Difference Between Invoice and Bill of Sale: A Detailed Guide

- 4 Nov 25

- 10 mins

Difference Between Invoice and Bill of Sale: A Detailed Guide

Key Takeaways

- An invoice requests payment for goods or services rendered, while a bill of sale serves as legal proof that ownership of goods has been transferred after payment.

- Invoices hold stronger legal standing, supporting accounts receivable records and tax filings, while bills assist in accounts payable and ownership documentation.

- Under India’s GST e-invoicing system (mandatory for ₹5 crore+ turnover), invoices are digitally registered and authenticated, while bills of sale continue to function as transaction receipts for ownership proof.

- Using integrated tools like PICE, Tally, or Zoho Books ensures proper invoice-bill management, prevents errors, aids audits, and simplifies GST compliance.

In business transactions, knowing the difference between invoice and bill of sale is crucial for compliance, tax filing, and smooth payments. In 2025, with GST e-invoicing and digital billing becoming standard in India, this distinction matters more than ever.

An invoice is a formal payment request issued when goods or services are provided, detailing the items, price, and due date, for instance, a manufacturer issuing a ₹30,000 invoice payable within 15 days. In contrast, a bill of sale is proof that the transaction is complete and ownership has transferred.

So, read this guide to explore the key differences, uses, and legal significance of both documents.

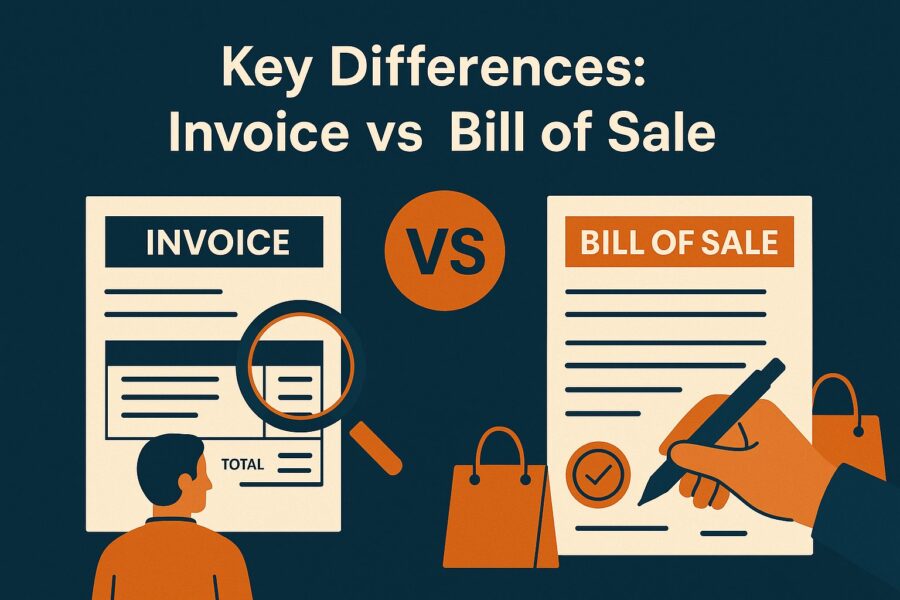

Key Differences: Invoice vs Bill of Sale

| Parameters | Invoice | Bill |

| Purpose | Requests payment for goods and services | Detailed billing statement of the outstanding due amount |

| Issuer | Seller or service provider | Utility company, seller or the service provider |

| Recipient | Buyers | Customers or consumers |

| Terms of Payment | Includes the due date of payment and terms | Asks for payment of the due amount immediately |

| Legal Status | Often possesses legal standing | Possesses less legal weightage |

| Detailed Level | Usually more detailed | Less detailed version |

| Accounting Use | Used for receivable accounts | Used for payable accounts |

| Customisation | Often subject to customisation with company branding | Usually presents in a standardised format |

Invoice: Meaning and Types

An invoice is a formal document issued by a seller to demand payment for the provision of goods or services. It specifies details such as product or service description, quantity, price, applicable taxes, and payment due date. For example, a graphic designer delivering a brand logo may send an invoice to the tune of ₹10,000 stating terms like "Pay via bank transfer within 15 days."

A GST invoice format must contain crucial details like GSTIN, HSN/SAC codes, and tax breakup. Since 2025, e-invoicing for GST has become mandatory for businesses with turnover exceeding ₹5 crore. This involves the generation of invoices on the government portal and an optional digital signature for validation.

Nowadays, many businesses opt to couple invoicing with their accounting platforms, such as by PICE, Zoho, Tally, or QuickBooks, to maintain simple compliance and easy payment tracking.

Many entrepreneurs confuse different types of invoices with bills, but knowing the difference between invoice and bill of sale ensures the right document is issued for each stage of a transaction. There are different types of invoices, each serving different purposes under different situations that has been discussed below:

1. Standard Invoice: This is a regular bill issued after delivery of goods and services.

2. Proforma Invoice: An invoice stating the estimated amount before sale or shipment of goods.

3. Interim Invoice: This invoice is sent out in stages in case of large projects.

4. Final Invoice: A seller generates this invoice only after project completion.

5. Recurring Invoice: This invoice is issued at regular intervals for the services chosen and ongoing.

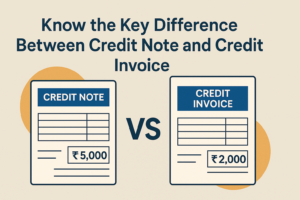

6. Credit Invoice: Also known as a credit memo, lowers or makes adjustments in an existing charge.

7. Debit Invoice: Also known as a debit memo, this invoice raises the owed amount after final billing process.

8. Timesheet Invoice: This is the bill generated based on the working hours.

9. Commercial Invoice: This invoice is used for custom purpose in international trade.

10. Expense Invoice: The document stating the claim back amount during travel.

7 Practical Uses of an Invoice in Business

1. Record Maintenance

Invoices are official records of a business. As an example, a small business may include detailed items showcasing an amount of sales as ₹5 lakh per month tracked through invoices. Such records come in handy when auditing and financial reviews take place.

2. Tracking of Payments

Invoices have due dates and the amount owed. A freelance consultant may have issued 5 invoices worth a total of ₹2 lakh, of which two are unpaid, and reminders are set. This boosts cash flow and minimises overdue payments.

3. Legal Protection

An invoice stating “Payment due date within 20 days” can be a legal record. Suppose a customer fails to make due payment of ₹1 lakh. The invoice document then proves to be strong evidence in dispute resolution.

4. Easy Filing of Taxes

Taxes on GST or VAT are written in invoices. Consider that a retailer makes ₹10 lakh worth of invoices in a quarter. He can easily calculate the amount of GST he has accumulated and file his returns correctly.

5. Business Analytics

Trend analysis is done using invoice data. For instance, a boutique finds through invoice entries that their sales increased by 40 per cent in Q4 as compared to Q1. The information thus assists in refining the marketing strategies.

6. Professional Image

An invoice that includes a logo and good contact information, as well as a well-formatted document, supports credibility. Well-designed invoices motivate clients to pay quickly compared to informal notes.

7. Customer Communication

Promotional offers or friendly messages can be put on invoices. A coffee shop adding a note on the bill stating, ‘Thank you! Get 10% off next time you come’ promotes repeat business and greater customer interactions.

Bills: Meaning and Types

A bill refers to a financial document that represents the sum owed for goods or services received. While bills are often simpler than invoices, the difference between invoice and bill of sale lies in the fact that an invoice demands payment, whereas a bill of sale proves ownership transfer.

In a restaurant context, one can say that a waiter comes to hand the bill upon listing the food items along with applicable taxes and the total payable amount.

Typically, bills include much less detail than invoices and find frequent use in areas such as retail, health, and utilities. For instance, a utility company sends out monthly electricity bills with units consumed, rate per unit, and total due payment. The bills thus prove to be purchase evidence, for budgeting, and for record-keeping.

With the onset of digital and automated billing in 2025, bills will more frequently be sent through an app, SMS, or e-mail to allow for easier tracking of expenses and payments.

Here is a list of the different types of bills common in everyday use and business operations:

1. Utility Bills: Monthly statement generated for essentials such as water, gas and electricity.

2. Subscription Bills: Recurring charges applicable for services such as a video streaming platform.

3. Rent Bills: Rent dues for residential or office space in a city.

4. Credit Card Bills: Statements of business transactions carried out through credit card on a monthly basis.

5. Purchase Bills: Receipts issued during purchase of goods and services at online stores or physically.

6. Medical Bills: Charges applicable for healthcare services, consultations and tests as doctors suggest.

7. Phone Bills: A Monthly statement that shows the bill amount for mobile and landline service.

8. Tax Bills: Bill generating notifications of taxes such as income tax and property tax.

9. Internet Bills: Bill reflecting the monthly payment for data service and broadband.

10. Service Bills: Invoice stating payment history for services such as repairing, cleaning and maintenance.

11. Insurance Bills: This bill includes premium payments for providing health, home and auto insurance.

12. Education Bills: An invoice stating detailed fees for school, coaching, and tuition.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

5 Uses of Bills in Business

1. Proof of Debt

Bills state what is due and keep services running. For example, making on-time payment of electricity and phone bills so that there is no cut in power or interruptions in mobile service.

2. Financial Planning and Penalty

Continuous tracking and payment of bills prevents late charges and interest. Late payments may harm the credit report and disrupt services.

3. Efficiency and Automation

Bills provide clear visibility of expenses such as recurring billing of rents or subscriptions. Keeping track of monthly bills is convenient by listing in a planning tool or spreadsheet.

4. Budgeting

Online or automated bill payments save businesses and consumers time and reduce errors. An automatic billing service, such as subscriptions and bills, simplifies finances.

5. Record Keeping and Financial Tracking

Bills generate a digital or paper-based spending estimation. Applications and programs also help individuals set reminders and track expenses accurately.

Common Mistakes Businesses Make with Invoices and Bills

Most companies experience fiscal problems due to minor but expensive billing and invoicing mistakes. Some of these include not including GST information, issuing outdated invoices, missed due dates, or not sending reminders.

Bills also lead to confusion when the terms of payment are not well communicated or there are double charges. These errors may result in delayed payments, penalties for compliance, or even disputes.

By 2025, the majority of accounting programs do this automatically to prevent errors, yet companies need to double-check entries, use consistent templates, and reconcile invoices and bills on a regular basis to keep things running smoothly.

Conclusion

Familiarising yourself with the difference between invoice and bill of sale is essential for effective financial management and carrying out smooth business operations. Remember, invoices are for sales while bills are for purchases. Make sure to double-check your bills and invoices before sending out.

From the perspective of GST in India, both invoices and bills play a crucial role towards the calculation of taxes and compliance. Businesses should issue the correct document applicable to each transaction.

By

By