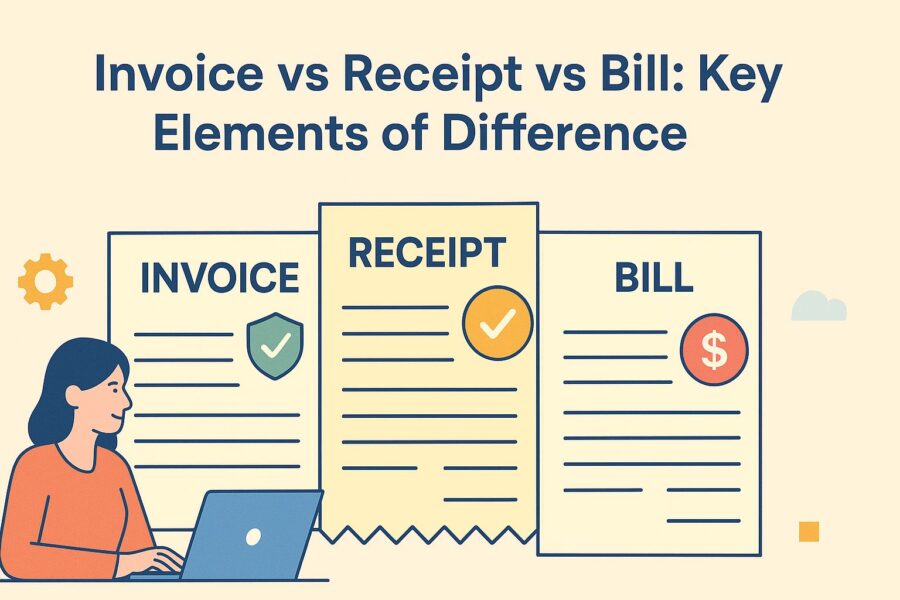

Invoice vs Receipt vs Bill: Key Elements of Difference

- 7 Nov 25

- 6 mins

Invoice vs Receipt vs Bill: Key Elements of Difference

Key Takeaways

- Section 31 of the CGST Act, 2017 mandates that every supply of goods or services must be backed by an invoice or bill of supply.

- Invoice vs receipt vs bill differ mainly by purpose, invoice requests future payment, bill requests immediate payment, and receipt confirms payment.

- Invoices are used for B2B transactions, bills for retail sales, and receipts for payment acknowledgment.

- Knowing the difference between invoice vs receipt vs bill ensures proper documentation and helps claim Input Tax Credit (ITC).

- Each document, invoice, bill, or receipt, must include specific details like buyer-seller info, items, amounts, and payment method.

Section 31 of the CGST Act, 2017 mandates the issuance of an invoice or bill of supply for every supply of goods or services. It serves as proof of supply and is crucial for the recipient to claim Input Tax Credit (ITC). On the other hand, a receipt is a legally binding document that confirms the goods or services have been received and paid for.

While the three play crucial roles, they serve distinct purposes. Despite a few similarities, they are not interchangeable. Let’s break down the differences between invoice vs receipt vs bill with practical examples and outline what each must contain.

Invoice vs Receipt vs Bill: Differences

Invoices, bills and receipts have certain core differences based on their purpose, use and other factors. Knowing these differences can help you issue the right document when necessary. Here are the key differences between invoices, bills and receipts:

| Parameters | Invoices | Bills | Receipts |

| Purpose | Sellers issue invoices to request a future payment | Issued to request immediate payment at the time of the supply of goods and services | Proof of payment to confirm payment and transaction completion |

| Time of Issuance | Issued before or after the supply of goods and services | Issued at the time of the transaction | Issued after payment completion |

| Details | Includes transaction details such as payment terms and conditions | Contains basic transaction details and outstanding payment | Includes payment method and amount paid |

| Use | Used for deferred payments in B2B transactions | Used in the retail and service industry | Used as proof in all transactions |

| Role in Accounting | Used to monitor accounts receivable and payments within the stipulated time | Used to manage cash flow and as a sales document | Used for tax purposes, to record sales and as proof of income |

| Record Keeping | For audits, financial records and tax filings | For day-to-day financial management | For tax audits and returns |

Examples of Invoice vs Receipt vs Bill

If you are a seller of goods and services and are confused about whether to issue an invoice or a bill, here are illustrations to demonstrate your choice.

Suppose Mr A hires Mr X, a freelance graphic designer, to create a custom logo for his clothing store, ABC Retail. The agreed fee is ₹3,000 and the work is scheduled for delivery on 14th August 2025. Once the logo is delivered, Mr X will issue an invoice to Mr A requesting payment for the design service.

On the flip side, suppose Mr Y visits the ABC retail outlet to purchase t-shirts, trousers and shoes worth ₹5,000. ABC retail will issue a bill of ₹5,000 to Mr Y, demanding instant payment for the goods supplied.

On receiving payment from Mr Y, ABC retail will issue a purchase receipt confirming payment. The receipt will include payment mode, amount paid and description of goods such as t-shirts, shoes and trousers, in addition to Mr Y’s name and contact details.

Usually, lawyers, business consultants, accountants and freelancers issue invoices. On the flip side, hotels, retail outlets, grocery stores and similar goods or service providers issue bills.

Receipts are an acknowledgement of payments made by customers to sellers. Customers pay in accordance with bills and invoices to get receipts as payment confirmation.

Inclusions in an Invoice

To structure your invoice appropriately, you need to include certain details. This makes it a valid document, issued after receiving a purchase order. Here are the details that you need to include in an invoice:

- Your or business owner’s details such as name, address and contact number

- A unique invoice number

- Recipient’s name, address and contact details

- List of items followed by units, prices and total number of goods and services (for instance, 2 goods at ₹3,000 each and 4 services at ₹1,000 each, making it a total of 6 items worth ₹3,000 * 2 + ₹1,000 * 4 = ₹10,000)

- Payment terms and conditions as per the payment agreement, such as due date, discount for early payment and late payment fees

- Total amount inclusive of taxes and shipping cost, in addition to other fees, if any; for instance, 18% tax on ₹10,000 = ₹1,800 + ₹10,000 = ₹11,800

Inclusions in a Bill

A bill usually contains less information than an invoice. As a seller, you need to issue a bill for immediate payment for goods and services supplied. You need to include the following details in your bill:

- Buyer’s name, contact details and address

- Description of goods and services supplied

- Total amount payable by the recipient for all goods or services

- Last date of payment

- Payment options or modes such as cash, online, using a credit card, debit card or UPI

Inclusions in a Receipt

Payment receipts are confirmation of payments that act as evidence for future reference. As a result, you mandatorily need to include the following details in a receipt:

- Your information such as name, contact information and address

- Buyer’s details such as name, contact details and address

- The exact business transaction time

- Description of services or goods supplied

- The total amount paid, the method of payment and the transaction number

Conclusion

The differences in transaction documents, that is invoice vs receipt vs bill, are based on the time of issue, purpose, legal importance and other factors. You can use all these documents as proof in case of disputes with a buyer.

Ensure you include all the necessary details in each of these documents for transparency with buyers. It further enhances adherence to legal guidelines in India. Now that you know the differences, ensure you issue the right document at the right time to avoid adverse legal consequences.

By

By