GST on Insurance Premium: Rates & Tax Benefits

- 5 Nov 25

- 6 mins

GST on Insurance Premium: Rates & Tax Benefits

Key Takeaways

- GST on insurance premiums is 18%, applicable to life, health, and general insurance policies.

- GST increased insurance costs, raising the tax rate from 15% (service tax) to 18% post-2017.

- Life insurance GST rates vary — 18% for term plans, 4.5% on first endowment premium, and 2.25% on renewals.

- Premiums including GST qualify for tax deductions under Sections 80C and 80D of the Income Tax Act.

- Understanding GST on insurance helps policyholders plan better, save tax, and stay compliant with regulations.

In India, Goods and Services Tax (GST) was introduced in 2017. This marked a significant change in the taxation structure.

So while buying a policy, keep in mind that the applicable GST on insurance premium is set at 18%. This means if your premium is ₹100, you will actually pay ₹118 (₹100 for the policy and ₹18 as tax).

Knowing the tax implications can help prevent compliance issues or being flagged for suspicious behaviour.

Impact of GST on Insurance Policies

With the GST introduction, premium rates for insurance policies have increased. Previously taxed at 15%, the majority of policies now attract an 18% GST. This change indicates that customers have to pay more, particularly for life and health insurance.

The link between insurance and GST has now become more financially noticeable for the policyholders.

Simplified Tax Structure

GST has now replaced multiple indirect taxes and simplified the taxation system. This has made it easier for the customers to understand what taxes they are paying. While this adds to the transparency, the actual cost of insurance has gone up due to a higher GST rate slab for tax.

Impact by Policy Type

The effect of GST also differs based on the type of policy. For instance, single premium policies carry 18% GST applicability at once. However, regular premium plans spread the tax across different payments, making it easy to manage.

Affordability Concerns

Many individuals purchase term plans expecting lower costs, but GST adds to the total. For instance, GST for life insurance premium payments increases the amount that customers need to budget. This potentially affects the purchasing decisions.

What are the GST Rates on Different Life Insurance Policies?

Due to changes introduced by the GST Council, it is important to know about the GST on insurance premiums for each policy type. This can help individuals file returns correctly and claim applicable benefits like Section 10(10D) exemptions.

| Type of Product | Applicable On | GST Rate for Life Insurance (1st July, 2017 Onwards) |

| Term Policy | Premium Payable | 18% |

| Single Premium Annuity Policy | Premium Payable | 1.80% |

| Endowment Policy | First Premium | 4.50% |

| Endowment Policy | Regular Premium | 2.25% |

| Health Insurance Policy | Premium Payable | 18% |

| Unit Linked Insurance Policy Riders | All Applicable Charges | 18% |

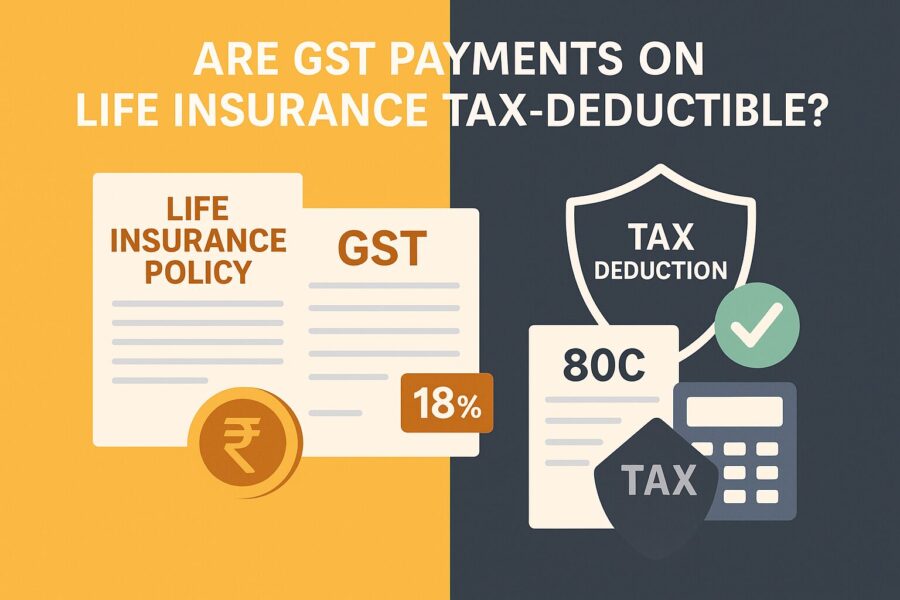

Are GST Payments on Life Insurance Tax-Deductible?

The GST on insurance premiums may offer tax benefits, but only under certain conditions defined by the Income Tax Act, 1961. While the GST itself is not separately deductible, the total premium amount, including GST, qualifies for tax deductions under specific sections.

- Under Section 80C, you can claim a deduction of up to ₹1.5 lakh yearly for life insurance premium, including paid GST.

- The Section 80D allows you to claim up to ₹1 lakh yearly for policies that cover self, spouse, parents and children.

- Critical Illness Rider are also eligible under Section 80D tax laws.

Ways to Save Tax with Life Insurance Policies

Claim Deductions Under Section 80C

Policyholders get to claim deductions of up to ₹1.5 lakh yearly on premiums paid towards eligible insurance plans. It includes endowment term insurance and ULIPs. This makes it a smart choice for both tax planning and protection.

Save More with Section 80CCC

Policyholders who contribute to pension plans that are offered by life insurance companies can claim additional deductions under Section 80CCC, up to ₹1.5 lakh every year.

Use Section 10(10D) for Tax-Free Maturity

Under Section 10(10D), all the maturity proceeds from a life insurance policy are tax-exempt, provided certain conditions are met. It includes the sum assured and any bonuses received.

Pension Tax Relief with Section 10(10A)

If you choose a commuted pension (lump sum) from the pension fund of a life insurer, Section 10(0A) allows for full or partial exemption. It applies primarily to government employees and others who receive qualifying pension benefits.

Conclusion

Knowing how GST on insurance premium interacts with tax provisions like Section 80CCC ensures better planning and accurate reporting. Make sure to stay mindful of what is not acceptable and always request details when clarification is needed to maintain direct tax compliance.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By