What Is a Credit Invoice in Accounting? Understanding Its Role for Indian Businesses

- 17 Nov 25

- 7 mins

What Is a Credit Invoice in Accounting? Understanding Its Role for Indian Businesses

Key Takeaways

- Understanding what is a credit invoice in accounting helps businesses correct sales values, errors, or returns without altering original invoices.

- A credit invoice legally records reduced receivables and supports transparent creditor–debtor relationships.

- It is essential for GST compliance, as suppliers must report credit invoices in GSTR-1 within the statutory deadline.

- Credit invoices accurately adjust revenue, accounts receivable, tax liability, and—in case of returns—inventory records.

- For Indian SMEs, knowing what is a credit invoice in accounting improves financial clarity, strengthens customer trust, and maintains a clean audit trail.

Have you ever wondered how companies correct invoice errors or modify payments without the worries? A credit invoice comes in at that point. As the tax and business environment of India is very dynamic, it is important to know what credit invoice is in accounting and how it can rescue companies out of non-compliance issues, monetary confusion.

Indian SMEs also suffer a lot in terms of delays of payments and returns with more than 60 percent of them faced with these problems; learning how to use this simple but effective document can serve to cushion against opaqueness and increase confidence. Through this blog, the normal attributes, uses and impacts of credit invoice to accounting will be explained through the representations of a taxpayer.

Key Characteristics of Credit Invoice

All GST registered suppliers who issue their credit invoices are supposed to report the details in their GSTR 1 in the month the note is issued, within the limited time (usually by 30 th November of the following financial year, or annual return is filed whichever is earlier).

These documents are vital as they serve the following purposes:

- Signifies a Credit Sale: It is a sale where the payment, not at the time of the sale, is by delivery.

- Legally Binding: Credit invoices create a creditor-debtor relationship until the payment is concluded.

- Essential for GST Compliance: This document has all the necessary details, including GSTIN, the invoice number, date, the taxable value, and the tax amount.

When processed through an integrated accounting system, credit invoices also allow for seamless updates to accounting records, ensuring businesses reflect the most accurate financial position.

Key Differences Between a Credit Invoice and Other Crucial Documents

When it comes to validating transactions and managing documentation for timely tax compliance, suppliers must also maintain other important documents. These include cash memos, sales invoices, and similar records.

Let us examine some basic differences among the three documents mentioned above to gain a more comprehensive understanding.

| Parameter | Credit Invoice | Cash Memo | Sales Invoice |

| Payment Category | Credit or future settlement | Immediate Cash | May support both cash and credit transactions |

| Accounting Consideration | Increases accounts receivable of the issuer | Cash memo is recorded in a cash book | Impacts payable/ receivable |

| Legal Standing | Shows the amount due from the buyer | Memos are proof of immediate payment | Tends to vary as per the specific type |

| GST Effects | Increases the tax liability | GST is collected instantly | Tends to vary as per the specific type |

When is a Credit Invoice Issued?

These are some common scenarios where a credit invoice needs to be generated:

- Business-to-business Sales (B2B Sales): A vast majority of B2B sales in India are made on credit through credit invoices, which means that the client is obliged to pay once a certain time frame is passed (usually 30 or 60 days).

- Bulk Purchases: Large orders are frequently paid in arrears, and therefore, credit invoicing is the norm.

- Services Delivered Before the Payment Settlement: Credit invoices are used in IT services, consultancy and professional services where payment terms initiate after delivery of the service.

In all the above cases, the credit amount helps reflect the true outstanding dues in the company's books.

What Should a Credit Invoice Include?

Generating a credit invoice is not that difficult. If you have access to professional accounting software, you can achieve this task very easily.

To make a complete credit invoice, ensure all these elements are present:

- Header: It must state whether the supplier refers to it as a ‘credit invoice’ or ‘credit memo’.

- Company Details: Next, the invoice should show the name, business address and contact specifications. Including complete company information helps customers identify the sender clearly.

- Customer Data: It comprises the name of the customer, their address, phone number, etc.

- Invoice Particulars: In this segment, you find the unique reference number, invoice issue date, description of the supplies provided on credit, etc.

- Applicable Taxes: Finally, the software should automatically calculate GST based on each product's HSN code.

Using a pre-set invoice template can speed up this process and ensure all required data fields are accurately filled.

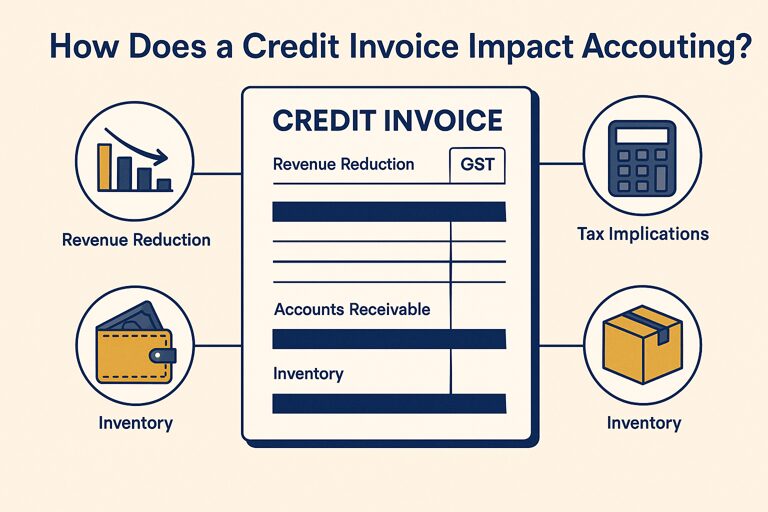

How Does a Credit Invoice Impact Accounting?

Credit invoices enable proper recording of the financial data as they reflect the adjustments of sales in a correct way. Some major implications for accounting include:

- Revenue Reduction

- The original sales revenue is reduced by the amount reflected in the credit invoice. This ensures the company has the correct representation of its revenue, as there is no over-charging or product returns.

- Adjustments of Accounts Receivable

- The amount of accounts receivable in the balance sheet would reduce as the amount of outstanding balance is reduced in the customer account. This indicates the amended value that the customer is supposed to pay.

- Tax Implications

- Sales tax, as well as value-added tax (VAT), is recalculated on the basis of the lower, corrective invoice value. Through credit invoices, taxes are not charged on estimated sales and hence no overpayment to the tax authorities.

- Correction of Inventory (Applicable Only if Goods are Returned)

- In case of returned products that are to be reissued as credit notes, the inventory account is to be adjusted to indicate those items that have been added. This assists in maintaining proper stocks.

- Customer Relationship Management

- A credit invoice provides transparency and maintains trust, as clients can see errors or returns formally acknowledged.

By documenting each transaction accurately, businesses ensure their accounting records remain audit-ready and up-to-date.

Benefits of a Credit Invoice

When a supplier issues credit invoices, they can stipulate that their financial records are transparent. To maintain accurate accounting, using a credit invoice is preferable to altering or deleting the original invoice, as it leaves a clear audit trail. This improves accounts receivable, ensures accurate sales tax records, and builds customer trust through clear communication.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

Conclusion

Knowing what a credit invoice is in accounting is essential to Indian businesses. It does more than just assisting them in managing credit sales. Moreover, it makes sure the companies remain compliant with GST laws and leaves their records clean and transparent.

They help in accurate financial reporting, facilitate accounts receivable collections and create good customer care relations when in proper use. This positions businesses for long-term success and compliance.

By

By