Top 6 HDFC Credit Cards with Lounge Access Options to Explore in 2025

- 10 Nov 25

- 7 mins

Top 6 HDFC Credit Cards with Lounge Access Options to Explore in 2025

Key Takeaways

- Several HDFC credit cards offer complimentary or unlimited lounge access for frequent travelers.

- Infinia Metal and Diners Club Black Metal provide unlimited airport lounge access worldwide.

- Eligibility and income criteria differ for each HDFC credit card with lounge access.

- Annual fees on most cards are waived with eligible yearly spends.

- These cards also include premium travel, lifestyle, and reward benefits beyond lounge access.

Are you a frequent flyer? Then, you know the significance of lounge access during long airport waits. But lounges are for business and first-class flyers.

What if we tell you that with an HDFC credit card, you can get unlimited lounge visits every year? Yes, you read that right. An HDFC credit card with lounge access lets you relax in style before stepping on the air.

In the following guide, we will explore the top 6 HDFC credit cards that offer generous lounge access and premium travel benefits in 2025.

6 Best HDFC Credit Cards with Lounge Access in 2025

- Diners Club Miles Credit Card

Ideal for frequent domestic and international flyers, the Diners Club Miles credit card perfectly combines comfort and savings. It allows you to earn exciting travel rewards while providing access to luxurious airport lounges.

Lounge Access: 6 complimentary airport lounge visits

Eligibility:

- Salaried persons between 21 and 60 years with a monthly earning of ₹30,000

- Self-employed individual between 21 and 65 years with annual filing of ₹360,000.

Annual Fee: ₹1000 + GST (waived on annual spends of ₹100,000)

Additional Perks:

- Access to 1000+ leading lounges internationally

- 4 reward points for every ₹150 spent.

- Tata Neu Infinity HDFC Bank Credit Card

If you are a Tata Neu user and are willing to receive travel benefits along with NeuCoins, the Tata Neu Infinity credit is the one to opt for. It lets you transform your spending on BigBasket or Croma into exclusive Additional Perks.

Lounge Access:

- 8 complimentary domestic lounge visits (Visa and RuPay)

- 4 complimentary international lounge access via Priority Pass (Visa)

- 4 complimentary international lounge visits (RuPay).

Eligibility:

- Salaried person of 21 to 60 years with a net monthly income of ₹100,000

- Self-employed individual between 21 and 65 years with annual filing of ₹12,00,000.

Annual Fee: ₹1499 + GST (waived on annual spends of ₹300,000)

Additional Perks:

- 2% reduction on your foreign currency spending

- 5% NeuCoins on Tata Neu app spends.

- HDFC Infinia Metal Edition Credit Card

Packed with exclusive benefits, the Infinia Metal Edition credit card is the ultimate gateway to top-tier privileges. If you often travel internationally, this is your luxury pass.

Lounge Access:

- Unlimited domestic lounge access for the primary cardholder and the add-on member

- Enjoy complimentary unlimited international airport lounge access to 1,000+ global lounges with Priority Pass.

Eligibility:

- Invite only

Annual Fee: ₹12500 + GST (waived on spends of ₹10,00,000 in the former 12 months)

Additional Perks:

- First 1 year of complimentary Club Marriott membership

- Enjoy a 1+1 buffet per booking at participating ITC hotels.

- 6E Rewards XL - IndiGo HDFC Bank Credit Card

Are you a regular IndiGo flyer? Then, the IndiGo HDFC credit card is your reward swiper. You can get a complimentary ticket with dinner, priority check-in, fast baggage claim, and much more with this card.

Lounge Access: 8 complimentary domestic airport lounges

Eligibility:

- Salaried person (21 - 60 years) who earns ₹120,000 monthly

- Self-employed individual between 21 and 65 years with annual filing of ₹14,40,000.

Annual Fee: ₹1500 + GST

Additional Perks:

- 5 6E rewards on every ₹100 spent on the website or app of IndiGo

- Cardholders can get 12 golf lessons along with 4 rounds of green fees.

- HDFC Regalia Gold Credit Card

The HDFC Regalia Gold credit card comes with all-around benefits in lifestyle and travel. It stands right below the ultra-premium segment, offering exclusive perks to high-income individuals.

Lounge Access:

- 12 zero-charge lounge access at both domestic and international terminals in India

- Up to 6 lounge visits outside India using Priority Pass.

Eligibility:

- A non-government salaried person of 21 to 60 years who earns ₹150,000 monthly

- Government-salaried person (21 to 60 years) with an income of ₹100,000 monthly

- Self-employed individual between 21 and 65 years with annual filing of ₹18,00,000.

Annual Fee: ₹2500 + GST

Additional Perks:

- Get Club Vistara Silver Tier and a Make My Trip Gold membership as welcome gifts

- Cardholders can earn flight vouchers of ₹5000 worth of flight vouchers on annual spends of ₹500,000, and a supplemental voucher worth ₹5000 if yearly air-spends reach ₹750,000.

- HDFC Diners Club Black Metal Edition Credit Card

The HDFC Diners Club Black Metal Edition is a premium credit card. It is ideally suited for heavy spenders, as they can earn exclusive access and substantial rewards in a single tap.

Lounge Access: Enjoy unlimited airport lounge access to over 1,300 lounges across the globe.

Eligibility:

- Salaried person of 21 to 60 years with a net monthly income of ₹250,000

- Self-employed individual between 21 and 65 years with annual filing of ₹30,00,000.

Annual Fee: ₹10000 + GST (waived on annual spends of ₹800,000 in preceding 12 months)

Additional Perks:

- Get 10000 reward points on every ₹400,000 spent

- Earn up to 10X reward points via SmartBuy.

💡Access several rewards like airport lounge access by paying your credit card bills with the PICE App.

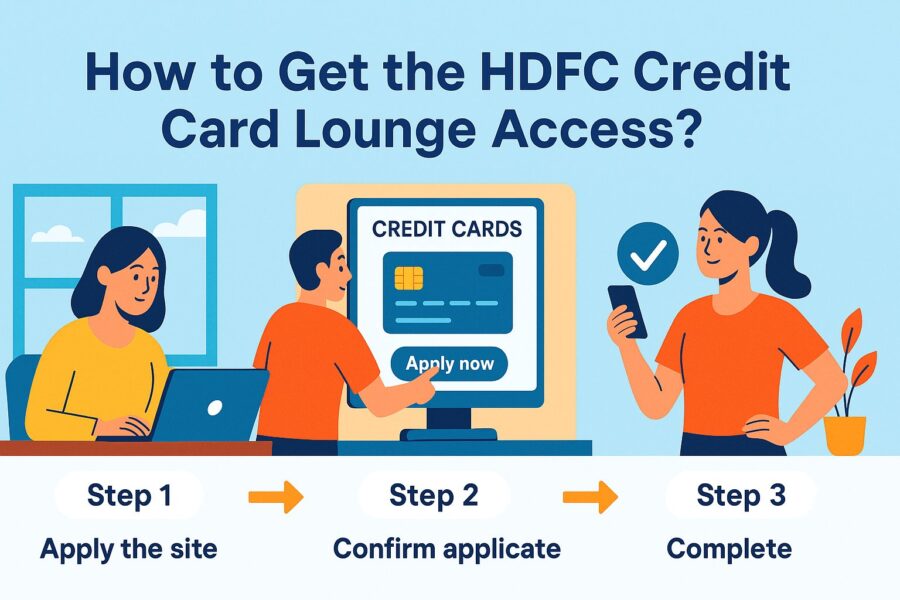

How to Get the HDFC Credit Card Lounge Access?

To receive complimentary lounge access with either of the above-mentioned credit cards, you must apply for them online or offline. The online application requires 3 simple steps:

- Step 1: Go to the official website of HDFC Bank and navigate to ‘Pay’, then ‘Credit Cards’.

- Step 2: Pick your preferred card and click on ‘Apply now’.

- Step 3: Complete the digital application and click ‘Submit’.

You can also apply for HDFC credit cards offline:

- Step 1: Visit the nearest HDFC Bank branch and request a credit card application form.

- Step 2: Select the card you prefer and fill out the form with your personal and income details.

- Step 3: Review the details and submit the form.

Please note: In both processes, you are required to submit copies of your income, identity, and address proofs. After the application is submitted, the authorities will verify the provided information, and the card will be delivered to your registered address.

Conclusion

Hopefully, this detailed guide to the HDFC credit card with lounge access has met all your queries. Each card is designed with unique benefits, ensuring that you find the right match based on your travel frequency and spending patterns.

By thoughtfully selecting from the options as mentioned earlier, you can turn stressful airport waits into moments of comfort and relaxation. A well-chosen card not only upgrades your air-travelling experience but also adds long-term value to your journeys.

By

By