Common Factoring Charges: How Much Does Invoice Financing Cost in India?

- 13 Nov 25

- 7 mins

Common Factoring Charges: How Much Does Invoice Financing Cost in India?

Key Takeaways

- Invoice financing helps businesses unlock cash tied up in unpaid invoices and maintain smoother cash flow.

- How much does invoice financing cost varies widely depending on industry, invoice volume, and the lender’s fee structure.

- Whole book financing includes multiple charges like service fees, arrangement fees, discount fees, and renewal costs.

- Selective invoice financing is more flexible for Indian MSMEs as it allows financing only specific invoices.

- Understanding hidden fees and negotiating terms is essential to control how much invoice financing cost impacts your bottom line.

Are you struggling with delayed customer payments that disrupt your cash flow? You are not alone. Over 83% of Indian businesses across sectors face similar issues and turn to invoice financing as a solution. This financing tool helps companies unlock working capital tied up in unpaid invoices, thereby bridging cash flow gaps effectively.

However, the cost of invoice financing is not one-size-fits-all. Charges vary based on industry, invoice volume, and service provider. Whether you are in manufacturing, retail, or services, understanding the common factoring charges can help you make smarter financial decisions and avoid hidden fees while improving your credit control processes.

In this article, we break down how much invoice financing costs in India.

What Does Invoice Financing Cost Your Business?

To understand the applicability of invoice financing charges, first, you should learn about the various types. Normally, invoice finance works in two ways:

Full or Whole Book Invoice Finance

In this first option, a company owner applies for a set time frame (suppose 1 year) and continues to finance all their invoices issued in that time. On selecting this method, you will be charged:

- Service fee (also referred to as management fee)

- Arrangement fee

- Invoice Discounting fee

- Renewal charges after the one-year period (in the above-mentioned case)

Before you finalise a lender for whole book invoice financing, ensure to check their policies related to several hidden ancillary costs. This can be re-factoring fees, payment transfer fees, charges incurred for holding your amount in a trust folio, etc. Managing your sales ledger efficiently can help reduce such costs.

Single or Selective Invoice Finance

Single invoice financing is simplified, where you select the specific invoices you wish to finance. When repaying, you pay interest plus the invoice amount against which financing was availed.

As there is no formal agreement, an owner does not have to worry about any minimum obligation to borrow on a regular basis. Because only 10% of deep supply chain MSMEs access affordable invoice financing, selective financing is more appropriate in the Indian market.

After knowing the individual types, let us see how much invoice financing costs in a given scenario.

Invoice Financing Example

To understand how invoice financing works, let us assume that a software company has managed to receive a new work contract. However, the owner has realised he would require more workforce to meet the deliverables.

Despite needing to invest in equipment and hire more staff, he anticipated some major invoices to be cleared within the next three months. Hence, he decided to opt for a single invoice finance solution for ₹2 Lakhs.

Consequently, he gets a cash advance of 80% and the lender agrees to a repayment interest of 2% per month. By using ₹1.6 Lakhs, i.e., 80% of the invoice amount, he hires a new software engineer and purchases cutting-edge programming devices.

By month's end, the business owner returns ₹1.6 Lakhs plus ₹3,200 in interest to his client and receives ₹36,800, the remaining invoice amount.

Thus, as you may see, using invoice financing can allow a person to fund new opportunities and scale their company while managing payment terms effectively to maintain a healthy credit rating.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

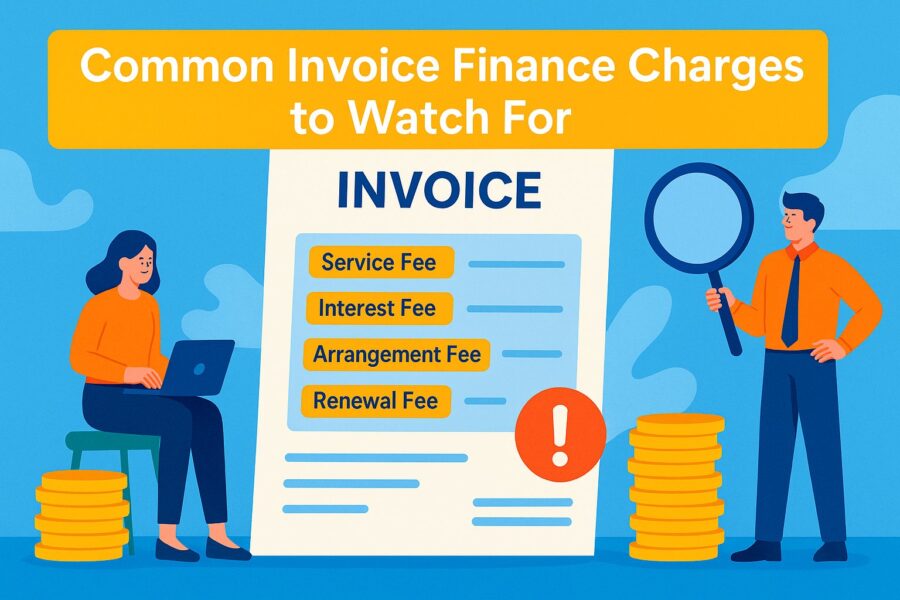

Common Invoice Finance Charges to Watch For

At the end of the previous year, bank lending to MSMEs grew by 13.5%, eventually touching $304.7 billion. This trend prominently reflects a rising demand for liquidity. Many invoice finance providers, however, face complaints about undisclosed charges that often go unnoticed by smaller businesses.

If you desire a smooth processing of invoice financing solutions, ensure to learn about the following charges:

- Service Fee: It typically covers the fund management, administration and collection expenses. Normally, the lender keeps it between 0.75% and 2.50% of the borrowing company's total revenue.

- Interest Fee or Discount Fee: This charge is normally a percentage of the entire funding limit. Invoice finance providers generally keep it at 1-3% of the base rate.

- Arrangement Fee: Many service providers skip this fee, while some companies charge an amount for setting up the initial finance facility.

- Renewal Fee: Again, this is an optional fee charged by many lenders annually for renewing invoice financing facilities.

Besides the common factoring charges, a few invoice financing companies require their clients to sign an agreement for a specified time frame. If any borrowing company violates this contract, it will be liable to pay a termination fee.

For instance, a service-based SME signs a 1-year invoice factoring agreement worth ₹30 lakhs but opts out after 6 months.

Termination Fee: 2% of the unused limit (₹15 lakhs) = ₹30,000.

So, breaking long-term agreements can unexpectedly raise costs, often overlooked during negotiations.

3 Factors Influencing Invoice Finance Cost

Understanding the underlying factors will help determine how much invoice financing costs in real time. Some of the impactful elements include:

- Number of Specified Invoices

To minimise fees, it is better to have fewer, higher-value invoices than many low-value ones, since fees are tied to the total number of collections.

2. Borrowing Amount

If you are seeking invoice financing for a large invoice amount, chances are high that you will reach a more favourable factoring agreement.

3. Line of Work

In an invoice factoring or discounting arrangement, the line of business plays a crucial part. For instance, lenders consider construction companies to be at a greater risk. Therefore, the financing costs are higher for such companies.

How to Avoid High Invoice Finance Charges?

Companies can cut down on hefty invoice finance charges by negotiating better terms with various providers and comparing their offers to achieve lower rates. By consolidating invoice values, financing fewer but larger invoices instead of a bunch of smaller ones, you can often end up with better pricing.

Additionally, consider keeping your financial records tidy and your documentation up to date to build trust with lenders, which can lead to lower fees. Finally, you must remember to ask for a detailed cost breakdown. This should include service fees and any possible penalties. The goal should be to opt for transparent, reputable platforms to steer clear of hidden charges.

Conclusion

As soon as you understand how much invoice financing costs, you can negotiate better terms with lenders and improve your business’ creditworthiness. Before you opt for this option, you should be confident in your customers’ repayment capabilities. Otherwise, late payments will incur additional interest charges. So, you should explore alternative corporate financing options if the current option is unsuitable.

By

By