How to File GSTR 2 Using Offline Utility?

- 16 Sep 25

- 7 mins

How to File GSTR 2 Using Offline Utility?

Key Takeaways

- GSTR-2 was a monthly return for receiver taxpayers but has been suspended since September 2017.

- GSTR-2 included details of inward supplies, credit/debit notes, and ITC-related adjustments.

- Entities like composition dealers, ISDs, and e-commerce operators were not required to file GSTR-2.

- Late filing of GSTR-2 attracted a penalty of ₹100 per day under CGST, plus state GST fees.

- GSTR-3B has replaced GSTR-2, and it can be filed easily using the GST offline utility in JSON format.

If you are a receiver taxpayer, you would need to file GSTR-2 monthly returns to accept, reject or modify invoice-level outward supplies that the supplier furnishes. However, GSTR-2 has been suspended and replaced by GSTR-3B since September 2017.

GSTR-2 helped prepare details of credit notes, debit notes and inward supplies. Learn in detail about how to file GSTR-2 using the offline utility and its replacement form, GSTR-3B in this blog.

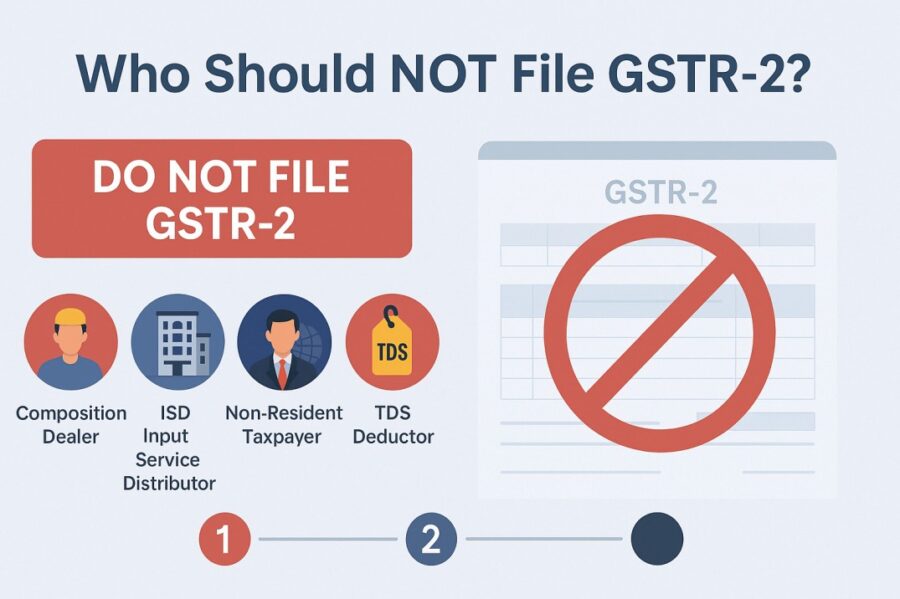

Who Should Not File GSTR-2?

Here is the list of entities that were not applicable to file GSTR-2:

● Composition taxpayers who file returns in Form GSTR-4

● Non-resident foreign taxpayers who file returns in GSTR-5

● Input Service Distributors who file returns in GSTR-6

● Online information database and access retrieval service providers who file returns in GSTR-5A

● TDS (Tax Deducted at Source) deductors who file returns in GSTR-7

● E-commerce operators or TCS (Tax Collected at Source) collectors who file returns in GSTR-8

Due Dates to File GSTR-2

The last date to file GSTR-2 was the 11th to 15th of the month following the tax period. For instance, if you had received goods and services in January, then you had to file GSTR-2 returns between the 11th and 15th of February.

Notably, casual taxpayers and taxpayers who applied for voluntary cancellation could file GSTR-2 returns before the end of the current tax period. However, normal taxpayers could not file the returns in GSTR-2 before the end of the current tax period.

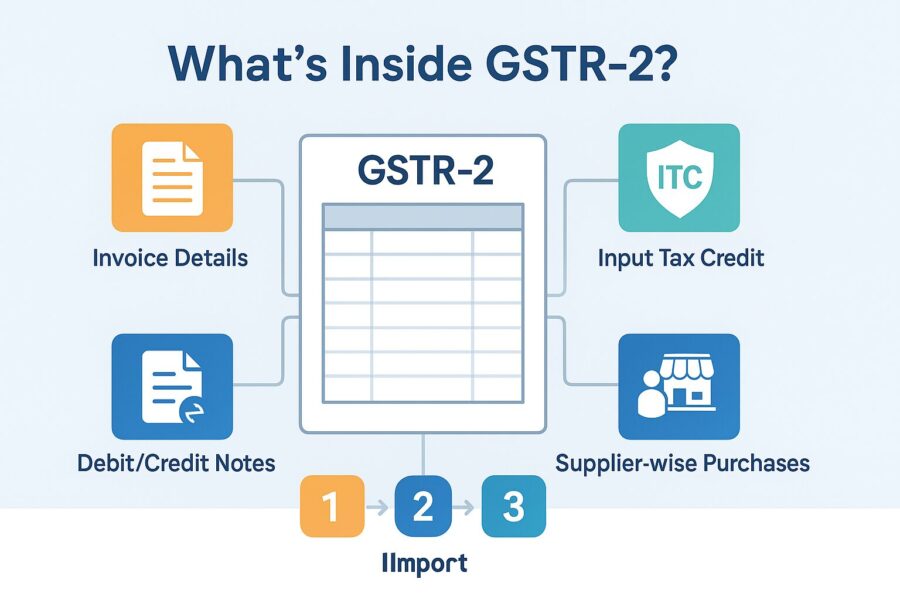

Information Included in GSTR-2

Check out what details were included in GSTR-2:

● Details about inward supply invoices pertaining to input, capital goods and input services received from a registered person, excluding supplies from a supplier under the reverse charge mechanism.

● Inward supplies of inputs, capital goods and input services from a registered person attracting reverse charge

● Details on inward supplies from an unregistered person.

● Input or capital goods received from SEZ units (Special Economic Zones units) or overseas units on a Bill of Entry.

● Amendments in debit notes, credit notes and details of inward supplies furnished in previous returns.

● Supplies received from a composition taxable person, excluding exempt/nil-rated or non-GST supplies received.

● TDS or TCS credit

● ISD credit

● Advances paid or adjusted for the receipt of supplies

● Addition and reduction of the output tax amount due to a mismatch or other reasons.

● Input tax credit reversal

● HSN summary of inward supplies

Pre-conditions for Filing GSTR-2

GSTR-2 filing entailed certain pre-conditions as follows:

● If you are a receiver taxpayer, you need to be a normal registered dealer with an active GSTIN.

● You need to have a valid login user ID and password.

● As a receiver taxpayer, you need to have a non-expired and avoid DSC (Digital Signature Certificate). Notably, DSC is mandatory for companies, FLLPs and LLPs.

● The last date to file GSTR-1 for the same tax period should have passed.

Late Filing of GSTR-2

If you are a receiver taxpayer, a late fee would have been charged if you did not file returns within the due date. The late fee is auto-calculated on filing returns. Before the suspension of GSTR-2, the late fee had to be paid prior to filing GSTR-3, as otherwise it would have been rendered invalid.

This late fee amounted to ₹100 per day per the CGST Act (Central Goods and Services Tax Act). Further, the states had their separate fee depending on inward supplies received by the taxpayer were interstate or intrastate.

GSTR-2 and ITC Claims

You could claim Input Tax Credit up to 12 months from the date of issuance of the original invoice or file an annual return, whichever was earlier. If there was a gap exceeding one year, between the original invoice date and the date of filing GSTR 3, there would be no transfer of the electronic credit ledger.

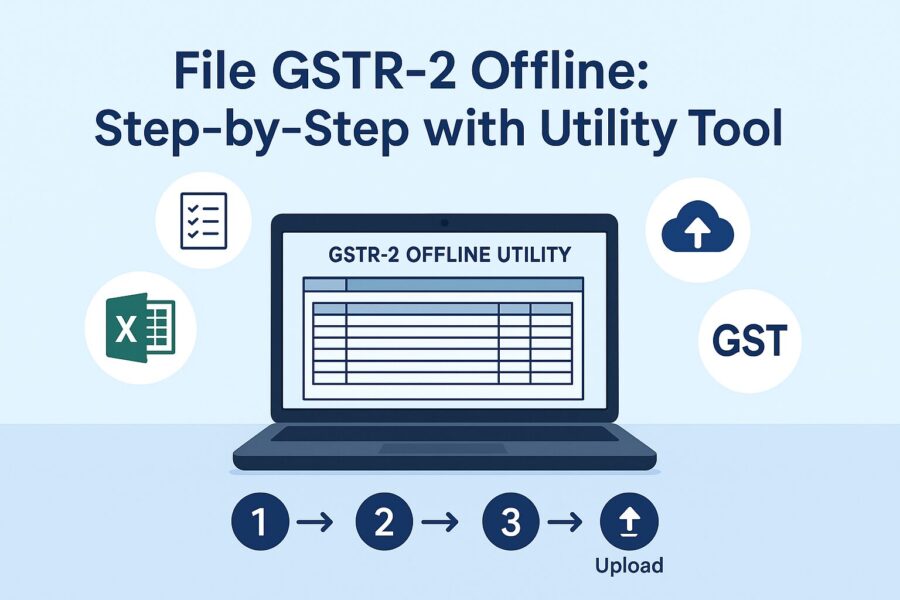

Step to File GSTR-3B Using GST Offline Utility

As GSTR-3B is the replacement form for GSTR-2, here are the steps to file GSTR-3B using the GST offline tool:

Step 1: Visit the unified GST portal.

Step 2: Go to ‘Downloads’, then ‘Offline Tools’ and ‘GSTR-3B Offline Utility’.

Step 3: Click on ‘Download’ followed by ‘Proceed’.

Step 4: Extract the content from the downloaded zip file and open it in an Excel file (Excel workbook).

Step 5: Prepare the offline tool and upload the JSON format file to proceed.

Step 6: Once you upload the JSON file, your GSTR-3B filing is completed.

Conclusion

Now that you know how to file GSTR 2 using the offline tool, or rather, how to file GSTR-3B using the offline tool, you can experience a seamless journey in the process.

Ensure you file GSTR-3B within the due date, which is the 20th of the next month following a tax period for monthly filers and the 22nd or 24th for quarterly filers, to avoid the imposition of late fees and penalties.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By