Best Balance Transfer Credit Cards for 2025

- 24 Oct 25

- 9 mins

Best Balance Transfer Credit Cards for 2025

Key Takeaways

- Using the best balance transfer credit cards allows you to move high-interest dues to a lower-rate card, easing repayment pressure.

- Many banks in India offer 0% interest for up to 60 days or reduced rates (1%–1.7% per month), helping save on interest charges when managed responsibly.

- Most issuers charge a small processing fee (1%–3% or ₹199–₹349) for the transfer. Always compare total costs before applying.

- Applicants with a good credit score (700+) and consistent repayment history stand a better chance of approval for balance transfer offers.

- Balance transfer credit cards are best used as part of a short-term repayment plan. Failing to repay within the promotional window can result in high standard interest rates.

Credit card debt can quickly snowball, as interest rates in India generally range from 23% to 49% per annum for unpaid balances. Transferring a balance lets you move existing dues to a new card that may offer a lower rate, or even a 0% promotional period, making repayments more manageable.

Almost all Indian credit cards offer balance transfers, but when comparing the best balance transfer credit cards, people consider factors such as interest savings, transfer fees, and ease of approval. This blog dives into those details, so you can choose with confidence.

Top 5 Balance Transfer Credit Cards in India

You may take a look at some of the leading credit card issuers in India offering the balance transfer facility:

- SBI Balance Transfer on Credit Cards

The credit card users of SBI Bank can enjoy a host of benefits, like:

- A processing fee of ₹199 or 2% of the outstanding amount is charged for the balance transfer facility. In return, card users get a zero-interest period for 60 days.

- For up to 180 days, a nominal interest rate of 1.7% per month is charged on the unsettled amount.

- It is possible to transfer up to 75% of the credit limit to another credit card. However, the minimum amount has to be ₹5,000.

- HDFC Bank Balance Transfer on Credit Cards

Existing HDFC Bank customers can take advantage of the following benefits while using the bank’s credit cards:

- No documentation is needed for the balance transfer option, as it is already pre-approved.

- Based on your current financial condition and outstanding balance, you can select a monthly instalment from as low as ₹27.

- Customers can avail the easy EMI option from 9 to 48 months.

- Axis Bank Balance Transfer on Credit Cards

Axis Bank balance transfer credit cards provide the following benefits:

- Interest rates start from just 1% per month.

- Card users can avail balance transfer from only ₹5,000. Typically, a processing fee of 1.5% or ₹250 (whichever is higher) is charged for the balance transfer facility.

- You can select a repayment term of either 3 or 6 months.

- IDFC FIRST Bank Balance Transfer on Credit Cards

If you are using an IDFC FIRST Bank credit card, then you can enjoy:

- Merging benefits for all your IDFC FIRST Bank credit cards

- Convenient repayment terms with fairly low interest rates

- Flexible tenure options of 3, 6, 9, and 12 months

- A nominal balance transfer processing fee of 1% + GST (should be a minimum of ₹99)

- Kotak Mahindra Bank Balance Transfer on Credit Cards

Kotak Mahindra is a reliable bank, especially when you need help with your mounting debt. The typical advantages include:

- You can transfer up to 75% of your allowed limit, with the minimum balance being ₹2,500

- To initiate your transfer credit card, you can simply utilise the bank’s net banking facility

- For every ₹10,000 debt transferred, you will be charged a processing fee of ₹349 + GST.

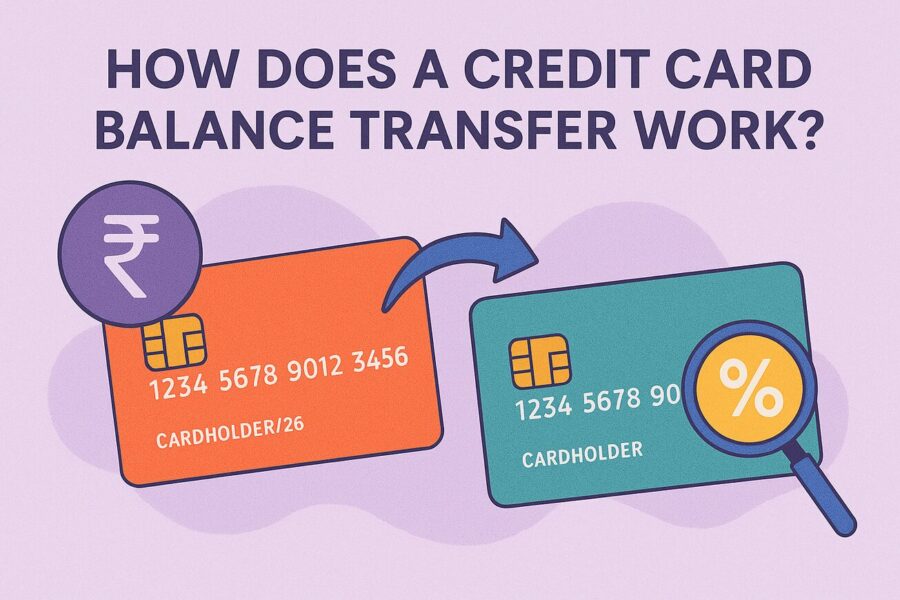

How Does a Credit Card Balance Transfer Work?

A balance transfer on a credit card allows you to transfer unpaid credit from one card to another, typically to take advantage of a lower interest rate or a 0% promotional period. In India, your new card issuer settles your outstanding amount on your old card, commonly via NEFT or demand draft, and converts it into a payable credit on the new card. This reduces the excessive interest that otherwise accrues on outstanding credit card debt.

The transferable amount cannot exceed the credit limit of the new card. For instance, if the outstanding balance of the old card is ₹75,000 but the new card has a limit of ₹50,000, only ₹50,000 can be transferred, and the rest needs to be settled individually. The majority of banks also charge a processing fee, typically ranging from 1% to 3% of the transferred amount. The lower rate of interest is applicable for a short promotional period, after which the standard rates will be applied.

To use you generally need to send your card statements and identification papers to the new issuer. Acceptance is subject to your credit record and the bank's policy. Balance transfers, when used sensibly, can help control debt more effectively, save on interest charges, and provide a systematic repayment schedule, making them a viable tool for financial responsibility.

Benefits and Drawbacks of the Best Balance Transfer Credit Cards

A credit card balance transfer has both merits and demerits. Therefore, before selecting this facility, borrowers should thoroughly review it.

Some common benefits include:

- Reduced Interest Rates: Most issuers offer lower interest rates for a limited period, making repayment more manageable.

- Debt Consolidation: It is possible to consolidate multiple credit card balances onto one card, making it easier to repay.

- Discounts on EMIs: For lower rates, there will be a lower monthly instalment.

- Short-term Liquidity: Customers will be able to release funds in other areas by eliminating immediate interest outgo.

- Better Credit Discipline: A well-organised transfer scheme can promote payments on time, which will ultimately raise credit ratings.

People who use credit card balance transfers typically report that they have these problems:

- Processing Fee: The Processing fee is a nominal charge individually added to the cost of most of the transfers.

- Short Period: Common tenures include 3 months, 6 months, or even 12 months. The shorter the tenure, the lower the interest rate.

- Eligibility Restrictions: Not every cardholder is eligible for a balance transfer facility. Card issuers need a good credit history before allowing offers.

- More Temptation to Spend: The sense of reduced burden may push some users to accumulate fresh debt.

- Adverse Effects on Credit Limit: The transferred amount may block available credit on the new card.

This balance transfer feature is most useful for those with a concrete repayment plan. Without timely repayment within the promotional window, the benefit is lost, and standard credit card rates (often ranging from 24% to 48% annually) can apply. Hence, while balance transfers are a smart tool for managing debt, they require discipline and careful financial planning.

Who Can Apply for a Balance Transfer Feature?

The facility is generally available to salaried and self-employed individuals with an existing credit card and satisfactory repayment history. Card issuers also set criteria for most cardholders to have a minimum standing balance before they can submit a transfer request.

Eligibility is boosted by a good credit score (typically 700 and above). Moreover, only between two card issuers this transfer is possible. The dues of one bank cannot even be transferred to the portfolio of the same bank.

For instance, the pending amount from one bank’s card cannot be shifted within the same bank’s portfolio. Applicants must also meet income requirements and ensure their card usage is active with no history of default or late payments in the recent past.

Points to Remember While Opting for Credit Card Balance Transfer

Balance transfer is one of the most effective features that can be wisely used. Key considerations include:

- Compare the processing fee and determine whether the savings exceed the cost.

- Know the repayment term and interest-free period being offered by your issuer.

- Check the effect on your credit limit for each card as transfers reduce your spending power.

- Ensure that the transfer covers genuine repayment requirements and not fuel new expenditure.

- Take the time to read the terms of repayment of the loan, particularly the fines imposed in case of default on EMIs.

- Note that there is a reversion to normal rates, which are also amongst the high lending rates in India.

A balance transfer is a temporary solution and not a permanent fix. It is most effective when used as part of a disciplined repayment strategy with a clear end goal of becoming debt-free.

💡Pay your credit card bills in an easy and secured way with the PICE App.

Conclusion

Managing debt gets easier when you opt for the best balance transfer credit cards. You can evaluate processing fees, zero-interest periods, and tenures before transferring your balance to determine the best option for you. The balance transfer credit cards offer real savings only when paired with strict repayment discipline, helping cardholders reach financial stability with minimal extra cost. So, you can transform short-term relief into long-term financial health.

By

By