How to Create an IGST Tax Invoice Format?

- 12 Dec 24

- 11 mins

How to Create an IGST Tax Invoice Format?

Key Takeaways

- Uniformity in Taxation: IGST ensures consistent tax rates for interstate transactions.

- Seamless ITC: Businesses can claim Input Tax Credit on IGST paid for purchases.

- Mandatory Compliance: IGST invoices are essential for interstate supply documentation.

- Accurate Details: Include GSTIN, HSN/SAC codes, and IGST rates for error-free invoicing.

- Efficient Practices: Use billing software, verify details, and issue invoices on time.

Integrated Goods and Services Tax (IGST) is a vital element of the GST framework. It applies to the sales of goods and services across states or union territories. For business owners engaged in interstate transactions, understanding the IGST tax invoice format is essential.

Not only do IGST invoices maintain a uniformity of taxation between all interstate movements, but also reduce complexity. To help you comprehend better, this all-inclusive overview speaks of the definition, significance and key component of this tax system for an effortless invoicing process.

What Is IGST?

The Central Government of India introduced IGST to regulate and control all interstate supplies of goods and services as well as import and export services. It helps to maintain the input tax credit chain in supplies and allows the consumer state to pay SGST. IGST is for interstate sales, whereas CGST (Central Goods and Services Tax) and SGST (State Goods and Services Tax) are for intrastate transactions.

For instance, if a business based in West Bengal sells products or services amounting to ₹1,00,000 to a registered customer based in Maharashtra, and the IGST rate is 12%, the calculation would be:

Value of the goods or services x Rate of IGST /100 = Total IGST

100000 x 12/100 = 12000

Thus, the Maharashtrian buyer would be paying ₹1,12,000 to the seller of West Bengal.

The IGST invoice generation is crucial for all except for composition dealers. Vendors under the composition scheme or composition plan must issue a bill of supply instead of a tax invoice.

What Are the Rates of IGST?

IGST applies to inter-state transactions and import and export of goods and services. IGST revenue is divided between the State and Central Governments. The IGST rates applicable are 0%, 5%, 12%, 18% & 28%. The rate varies according to the product.

What Are the Features of IGST Invoicing?

IGST invoicing has certain unique features. Some of them are:

- Uniformity: The GST council puts a uniform IGST rate across the nation. Thus, it avoids confusion in assessing the estimation of the valuation of goods and services to the registered traders who deal with different states.

- Destination Principle: The amount collected as IGST goes directly to the tax authority of the state where the goods are being consumed.

- Input Tax Credit (ITC): A business can claim a tax credit if it pays IGST on its purchases. It reduces the amount of IGST that the business owes while calculating its final tax bill.

Why Is a GST Invoice Important?

An IGST invoice is a legal requirement for businesses operating between Indian states. Here are the reasons behind its importance:

- IGST helps to accurately record all domestic sales.

- It offers a foolproof estimation of taxes.

- It allows business owners to maintain optimum compliance with GST regulations.

- It keeps taxpayers safe from legal implications and penalties.

- An IGST invoice establishes a collaborative relationship between buyers and sellers.

- It repels the risk of scams or miscalculations.

- Finally, IGST invoices safeguard your business reputation.

Key Parts of a GST Invoice Format

There are several pieces to the IGST invoice puzzle. Each component holds crucial information, meeting specific requirements. These mandatory fields are:

- Invoice Number and Title

At the top of the invoice, the business owner must add a unique invoice number along with the date. In addition, do not forget to mention the term ‘Tax Invoice’ at the top of the invoice.

- Details of Seller

This section comprises complete details of the seller. Thus, carefully add your business name, registered address, company details, contact details and GSTIN.

- Recipient Details

Similarly, here you must include crucial customer details such as name, delivery address and GSTIN, customer code, if any.

- Details of Supplied Goods and Services

This field is for item description. Here, describe the product or service you are supplying. These details include name and type of goods and services, quantity, unit price and total value before applying taxes. This helps everyone to understand what is being sold and how much it costs.

- 8-digit HSN Code or SAC

Every product under the GST mechanism carries a unique code. This code is either a Harmonized System of Nomenclature (HSN) or a Services Accounting Code (SAC). While HSN is for goods, SAC applies to the services. Ensure to add this unique code on your IGST invoice.

- Taxable Value

The total sale amount without taxes is determined by multiplying the quantity by the unit price.

For instance, if you sell 100 units of a product priced at ₹20 each, the taxable value would be ₹50 multiplied by 100, which equals ₹5,000.

- IGST Amount and Rate

This is a very important section of the IGST invoice format. You are required to mention the IGST tax details of the product or service. The rate varies for different products and also changes over time, therefore must be selected according to what is required. Upon determination of the applicable tax rate, you multiply this with the taxable value of your product or service.

For example, if the taxable value is ₹10,000 and the IGST rate is 18%, the IGST amount will be: ₹10,000 x 18% = ₹1,800.

- Total Value of the Invoice

The total transaction details on the invoice are the sum of the taxable value and the IGST. This is the full amount the buyer has to pay. Clearly state this amount in both numbers and words.

- Terms of the Payment

If you have particular payment terms, you can mention them in this payment report field. These conditions can be payment deadline, payment methods (e.g., bank details, online payment options, etc.), advance payment made and any fees for late payment or discounts for prompt payments.

- Declaration

In this part, you can include a standard declaration. This is a statement that serves as a compliance detail that verifies the information on the invoice is correct. For instance, you might say: “I affirm that the details provided in this invoice are accurate and true to the best of my understanding.”

- Authorised Signature

Ultimately, the invoice must be signed by someone who has the authority within your organisation. This may include the owner, director or anyone who is permitted to generate invoices. A signature is essential for the invoice to be considered official.

Note: Apart from the above-mentioned fields, if you are willing to add some extra details, then make sure to include them before the declaration.

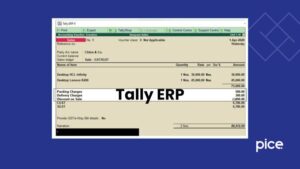

Step-by-Step Process on How To Create a GST Invoice

An IGST invoice format can be a bit complex to develop. However, this step-by-step procedure will allow you to easily tailor it. Here is a step-by-step tutorial:

1: Choose an Invoice Template

Choose an invoice template. There are so many free templates available online. You can also use the GST invoice generator to make a professional commercial invoice. The template should include all the important sections.

2: Fill in Seller and Buyer Information

Fill in the details for both the seller and the buyer, such as billing address, company address, business details, client details and other essential details. Check the GSTINs for both to avoid mistakes. If the buyer is not registered under GST, you can leave out their GSTIN.

3: Add the Description of Goods or Services

List the details of the goods and services that are on sale. Provide the quantity and the unit price for all. The total value for every item is also included in this list. Attach the 8-digit HSN or SAC, so that compliance under GST will not be a problem.

4: Apply the Correct IGST Rate

Check the IGST rate applicable to your goods or services. Once you obtain a rate, multiply this by the taxable value to calculate the amount of IGST payable. This information must be printed on the invoice on a separate line.

5: Calculate the Total Invoice Value

Here you must sum up the costs of all products or services to get a subtotal. You then add any applicable taxes. You subtract any discounts, if applicable. The final result is your total invoice amount.

6: Review and Sign the Invoice

Ensure that all information appearing on an invoice is correct before a buyer receives it. In that case, you must sign the invoice or your e-signature if it needs to be sent online.

Note: Make sure to create custom fields and fill in these spaces with crucial information, such as ZIP code, bar code, government regulations, correct tax rates, time of supply, your expectations for payment, and additional billing details, for efficient and faster invoice creation.

Best Practices for Creating IGST Invoices

Taxpayers can adhere to the following practices to ensure IGST invoices are always correct and not in violation of any governmental policies:

- Billing Software Utilisation: The use of accounting software or GST bill generator makes it convenient to prepare IGST invoices without any hassle. Such software also saves you from the wrong calculations involved in the payment of tax.

- GSTIN Verification: The GSTINs of the seller as well as the buyer must always be verified before issuing an invoice. Wrong GSTINs create a problem at the time of tax filing.

- Timely Issuance: An IGST invoice is issued right after a sale or delivery of services. Delaying this process may lead to a complicated situation. It also incurs penalties and charges.

- Keep Track: Maintain proper financial records of all invoices, including all business supplies, digital payments, exempt supplies and more, in case there is a future audit or review by the tax.

What Are the Aspects to Consider in IGST?

Certain things must be kept in mind while dealing with IGST. Take a look:

- IGST Billing: During an interstate transaction, the seller must create the IGST tax invoices and send them off to the buyer who subsequently pays the amount.

- Requirement of GSTIN: Both sellers and buyers must be registered under GST to ensure fail-safe adherence to the IGST norms.

- Jurisdiction: The Central Government determines the jurisdiction of IGST. It not only accelerates uniform administration of the tax but also facilitates seamless collection of taxes from inter-state supplies.

- Import and Export: IGST also falls on internationally imported and exported goods and services. The treatment of tax relies on whether the product is imported to India or exported outside the nation.

Conclusion

So there you have it! This detailed overview of the IGST tax invoice format will streamline your business processes, ensuring faster payment and compliance with tax regulations. Knowing how to prepare an IGST invoice is an essential business requirement for a registered person under GST.

💡If you want to streamline your payment and make GST payments, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By