DRC 23 in GST: Release of Provisional Attachment of Property

- 17 Jul 25

- 6 mins

DRC 23 in GST: Release of Provisional Attachment of Property

Key Takeaways

- Form GST DRC-23 is issued to revoke a provisional attachment order made under Section 83 of the CGST Act.

- It allows the release of attached property or bank accounts once the tax officer is satisfied that attachment is no longer necessary.

- The property is released upon payment of the lesser of its market value or the pending GST dues, with proof of payment.

- DRC-23 ensures fairness in recovery proceedings and protects taxpayers from arbitrary or unjustified attachments.

- Taxpayers can file objections within 7 days of attachment and seek release if the attachment lacks valid grounds.

The Central Board of Indirect Taxes and Customs (CBIC) has issued guidelines regarding the provisional attachment of property under Section 83 of the CGST Act, 2017. Such attachment may be carried out to secure or safeguard the recovery of tax dues under the GST law.

If the property is found to be, or is no longer, liable for attachment, the government may release it by issuing an order in Form GST DRC-23.

This blog focuses on what is a demand and recovery case, while highlighting all the associated details you need to know about DRC-23 in GST.

What Does Demand and Recovery Under GST Mean?

Under the GST regime, demand and recovery provisions come into effect when a taxpayer fails to pay the tax due. This could result from default, fraud or even a genuine mistake. Section 83 of the CGST Act empowers tax officers to provisionally attach a taxpayer's property, which includes the attachment of a bank account, to protect government revenue during such proceedings.

Taxpayers can use Form DRC-22 to execute the order, but if they successfully justify their case or if the officer finds no further need for the attachment, Form DRC-23 is issued to revoke the order.

What is Form DRC 23 in GST?

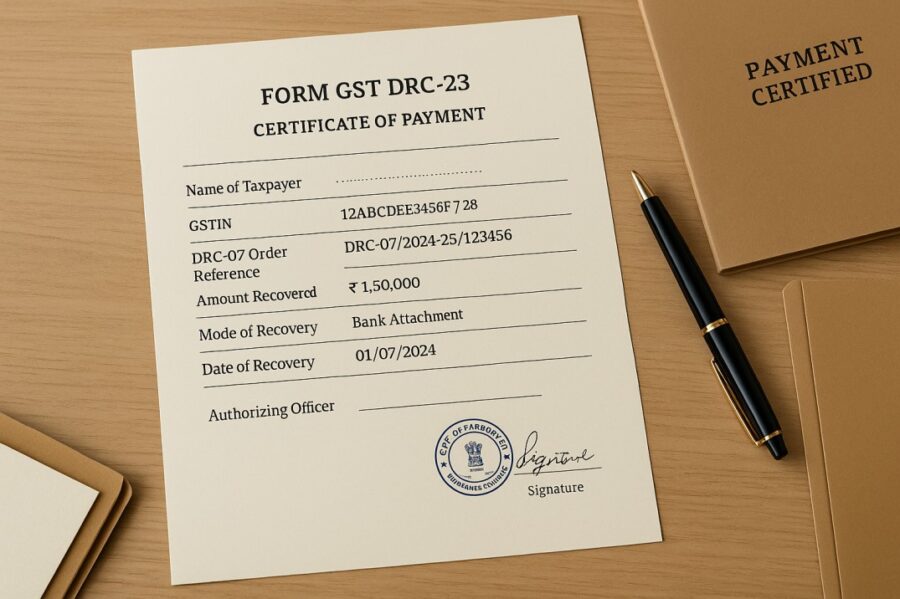

While certain specified proceedings are ongoing, the Commissioner has the authority to issue an order for the attachment of a taxpayer's property to safeguard the interests of the revenue. The Commissioner can release such property by issuing an order via the DRC-23 form.

This release is subject to the condition that the taxable person pays an amount equal to the market value of the property or the amount payable (or likely to become payable) under the GST Act, whichever is lower. The taxable person must also submit proof of such payment before the property is released.

Format of DRC 23 in GST

The DRC-23 form usually includes the following details:

- A reference to the earlier attachment order (DRC-22).

- The name and address of the bank or institution involved

- A confirmation that there is no longer any need for the attachment of bank accounts.

- The signature and designation of the Commissioner or authorised officer.

This form serves as an official instruction, which allows the smooth release of the bank account or any other attached property and restores normal business operations.

Is There Any Protection Against Arbitrary Attachments?

One growing concern among businesses is the trend of arbitrary bank attachments, even when no major default exists. While the law allows for attachment, it also requires that there be a valid reason and a fair approach.

Taxpayers can challenge any misuse of this power. Voluntary taxpayers should be aware that taking such actions is not to be done lightly.

DRC 23 in GST acts as a safeguard in the system, ensuring that unjustified attachments can be undone once the facts are clear.

Conclusion

Upon receipt of DRC-22, the voluntary or compulsory taxpayer may file an objection within 7 days of property attachment, stating that it was not liable for attachment. The Commissioner must provide a hearing, and if satisfied with the response, can release the property by issuing an order in Form DRC-23 in GST.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By