GST on Commercial Property

- 4 Oct 24

- 8 mins

GST on Commercial Property

- Understanding GST on Commercial Property

- Rate of GST on Commercial Property in India

- Reasons Behind the Tax Structure

- Benefits of Comprehending GST on Commercial Property

- Calculation of GST on Commercial Property

- GST on Lease Transaction

- GST on Other Rental Income

- Input Tax Credit (ITC) on Commercial Property Rent

- GST Compliance for Commercial Property

- How To File Your GST For Commercial Property In India?

- The Bottom Line

Key Takeaways

- GST at 18% is applicable on commercial rental income exceeding ₹20 lakhs annually, while residential property rent is exempt.

- Commercial properties in residential projects attract 5% GST, and other commercial projects are taxed at 12%.

- Tenants registered under GST can claim Input Tax Credit (ITC) on rent for commercial purposes but not for construction expenses.

- Religious trust-owned properties have GST exemptions if rental rates meet specific thresholds.

- Commercial property owners must file GSTR-3B and GSTR-1 returns to comply with GST regulations and optimize ITC claims.

Goods and Services Tax has made a significant mark in the taxation structure of India and brought changes to various sectors, including commercial properties. Whether you are renting or leasing a commercial property, being aware of GST implications on commercial property is important. It not only simplifies the taxation system but also increases transparency in the sector of real estate.

In this blog, we will discuss GST on commercial property, the applicable rate, calculation, the benefits of comprehending it and many more.

Understanding GST on Commercial Property

Renting out commercial properties involves subletting warehouses, offices and other business establishments. This can be a source of income for landlords. These properties can be used for various business activities. The agreement between the landlord and tenants is usually based on the duration of rent, rental amount, maintenance responsibilities, etc.

The GST applicability on rental income is:

- Rate of GST: The standard GST rate which applies to rental income is 18%.

- Taxable Supply: Subletting a property for commercial purposes is a taxable supply. Hence, landlords charge GST on the rent they receive.

- Threshold Limit: GST is levied only if the rental income is more than ₹20 lakhs annually. For special category states, this amount changes to ₹10 lakhs annually.

- Exemption: Although residential property rent is exempt from GST, commercial properties are taxable.

Rate of GST on Commercial Property in India

The rate of GST which is applicable on commercial property in India depends on the nature and location of the property. The GST rates on two types of commercial properties are:

| Commercial Property Type | Rate of GST |

| Commercial properties in residential real estate projects | 5% |

| Other commercial projects | 12% |

💡If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

Reasons Behind the Tax Structure

The reasons behind implementing Goods and Services Tax are:

- Subsuming Indirect Taxes: During the earlier regime, there existed multiple indirect taxes like Value-Added Tax, Central Excise Tax, Service Tax etc. GST was implemented with the aim of clubbing of taxes and creating a single tax regime.

- Common Market: GST was implemented so that every state in India follows the same tax rate on the same goods and services. This also helps the Central Government in proper decision-making regarding policies and also helps to control taxes.

- Eliminate Tax Evasion: Since GST is a single taxation system which applies to every state in India, it becomes challenging to evade taxes. Additionally, it also helps the Government to supervise fraudulent activities more efficiently.

Benefits of Comprehending GST on Commercial Property

The benefits of comprehending GST on commercial properties are:

- Knowing the intricacies of GST on commercial property helps business owners in decision-making, financial planning, compliance with the regulations and optimise ITC.

- It also helps in business growth and promotes healthy competition in the market of commercial property.

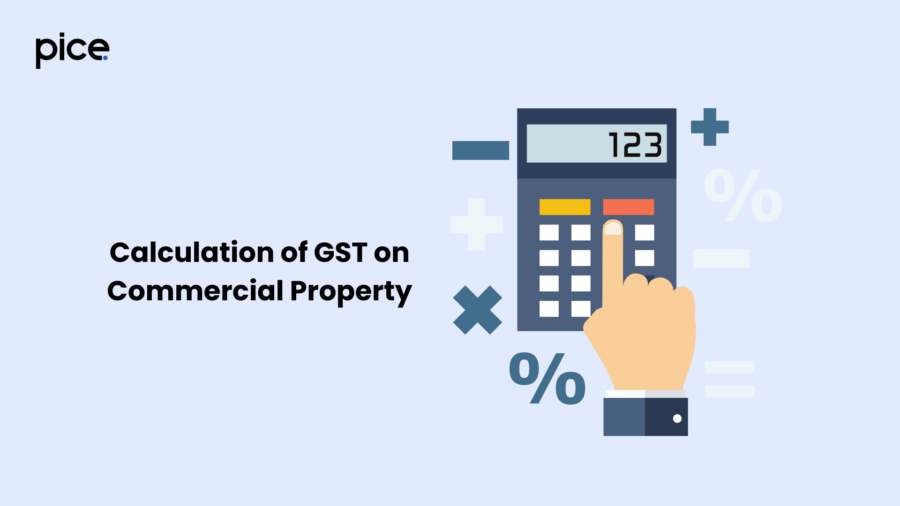

Calculation of GST on Commercial Property

For the calculation of Goods and Services Tax on commercial property, apply the 18% GST rate to rental income. For instance, if the rent is ₹10,000 monthly, the amount of GST applicable on this amount is ₹1,800. It is calculated as:

18% * ₹10,000= ₹1,800

Hence, the total payable amount, if we calculate GST on rent is ₹11,800.

GST on Lease Transaction

If you sublet a property for residential purposes, it does not attract any GST and is exempted. If you sublet a property for commercial purposes or any type of lease agreement for business purposes, it is treated as a supply of services and will attract a GST rate of 18%.

GST on Other Rental Income

If you rent out a property for commercial purposes, GST would be applicable at the rate of 18% on the total taxable services. However, if you are an owner of a religious trust that the public uses and has registration, it is exempt from GST. This means no GST will be applicable in this case. However, you will have to meet the following conditions:

- The rent of the rooms is less than the charge of ₹1,000 daily.

- The rental charge for shops and other business spaces is then the monthly amount of ₹10,000.

- The rental charge for open spaces like community halls is less than the daily amount of ₹10,000.

Input Tax Credit (ITC) on Commercial Property Rent

Tenants who have their registration under the GST Act can claim an Input Tax Credit (ITC) on the rental payment. However, it is important to remember that a tenant can only avail ITC if the property is used for business or any commercial purpose. It is necessary to deposit the GST with the government before claiming an Input Tax Credit.

There are certain expenses on which one cannot claim ITC as per Section 17(5) of the Central Goods and Services Tax (CGST) Act. You cannot claim ITC on expenses that you incur for the construction of properties. However, ITC can be claimed on actual expenses incurred for rental property repair or any brokerage cost.

GST Compliance for Commercial Property

Following are the GST compliance rules for commercial property:

- GST is applicable on every immovable property in India, irrespective of the type of property- residential or commercial.

- The GST rate applicable on property on rent is 18%. Additionally, the taxpayer needs to pay a 10% income tax, if the annual rent exceeds ₹2.4 lakh.

- Builders of property for business need to register under GST and need to file GST returns regularly with the government to ensure compliance.

- GST is applicable at the rate of 12% on the sale of commercial properties which are either under construction or newly constructed.

- Builders or developers of business properties can claim Input Tax Credit on the GST payment on goods and services which are put to use for the construction of properties.

- Commercial properties which are fully constructed or used for resale are not subject to GST.

How To File Your GST For Commercial Property In India?

Follow the steps below to file your GST return for commercial property in India:

Step 1: Sign in to this service.

Step 2: Tap on ‘Return’ under ‘Service’ and click on ‘Return Filing.’

Step 3: You need to file GSTR-3B returns and GSTR-1 returns for commercial property rent.

Step 4: Select quarterly or monthly filing of returns.

Step 5: Fill in the details of your current taxes.

Step 6: After return filing, you will need to make the payment for GST liability by clicking on 'Payment' on the official GST portal.

Step 7: Click on ‘Create Challan’, enter the correct payment amount and select the payment mode. After making the payment, ensure to download the receipt.

Step 8: Finally, acknowledge with an OTP which you will receive and sign using a digital signature.

The Bottom Line

Proper knowledge of GST on commercial property plays a crucial role in cost savings and ensuring compliance with GST regulations. Whether you are leasing, selling or renting, being aware of the latest GST guidelines and benefits like ITC, you can effectively manage your investments.

By

By