blog, you will know about the key differences between a voucher and an invoice, along with a conceptual idea of both.

Difference Between Voucher and Invoice

A voucher and an invoice are both important documents for a business to prove its compliance with the GST rules and regulations. However, to get a complete idea of their purpose, here is a list of key differences between vouchers and invoices.

| Feature | Voucher | Invoice |

| Meaning | A voucher is a document that serves as proof of payment. It is used by the accounts payable department of a company to record financial transactions and maintain internal control. | An invoice is a document containing sales information that vendors give to buyers whenever they make a credit sale. |

| Sequence of preparation | A business generates a voucher after making trade payables. | An invoice is the first document generated after a sale. |

| Details | Contains information on the debit and credit balance of the vendor and business books. | Contains complete details of the transaction, such as items sold, amount, GST applicable, etc. |

| Legal Implications | No legal implications. Businesses generate this document for internal business purposes to maintain accounting records. | All GST-registered businesses with an annual aggregate turnover of ₹5 crore or more have to create e-invoices for business transactions. |

| Cash Flow | Vouchers drive cash outflow for a business as it is a legal proof for payment made to a vendor. | Invoices do not trigger any cash flow. |

| Direction of Transfer | A voucher travels within the business from one of the departments to the accounts payable department to maintain accounting records. | An invoice travels from the business to the customers who are paying for the goods or services they received. |

Types of Vouchers

Businesses generate various types of vouchers from accounting transactions, such as debit vouchers and secondary vouchers. Here is a detailed list of the important ones:

- Payment Voucher: When there is a cash transaction from the business for any goods or services purchased, a payment voucher is generated. The buyer pays the amount when the vendor authorises and approves it.

- Petty Cash Voucher: Businesses generate this voucher to keep a record of miscellaneous or petty cash expenses. This helps the accounts payable department maintain up-to-date accounts.

- Journal Voucher: In a business, many internal transactions do not involve money transfer. However, this affects the general ledger accounts of a business. Hence, they make journal entries to adjust the imbalances.

- Gift Certificate Voucher: Some businesses offer a discount for making pre-payment for goods they might make a purchase order for in future. This discount is an expense for the business, which makes them create a gift certificate voucher to balance it.

- Inventory Receipt Vouchers: Businesses generate this voucher to record the purchase of inventory items. This helps businesses understand the costs and quantities of expenses.

- Contra Vouchers: Contra expenses do not affect the main account’s balance. However, there is a change in books. For instance, “bank a/c (dr) ₹500; To, Cash a/c (cr) ₹500. Businesses generate contra vouchers to keep a record of the exact balance in all the ledger accounts.

Details Included in a Voucher

A standard voucher consists of a number of important details that one needs to fill out before sending it to the accounts payable department. Here is a list of these details.

- Type of Voucher: It should have the name of the type of voucher a department is creating to send to the accounts payable department.

- Date: A voucher should have its date of creation in it.

- Voucher Number: All vouchers have a unique voucher number. Make sure your voucher has this number.

- Amount Paid: This refers to the amount of cash payment to a particular vendor.

- Terms and Conditions: All vouchers must have a section that clearly states the terms and conditions of that voucher.

- Signature: A signature of the cashier is necessary to make your voucher eligible.

Format of a Voucher

Vouchers come in various types depending on the nature of the transaction. However, the payment voucher is the most common type of voucher.

Here is the format of a payment voucher:

PAYMENTS VOUCHER

[Your Company Name/Organisation Name]

[Your Company’s Address]

[Your Company Contact Number/Email]

Date:

Voucher Number:

Debit Account Name(dr):

Credit Account Name(cr):

Total Amount:

Narration:

Authorised By:

Prepared By:

Signature of Cashier:

💡Use the invoice generation tool on the PICE App for your invoice needs.

Benefits of a Voucher

Vouchers are legal documents that help to streamline cash transactions and improve transparency. Here are some benefits of vouchers and using e-voucher generators:

- Bulk Payment: A business has to make several payments to its parties to sustain itself. Using e-voucher generators facilitates making bulk invoice payments in one go.

- Automatic Smart Payment: Software for e-vouchers helps to automatically segregate vouchers for approval and payment. This increases productivity by helping with payment plans.

- Trustworthy Payment Option: E-voucher generators help ensure that the payment processing is accurate. This helps people to make bulk payments altogether.

- Streamlined Audit Trail: All vouchers have their own unique voucher number. This enables easy tracking and increases efficiency in accounting and auditing the books of accounts.

- Transparency: Digital vouchers are easy to find and their unique voucher number helps prevent fraud. This builds transparency in business-to-business relationships.

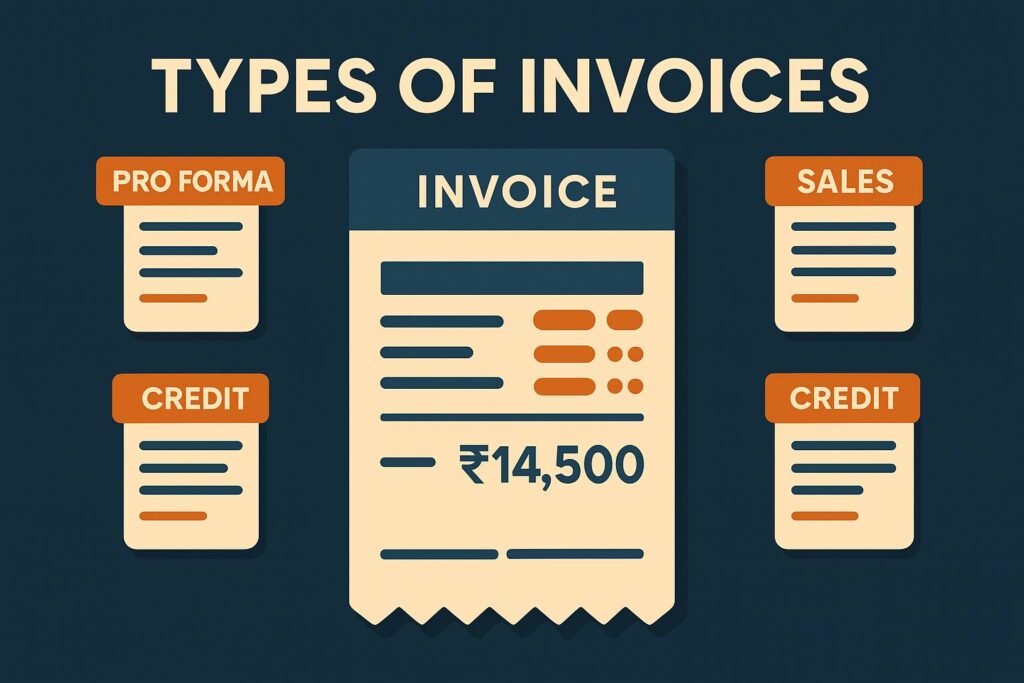

Types of Invoices

There are various types of invoices that businesses use to execute transactions between buyers and sellers. Here is a list of some important invoices:

- Pro Forma Invoice: This is a preliminary invoice that a seller provides to their buyers before finalising the sale and delivering the goods to the buyer. Since this is a preliminary invoice, its only use is to help buyers understand what they should expect in cost and goods out of that deal. This is not a demand for payment.

- Sales Invoice: A sales invoice, or the standard invoice, is a legal document that a seller issues to a buyer after delivering their goods and services as proof of sale. It contains all necessary information about the sale and acts as a formal request for payment.

- Debit Invoice: A debit invoice is a document that sellers send to buyers to increase the billing amount. This can happen due to various reasons, such as an error in the original bill or an increase in services provided etc.

- Credit Invoice: Buyers send this to reduce the final amount from the original invoice. This happens when the customer returns their goods or gets a discount.

Note: Other types of invoices include commercial, recurring, final and utility invoices.

Details Included in a GST-Compliant Invoice

An e-invoice must have some mandatory sections with details to remain GST-compliant. Here is a list of details you must have in your e-invoices:

General Details

- Customer Details: An invoice must contain relevant customer details such as the buyer’s official name or business name, address and GSTIN number.

- Supplier Information: Your invoice must have your business’s name, GSTIN number and address.

- Other Invoice Details: Other basic details in an invoice include your unique invoice number, its issue date and due date.

Goods or Services Detail

- List of Product Names: An invoice consists of the full name of a product or service that a person is buying. You can find it in the particulars section.

- Quantity: Alongside the particulars section, there is a column for quantity. This section signifies the volume of goods bought.

- Price per Piece: This column comprises the price for each unit of the product or service that a customer buys.

- Tax Information (GST): An invoice must have a column for the applicable rate of GST, even if no GST is applicable on the particular product that a customer is buying. The government decided the rate of GST on each product or service.

Transaction Details

- Total Amount: This section represents the total amount payable by a buyer after calculating the total and adding the GST taxes.

- Payment Terms: Your invoice must clarify the due date for payment and the credit terms of the invoice.

- Mode of Payment: Clarify the mode of payment a customer intends to use. For example, UPI, cash, bank NEFT, etc.

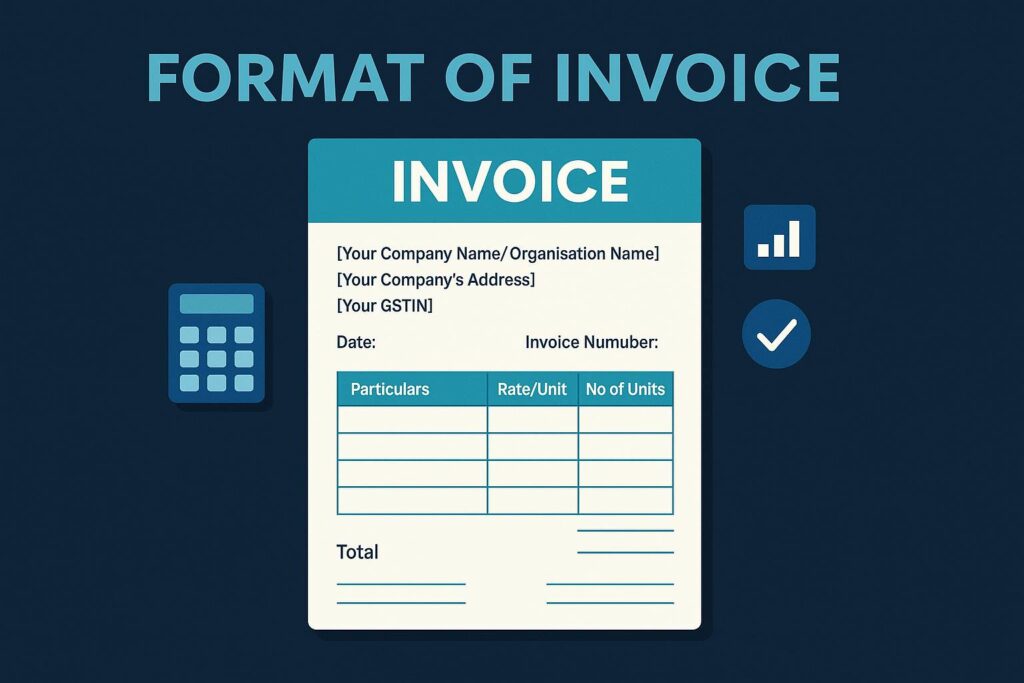

Format of Invoice

Good invoicing software is known to provide GST-compliant invoices to its users. Here is a format of a standard invoice. This will help you understand the differences between a voucher and an invoice better:

INVOICE

[Your Company Name/Organisation Name]

[Your Company’s Address]

[Your GSTIN]

Date:

Invoice Number:

Name or Business Name of Customer:

Address of the Customer:

Customer’s GSTIN (If Applicable):

| Particulars | Rate/Unit | No of Units | Rate of GST | Amount |

| Hair Oil | 100/- | 50 pc | 18% GST | 5,900/- |

| Toothpaste | 100/- | 50 pc | 18% GST | 5,900/- |

| Soap | 50/- | 50pc | 18% GST | 2,950/- |

| Total | 14,750/- | |||

| Add, Shipping and Handling Costs | 100/- | |||

| Total Amount Payable | 14,850/- | |||

Please pay your invoice by-______ (Due Date)

_____ (Sign)__________

(Sales Manager)

Benefits of Invoicing

All registered B2B businesses have to generate e-invoices in India as per the GST laws. Hence, compliance with GST rules becomes an obligation for businesses. However, here is a list of the benefits of e-invoicing:

- Time Efficient: Manually drafting a standard invoice for every business transaction can take up a lot of human time. E-invoicing can take place within minutes, and you can print multiple copies of it at once.

- Cost Efficient: Businesses have to hire a separate employee to manually draw up so many invoices. Moreover, there are stationary expenses. Whereas your computer can easily develop e-invoices through its software and store them in its database.

- Reduces Errors: E-invoicing software in India can directly connect to the GST portal and auto-populate some of the details. This helps to ease your task and reduce the probability of mistakes when filing GST returns like GSTR-1.

- Improves Safety: Having a digital database and saving your data in a cloud-based storage unit can save you from losing your financial records.

- Fast Transmission: There have been cases where customers missed their due date as they received their invoice too late via post. E-invoicing can facilitate the instant transmission of invoices to customers via email or message.

How Many Copies of Invoices Do Businesses Have to Generate?

Most businesses have to handle approximately 500 trade deals in a month, and businesses have to generate 3 copies of invoices for a single transaction, making them generate more than 1,500 invoices per month. This becomes a huge task if you are not e-invoicing. Let’s know where the 3 copies of the invoices go:

- The first and the original copy goes to the customer by email or SMS.

- Second copy is attached to the goods.

- The seller retains the last copy for themselves for reference purposes. They also use it to track credit sales.

Conclusion

Vouchers and invoices are both necessary source documents for a business as they help a business maintain its GST compliance and its books of accounts. However, knowing the difference between a voucher and an invoice is important to know which document will come into use and when.

Moreover, there are various software available in India that automate the process of generating a voucher or an invoice. This helps businesses to keep accurate books of accounts with ready proof of transactions, which are accessible at any time of the day.

By

By