Cumulative Invoice Meaning: Its Format, Advantages and More

- 3 Nov 25

- 8 mins

Cumulative Invoice Meaning: Its Format, Advantages and More

Key Takeaways

- A cumulative invoice records both past and current billing details, allowing businesses to issue progressive bills for long-term or phased projects instead of a single final invoice.

- Industries like construction, manufacturing, and software development often use cumulative invoices to track progress and maintain transparency in ongoing projects.

- A proper cumulative invoice format includes essential details such as previous and current charges, taxes, billing periods, client details, and total payable amounts.

- Using cumulative invoices can improve cash flow, enhance customer experience, and simplify financial reporting by consolidating multiple transactions into one clear record.

- Businesses can reduce manual errors and save time by using accounting or invoicing software to automatically generate and manage cumulative invoices.

Did you know that many businesses working on long-term or phased projects use cumulative invoices to streamline billing? Instead of sending a single final bill, they issue invoices at different stages, each showing both new charges and the total billed so far.

For example, if a project is worth ₹10,000, the first invoice may bill ₹3,000. The second would add ₹4,000 and show a total of ₹7,000 billed to date.

Implementing this method requires proper knowledge regarding its format. Using cumulative invoices also provides benefits such as better cash flow management and reduced administrative costs.

In this blog, we will explain several things related to a cumulative invoice, including exploring its format and highlighting its key advantages.

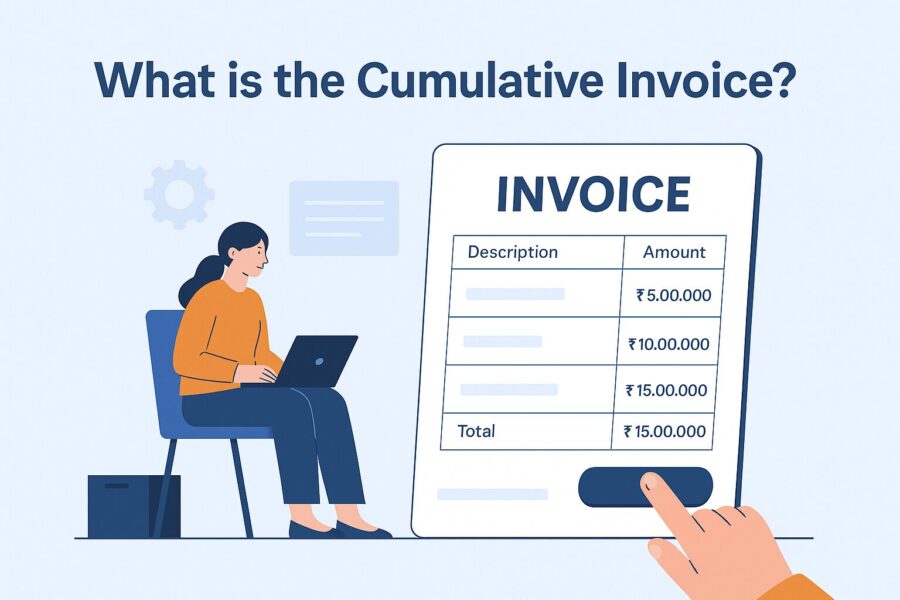

What is the Cumulative Invoice?

Cumulative invoicing is a kind of invoicing that a company uses for partial services or deliveries in stages as the project progresses. Each new invoice has details regarding the last transaction and the new completed work, which adds up to show the total value of all services provided so far.

Businesses use the cumulative invoice format to generate invoices that show all charges and payments made over a specific period. The term ‘cumulative’ refers to the way each invoice includes details of all previous transactions and balances it with the current date transaction.

This billing cycle method works especially well for long-term or phased projects. Industries such as manufacturing, construction and custom service contracts use this invoicing method. They often rely on cumulative bills to keep payment records transparent and up to date.

💡Use the PICE App to track your business expenses.

Explaining Cumulative Invoice with Real Life Examples

Let us get a clearer picture of what cumulative invoicing can mean in real life and how it works:

- Construction Companies

Firstly, to know how cumulative invoicing works for large-scale projects of construction companies, let us assume that a construction company is building a house.

The work is done in 3 steps:

- Laying the foundation

- Building the structure

- Interior finishing

After step 1, the construction company sends an invoice for ₹5,00,000 to the customer.

Then, after step 2 is complete, the construction company sends a cumulative invoice that shows:

- ₹5,00,000 (foundation)

- ₹10,00,000 (structure)

- Total: ₹15,00,000 (so far)

This process goes on until the project is complete. Each new invoice includes:

The old charges + new work = updated total.

- Software Development Freelancer

Secondly, let us consider how this can work on an individual level. Consider a freelancer who is building an app for a company.

She will build:

- Planning and design for ₹20,000

- Development for ₹30,000

- Testing and deployment for ₹25,000

Now, after she finishes every step, she sends a cumulative invoice to the company:

- First: ₹20,000

- Second: ₹20,000 + ₹30,000 = ₹50,000

- Third: ₹50,000 + ₹25,000 = ₹75,000

This helps the company track how much is done and paid.

What to Include in a Cumulative Invoice Format?

One key feature of a cumulative invoice format is that it gives a clear breakdown of partial goods/services and payments made so far. It shows previous invoice amounts, new costs, along with the net amount, GST and total invoice value.

The details to include in a cumulative invoice format are as follows:

| Detail | Description |

| Invoice Date | This is the date the invoice was sent. |

| Invoice Number | This will be the unique identification number for identifying the invoice. |

| Client’s Information | Under this, details such as the customer’s address, phone number and name need to be included. |

| Billing Period | The duration period for sending the invoice to the client. It can be a month, 3 months or annually. |

| Taxes and Fees | It should have accurate details regarding applicable fees, discounts or taxes. |

| List of Services or Goods | The invoice should include a list of services or goods that are delivered to the client. Along with this, it should also have the cost per unit and the total cost. |

| Payment Conditions | This should include late fee, incentives (if applicable) and the due date for making the payment. |

| Total Due | It should contain the taxes and fees details in the account payable section. |

| Company Information | The invoice should also have your company’s address, phone number and name. |

| Payment Instructions | Any instructions regarding the mode of payment should be included in this section. It should also include the contact information of the person to be contacted in case of any unexpected condition. |

Advantages of Using a Cumulative Invoice

Using a cumulative invoice format might seem like an unnecessary thing to do at first glance. You might wonder why I should send an invoice in parts and not at once after the completion of the project, or for every transaction made?

However, adopting this invoicing method brings several key benefits. Let us explore them below:

1. Boost Cash Flow Efficiency

By using cumulative invoicing, a company can maintain a smooth cash flow cycle over a long period of time. This ensures that a company has assured means of inflowing cash, which enables it to manage any investments or charges in a proper way.

Additionally, using a cycle of cumulative invoice generation enables a business to offer its customers transparency. It results in the reduction of customer complaints and confusion, overall making this process of invoice generation the most efficient one for a long-term project.

2. Deliver a Better Customer Experience

It can be overwhelming to see multiple bills that need to be paid. Thus, a business can use cumulative invoicing and combine multiple transactions into one bill for its customers.

This makes the process of transactions much more accessible and less frustrating for both the customers and the business. The cumulative billing process can also enhance customer service and experience by providing them with a complete summary of all of their previous transactions.

3. Simplify Monitoring and Reporting

If you use cumulative invoices for your businesses, you do not have to track multiple transactions. You can easily monitor your bills and payments and balance your accounts, along with creating accurate billing statements.

Using cumulative invoicing can save your business precious time and reduce mistakes that can happen while handling separate invoices. By recording all transactions in a single place, businesses can not only track their customers’ payments but also find any issues/missing payments quickly.

Lastly, cumulative invoicing can help companies free up employees to focus on more important tasks and improve overall efficiency.

How to Select the Right Software for Creating a Cumulative Invoice?

Issuing cumulative invoices manually can be time-consuming and prone to errors. So, a business should look into automating this process by adopting the right software for their company, especially when 80% of Indian companies recognise AI as a core part of their business strategy. To do so, you can:

- Choose a business accounting software that is highly compatible with the current IT system your company uses.

- Look into its customisation ability to serve your needs better.

- Always look for apps with good customer ratings.

- Get software that has internal features integrated to make your work easier.

Conclusion

A company issues a cumulative invoice when it provides any kind of goods or services to its customer over a long period. Using it can prevent customer confusion, reduce high administrative costs and also boost cash flow. So knowing the details of cumulative invoicing can guide your business platform in an efficient direction.

By

By