GST on iPhone: HSN Code and Applicable GST Rate on iPhone

- 16 Dec 24

- 10 mins

GST on iPhone: HSN Code and Applicable GST Rate on iPhone

- GST on iPhones

- GST Rate for iPhones in India

- How Is the GST Rate for iPhones Calculated Pre-GST vs Post-GST?

- GST on Refurbished iPhones

- Input Tax Credit for iPhones

- Common Challenges in Claiming GST on Mobile Purchases

- GST on the Supply of iPhones and Accessories

- Duties on the Import of iPhones

- How Does GST Benefit Smartphone Dealers?

- How to Claim Goods and Services Tax on iPhones?

- The Bottom Line

Key Takeaways

- The GST rate on iPhones in India is 18%, with an additional customs duty of 15% for imported models, impacting the overall pricing.

- Refurbished iPhones attract GST only on the profit margin, provided no Input Tax Credit (ITC) is claimed during the initial purchase.

- Businesses can claim ITC on iPhones if purchased for business purposes, provided all GST documentation requirements are met.

- GST simplifies tax compliance for smartphone dealers through uniform tax rates, reduced paperwork, and efficient supply chain management.

- Mixed and composite supplies, such as iPhones sold with chargers or accessories, require careful tax classification to determine applicable GST rates.

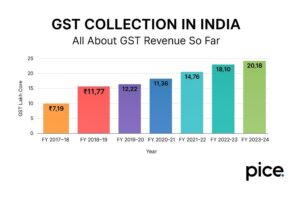

Since the implementation of the Goods and Services Tax in 2017, it has made an impact on the mobile phone industry, especially smartphones. Among the most popular phones, the iPhone is a premium product with a significant market share in India. Proper knowledge of the intricacies of GST on these phones is crucial not only for consumers but also for retailers and distributors.

In this blog, we will discuss various aspects of GST on iPhones, including its rates, calculation methods, import duties and the potential benefits for smartphone dealers.

GST on iPhones

Before GST implementation, the central and state governments levied multiple indirect taxes, such as service tax, central excise duties, VAT and customs duty, at stages of the entire supply chain. Post implementation, GST is levied as it subsumed the existing indirect taxes under one head. However, customs duty is also applicable as iPhones are imported from countries such as China. This is also the reason why iPhones are one of the high-end smartphones in India.

GST Rate for iPhones in India

The GST rate applicable on iPhones in India is 18%, the same as the applicable rate on other mobile phones in India. Under the single tax regime, this rate of 18% is uniform across all the Indian states. Along with GST, a customs duty of 15% is applicable on iPhones as per the 2024 Budget.

It is important to remember that if you purchase an iPhone from a dealer in the same state/UT then you are liable to pay 9% CGST and 9% SGST. If you purchase from a dealer located in a different state/UT, you need to pay IGST at the rate of 18% on the iPhone.

💡 If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

How Is the GST Rate for iPhones Calculated Pre-GST vs Post-GST?

Let us understand the calculation of GST rate for iPhones pre and post-GST with the help of a table:

| Particulars | Row | Pre-GST (Amount in ₹) | Post-GST (Amount in ₹) |

| Manufacturing cost | A | 50,000 | 50,000 |

| Applicable Customs duty @ 22% (Basic 20% + Surcharge 2%) | B | 11,000 | 11,000 |

| Value for GST/VAT calculation | C=A+B | 61,000 | 61,000 |

| VAT at the rate of14%*/GST at the rate of18% | D | 8,540 | 10,980 |

| Selling price to retailer | E=C+D | 69,540 | 71,980 |

| Value addition by the retailer | F | 2,000 | 2,000 |

| VAT@14%*/GST @18% | G | 280 | 360 |

| The total price paid by the customer | H = E+F+G | 71,820 | 74,340 |

GST on Refurbished iPhones

Refurbished phones refer to the old used phones which were purchased by a third party and later sold by them. They make any necessary repairs and undertake running checks to increase the value and selling price. Considering the high prices of iPhones in India, many choose to purchase refurbished mobile devices instead of new ones.

Let us understand this with an example:

A retailer purchases a refurbished model of iPhone from the original user, say for ₹60,000. The retailer then sells it off to a second owner of the phone, say for ₹90,000.

In the above case, the Goods and Services Tax will apply to the profit margin only, which is ₹30,000.

Therefore, the amount of GST is ₹5,4000.

It is important to remember there should be no claimant of Input Tax Credit during the initial purchase of the iPhone.

Input Tax Credit for iPhones

You are eligible to timely claim Input Tax Credit (ITC) on iPhones if you use them for business purposes or in the furtherance of business.

To claim ITC, the tax invoice needs to consist of the seller’s company name, GSTIN, HSN code, the total amount of GST, name and address of the buyer and the GSTIN. Additionally, according to the rules for claiming ITC, the buyer must have received the iPhone and it is mandatory for the seller to have cleared all their tax liabilities to the government and filed their GST returns. The total amount of GST payment needs to reflect in GSTR-2B as ITC.

As per the Central Goods and Services (CGST) Act, an iPhone purchase falls under the capital goods definition if they are put to the use of the business. It is important to remember you can not claim ITC if the GST portion of the purchase price is capitalised. However, you can claim depreciation on the total value in that case.

If the GST portion of the mobile phone prices is not capitalised, you will be eligible to claim Input Tax Credit to the extent of GST payment. Additionally, the rules of ITC reversal will be applicable if you sell the phone before the specific period.

Common Challenges in Claiming GST on Mobile Purchases

Common challenges in claiming GST on mobile purchases by businesses are:

- Personal Usage: If you wish to purchase a mobile phone for personal use, you are not eligible to claim ITC. It is therefore essential to maintain clarity and differentiate between personal and business use to be able to claim Input Tax Credit.

- Proper Record-Keeping: It is essential to maintain proper documentation. Incorrect records can lead to complications while conducting audits which can further be a challenge for claiming ITC.

- Dealer Issues: It is important to check the GST registration of the supplier before making a purchase. You can not claim ITC if you purchase the mobile phone from an unregistered mobile phone dealer.

- Incorrect Invoice: If the GST invoice contains errors or does not comply with the necessary regulations, you may face rejection while claiming ITC. Therefore, it is essential to verify the GST invoice details before you claim input tax credit.

- Changes in Tax Regulations: It is essential to check the GST portal to stay aware of the latest updates as GST regulations change from time to time. It is also necessary to comply with the latest GST regulations for successfully claiming input tax credit.

GST on the Supply of iPhones and Accessories

To understand the applicable GST rates on the supply of iPhones and mobile accessories, it is important to know the type of supplies: composite and mixed. Composite supply refers to the supply where you sell two or more goods or services as a set in the ordinary course of business and can not sell separately; i,e., naturally bundled. Take the example of an iPhone and an iPhone charger. Here, the iPhone is the principal supply and you need to consider the GST rate of the iPhone while issuing the payment receipt.

Mixed supply refers to the type of supply where you sell two or more goods or services which are not naturally bundled and you can sell them individually in the ordinary course of business. For instance, in the case of Apple earphones, it is not naturally bundled with an iPhone and comes under mixed supply.

Duties on the Import of iPhones

A basic customs duty (BCD) at the rate of 15% is applicable on iPhones which are imported to India. In addition to this, a social welfare surcharge of 10% is applicable on the BCD rate. These duties are applicable on all imported phones to make these products more expensive than the local products.

The value of goods for calculation of Integrated Goods and Services Tax (IGST): assessable value of goods + basic customs duty (BCD) + other duties which are chargeable on goods under a law.

How Does GST Benefit Smartphone Dealers?

The implementation of Goods and Services Tax has been beneficial to smartphone dealers in multiple ways:

- Simple Tax Structure: The uniform GST rate of 18% across India has been helpful in reducing significantly the operational complexities and tax burden.

- Less Paperwork: The digital process and fewer documentation requirements of GST have simplified the operational work.

- Efficient Supply Chain Management: The reduction of transit time and elimination of inter-state check-posts have been beneficial in increasing the efficiency of the supply chain.

- Increase in Customer Trust: The Indian pricing structure and uniform rate after GST implementation has been beneficial at increasing sales and building customer confidence.

- Claiming Input Tax Credit (ITC): Under Goods and Services Tax, dealers are eligible to claim Input Tax Credit on inputs and input services like electricity, rent, and transportation.

How to Claim Goods and Services Tax on iPhones?

Follow the steps below to claim GST on iPhones:

- Ensure that the purchase was solely for business purposes.

- Make sure that you purchase the mobile phone from a dealer who has GST registration.

- Keep these documents handy:

- Payment receipts

- Invoices which comply with the following GST regulations:

- Supplier’s GSTIN

- HSN Code of the iPhone

- Total amount of GST

- Applicable GST percentage rate

- It is necessary that you make the GST claim in the year of purchase.

- Visit the official portal to file GST returns and claim ITC.

The Bottom Line

The GST on iPhones plays an important role in the pricing of phone brands in India. From understanding the HSN code and applicable tax rates to claiming input tax credits, you must have proper knowledge about the impact of GST on the supply of iPhones to maintain business compliance.

By

By