How to Add GST Column in Tally Invoice?

- 9 Jul 25

- 7 mins

How to Add GST Column in Tally Invoice?

Key Takeaways

- Enable the discount column via F11 features in Tally ERP 9 to activate discount functionality in invoices.

- Apply discounts directly in sales and purchase vouchers using either percentage or fixed-value methods.

- Tally ERP 9 automatically calculates GST on the discounted amount to ensure tax compliance.

- Detailed reports and sales summaries allow easy verification and tracking of discounts applied.

- Avoid common errors like not enabling discount settings or misapplying GST during invoice creation.

Tally ERP 9 is an efficient accounting software for businesses across India. It is used to apply discounts and manage financial data. The implication of this software not only helps in financial management but also makes the reports more transparent.

Moreover, Tally ERP 9 significantly helps in GST returns. It simplifies GST registration compliance by enabling the generation of GSTR-1 and GSTR-3B returns directly from the software, in JSON format for easy uploading to the GST portal.

If you are using Tally ERP 9 for your venture and wondering how to add a GST column in a Tally invoice, then you are at the right place. Followingly, this subsequent overview will walk you through the steps of adding a discount column in the software, along with common mistakes to avoid.

Prerequisites for Adding Discount Column in Tally ERP 9 GST

Before you delve into the detailed process of adding a discount column in Tally ERP 9, it is important to know its prerequisites. Take a look:

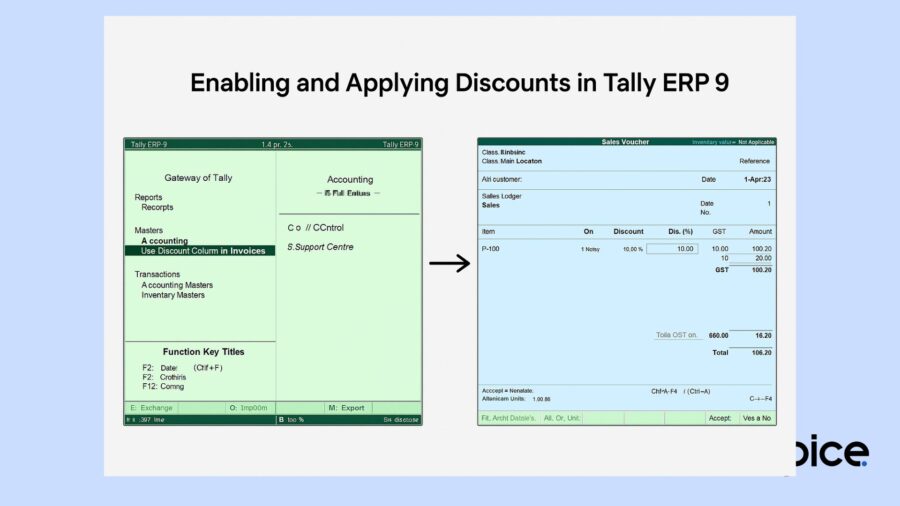

- Enabling Discounts in Tally ERP 9 GST

The discount feature in the Tally ERP 9 software remains inactive. You have to enable the feature first to access it. Here’s how:

- Step 1: Go to Tally ERP 9 and find ‘Gateway of Tally’.

- Step 2: Next, navigate to ‘F11: Features’ > ‘Accounting Features’ > ‘Use Discount Column in Invoices’ and set it to ‘Yes’.

- Step 3: Tap on ‘Enter’ to save the settings and activate the discount column feature.

- Adding Discounts to Sales Vouchers

In the next step, you have to configure the discount volume in the vouchers. Here’s the process:

- Step 1: Navigate to ‘Accounting Vouchers’ > ‘Sales’.

- Step 2: Next, in the sales voucher, choose the items you are selling from the list of stock items and provide their quantity and rate.

- Step 3: Then, on the discount column, add the discount percentage for every item.

- Step 4: The portal will auto-calculate the discount with GST rates and update the sales ledger.

- Configuring Discount Calculation in Tally ERP 9 GST

In Tally ERP 9, one must enter and apply the discounted rate in either of the following ways:

- Percentage-based Discounts: If you enter a percentage discount, Tally ERP 9 calculates the discount based on the item’s selling price. For example, if an item costs ₹100 and you apply a 10% discount, the system will calculate the discount as ₹10.

- Fixed-value Discount: You can also enter a particular discount amount. In this case, the system will directly subtract the discount from the item’s price.

How to Apply Discounts During Transactions

Now that you are all equipped with the prerequisites, let’s proceed to the process of applying discounts during transactions. Here is a detail:

Adding Discounts to Purchase Invoices

Applying discounts during purchase orders is easy in Tally ERP 9 GST. Have a look:

- Step 1: First, you have to go to ‘Inventory Vouchers’ and tap on the ‘Purchase Order’.

- Step 2: Include the sales items along with their details, as required.

- Step 3: Business owners must furnish the discount to the appropriate column for every item.

- Step 4: Finally, the discount will apply to the ultimate purchase order.

Adding Discounts to Sales Invoices

Businesses that generate sales invoices in Tally ERP 9 can add discounts directly on the invoice to reflect the reduced price using the discount column enabled earlier. The software will automatically update the final taxable sales price and the discount.

Viewing and Verifying Discounts in Reports

After applying discounts, you may want to review and verify them. With Tally ERP 9 you can scrutinise the detailed reports that are based on the discounts provided. Have a look:

Sales Summary with Discounts

You have to click on the ‘Inventory Books’ on the Tally ERP 9 to access the sales register. In it you can see a summary of sales transactions and any discounts given.

Detailed Reports on Discounts Provided

The software also furnishes detailed reports on discounts that are applied to transactions. This information can help with internal audits and reviews.

Common Mistakes to Avoid When Adding Discounts

While adding discounts in Tally ERP 9, many make mistakes. Be mindful of these:

- Not Enabling Discounts in Features: Forgetting to enable the discount column in the settings will prevent you from adding discounts in sales vouchers.

- Incorrect Discount Calculations: Ensure that you apply discounts either as a percentage or a fixed amount, as the calculations are based on your chosen method.

- GST Misapplication: Double-check the discounts that are applied after providing GST rate details, as they may lead to discrepancies in your tax filings.

- Ignoring Discount Ledger: Always ensure that you create and use the discount ledger for tracking all discounts.

Benefits of Using Discount Column in Tally ERP 9 GST

Using the discount column in Tally ERP 9 provides several benefits. Here are some of them:

- Accuracy in Discount Calculation: Since Tally ERP 9 automates the discount calculation process, there is no room for errors.

- GST Compliance: GST is automatically calculated on the discounted price in Tally ERP 9. It helps to maintain compliance with tax regulations.

- Transparency: This makes the discounts visible in reports, sale price and invoices. The process adds transparency to financial dealings.

- Saves Time: Using Tally ERP 9 speeds up the invoicing process by directly applying discounts in sales transactions.

Conclusion

With this, the discussion on how to add a GST column in a Tally invoice has come to an end. Inserting a discount column in Tally ERP 9 can simplify business transactions and improve the accuracy of your financial records. You can follow the steps above to apply either percentage or fixed-value discounts to your transactions. It is important to regularly check and correct your reports to avoid any errors.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By