How to Download Turnover Certificate from GST Portal?

- 22 Sep 25

- 7 mins

How to Download Turnover Certificate from GST Portal?

Key Takeaways

- A turnover certificate in GST is a CA-certified document validating a business’s total turnover in a financial year.

- Businesses need a turnover certificate for loans, tax compliance, audits, and government tenders.

- You can download a turnover certificate from the GST portal via GSTR-9 or GSTR-3B summary.

- The advantages of a turnover certificate include loan eligibility, ITC claims, and smooth regulatory compliance.

- Ensure your turnover certificate is signed by a Chartered Accountant for legal validity and acceptance.

Businesses need a turnover certificate for tax compliance and to meet regulatory needs. The turnover certificate helps businesses avail business loans and experience a seamless financial audit, among other benefits. It also supports business compliances related to vendor payments, legal documents, and timely filing of returns.

Learn how to download turnover certificate from GST portal here. Downloading the certificate can help you present it to the necessary entities, who seek the certificate for various purposes, including verification of application status for loans and registrations.

What Is a Turnover Certificate?

A Chartered Accountant-certified official document that verifies the total turnover of a registered taxpayer during a financial year is a turnover certificate. You can use this certificate for business loans, tax assessments, and regulatory compliance.

It is also considered one of the essential documents when applying for registration applications under GST and helps confirm your eligibility against the threshold limit for Input Tax Credit claims.

Here is the intent of a user pertaining to a turnover certificate:

- Know the process of downloading a turnover certificate from the unified GST portal.

- Learn the advantages of the certificate and its use for financial purposes and tax compliance.

- Know about the issues (if any) and their resolution in obtaining the certificate.

Instances to Obtain a Turnover Certificate

Here are the instances when you need a turnover certificate:

- Banks and financial institutions seek this certificate to assess the financial health of a business prior to providing business loans.

- This certificate validates tax filing and GST return filing by regular taxpayers for a specific tax period.

- You need this certificate to participate in government tenders, contracts, or dealings involving consumer products and corporate supply chains.

- As a business, you will need this certificate during financial audits and assessments of regulations.

- You need a turnover certificate to avail tax benefits and export-associated incentives. It also supports record-keeping for business transactions across business locations.

How to Download the Turnover Certificate from the GST Portal?

Here are the simple steps to download a turnover certificate from the official GST portal: Step 1: Visit the unified portal, fill in your GSTIN (Goods and Services Tax Identification Number), password, and captcha before you click 'Login'. Only a registered taxpayer can proceed beyond this step.

Step 2: Navigate to the ‘Services’ option and then ‘Returns’, and ‘Annual Returns’.

Step 3: Select the relevant financial year for which you need to download the turnover certificate and click ‘View Filed Returns’.

Step 4: Download the GSTR-9 or GSTR-3B summary before you extract details of turnover from the downloaded reports. This step ensures compliance with the simple process of obtaining a GST certificate.

Step 5: Ensure you verify and get the turnover certificate signed by a Chartered Accountant. This is crucial for verification of application and confirmation by a proper officer during inspections.

Step 6: You can use the signed turnover certificate for financial and tax purposes. Notably, you can keep a physical copy as well as a digital copy for future use. Also, ensure you stay within the time limit for any associated procedures.

Pros of a Turnover Certificate

Here are the advantages of a turnover certificate:

- Businesses can comply with tax laws and meet regulatory requirements.

- Financial institutions can check the certificate to provide business loans based on the amount of turnover.

- Businesses can use the certificate to participate in government tenders, followed by corporate tenders and consumer products distribution.

- As a business, you can use the certificate to file taxes and for verification.

- The certificate validates financial statements and the transactions in the statement, supporting all business transactions.

Cons of a Turnover Certificate

Here are the cons of a turnover certificate:

- You need to ensure that the certificate is signed by a Chartered Accountant.

- As a taxpayer, you need to extract the certificate from the GST returns.

- If there are incorrect entries while filing GST returns, there can be discrepancies in the turnover certificate.

- The turnover certificate has a validity period of a financial year, and you must adhere to the time limit set by authorities.

- The acceptance rules might vary between Indian states, sometimes requiring the intervention of a proper officer.

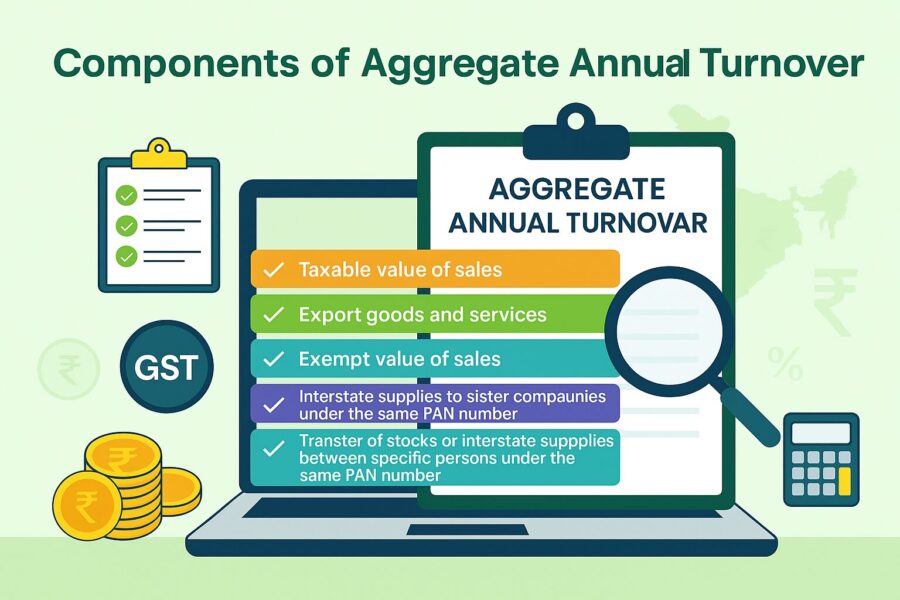

Components of Aggregate Annual Turnover

The following are the components of aggregate annual turnover:

● Taxable value of sales

● Export goods and services

● Exempt value of sales

● Interstate supplies to sister companies under the same PAN number

● Transfer of stocks or interstate supplies between specific persons under the same PAN number

These values play a critical role in calculating the overall turnover and eligibility for Input Tax Credit.

Conclusion

Now that you know how to download a turnover certificate from the GST portal you can seamlessly obtain it and get it signed by a Chartered Accountant. Ensure your turnover certificate is verified by a Chartered Accountant for official purposes.

You can manually extract the details of this certificate from your GST returns on the GST portal. Obtaining this certificate helps you comply with Indian tax laws and regulatory guidelines. Ensure you adhere to the process of downloading the certificate for a hassle-free experience.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By