Procedure to claim your IGST Refund on Export with Expert Tips

- 10 Aug 24

- 13 mins

Procedure to claim your IGST Refund on Export with Expert Tips

Key Takeaways

- Exporters can claim IGST refunds for goods exported with the payment of IGST, enhancing liquidity and cash flow.

- Accurate filing of GSTR-1 and GSTR-3B is crucial for a seamless IGST refund process.

- The IGST refund mechanism is largely automated, relying on data matching between GST filings and shipping bills.

- Exporters have the option to export goods without paying IGST by furnishing an LUT or bond, focusing on input tax credit claims.

- Timely and accurate documentation, such as shipping bulletins and GST returns, should be emphasized to prevent potential delays on the refund.

- Lately, the IGST refund process has been revised in attempt to make it straightforward through implementing enhanced automation and features such as real-time tracking.

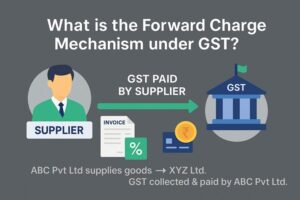

Exporters opting to export goods with payment of Integrated Goods and Services Tax (IGST) can claim a refund of the tax paid. The process begins with the accurate filing of GSTR-1 (details of outward supplies) and GSTR-3B (summary of outward supplies along with tax payments).

It's crucial that all details related to exports, including the IGST paid on exports, are correctly reported. The successful matching of the data in the GSTR forms with the shipping bill data submitted to Customs starts the largely automated refund process.

Overview of the GST Refund Process for Exports

The Goods and Services Tax (GST) regime in India has streamlined the tax framework, including the exporting goods process. Within this framework, exporters have two main avenues for their operations concerning GST: exporting goods with the payment of Integrated Goods and Services Tax and exporting goods without the payment of IGST.

Both methods have their own processes for claiming refunds on taxes paid or for receiving exemptions. Here's a closer look at each:

Export with Payment of IGST

- Process: Exporters who choose to export goods with the payment of IGST can claim a refund of the IGST paid on exported goods. The process involves the exporter paying the IGST upfront at the time of export and then claiming the refund after the export has been made.

- Refund Mechanism: The refund mechanism is primarily automated. After the exporter files the monthly returns on GSTR-3B and the details of exports in GSTR-1, including the IGST paid, the system automatically processes the refund based on the matching of these details with the shipping bill filed with customs.

- Benefits: This method ensures a smooth flow of credit and is beneficial for exporters who have enough liquidity to pay the IGST upfront. It also simplifies the process of reclaiming the tax paid once the goods are exported.

Exports without Payment of IGST

- Process: Exporters have the option to export without payment of IGST or by furnishing a Letter of Undertaking (LUT) or a bond. This method is particularly beneficial for exporters who wish to avoid the initial cash outflow associated with the payment of IGST.

- Refund Mechanism: In this case, since no IGST is paid at the time of export, there is no refund to be claimed. However, exporters can claim refunds on the input tax credit (ITC) for the inputs consumed in the production of exported goods. The process involves filing the monthly returns and providing details of the inputs used, after which the refund of the ITC is processed.

- Benefits: This method aids in maintaining liquidity as it exempts the exporter from the upfront payment of tax. It's particularly advantageous for exporters who have significant input credits and prefer to offset their tax liabilities without a cash payout.

Key Takeaways

- Choice of Method: Exporters can choose between paying IGST and claiming a subsequent refund or exporting under LUT/bond without payment of IGST based on their cash flow situation and business preferences.

- Documentation and Compliance: Regardless of the chosen method, accurate documentation and compliance with GST filings are crucial. This includes timely and accurate filing of GSTR-1 and GSTR-3B forms, along with proper documentation of exports.

- Automated Refunds: For exports with IGST payment, the refund process is automated, making it crucial for the details in GST returns to match the shipping bill details accurately to avoid delays in refunds.

- Input Tax Credit: For exports without IGST payment, the focus is on claiming the input tax credit

How Do Claim IGST Refund?

An important part of India's GST system is the Integrated Goods and Services Tax return process for exporting goods. This is meant to increase exports by keeping taxes out of the prices of goods being sold abroad. Exporters can get back the IGST they paid on goods leaving India through this process.

Here's a detailed overview of how the refund process works:

Step-by-Step Guide to the IGST Refund Process

- Export of Goods with IGST Payment: The exporter must first pay the IGST on the goods they intend to export. This payment is made at the time of exporting the goods by declaring the same in the shipping bill.

- Filing of GST Returns: The exporter is required to file monthly GST returns. This includes:

- GSTR-1: Where the details of the exported goods, including the tax paid, are declared.

GSTR-3B: A summary return where the payment of integrated goods and services tax is also declared. It's crucial that the details in GSTR-1 match the information provided in the shipping bill and GSTR-3B to ensure a seamless refund process. - Automated Refund Process: The refund process for IGST on exported goods is largely automated. Once the GSTR-1 and GSTR-3B are filed and the shipping bill details are furnished accurately, the GST portal and the customs portal (ICEGATE) cross-verify the data. If everything matches, the refund process is initiated automatically.

- Bank Account Details: The exporter must ensure that their bank account details are correctly registered with the GST portal since the refund is directly credited to the bank account mentioned in the records.

- Refund Claim Processing: If the details filed in the GST returns and the shipping bill are in agreement, the refund claim is processed without any manual intervention. The system automatically calculates the refund amount based on the IGST paid on the exported goods.

- Refund Issuance: After processing, the refund is issued directly to the exporter's bank account. The time frame for the refund to be credited can vary, but efforts are made to expedite the process so as not to hold up the exporter's capital.

Latest Updates on IGST Refund

As of my last update in April 2023, specific "latest" updates on the Integrated Goods and Services Tax (IGST) refund process or policies may not be accurately provided without current access to real-time data or recent notifications from the GST Council or the Indian government's official channels.

For the most current information, including any recent changes or updates on IGST refunds, it's recommended to consult the official GST portal, notifications from the Central Board of Indirect Taxes and Customs (CBIC), or official government press releases.

These sources provide authoritative and up-to-date information on GST policies, including any refinements or adjustments to the IGST refund process that may impact exporters.

Official sources for updates:

- GST Portal: Check for circulars, notices, and updates specifically about IGST refunds.

- Central Board of Indirect Taxes and Customs (CBIC): Look for press releases or notifications regarding IGST.

- GST Council Meetings: Summary outcomes or press releases post-GST council meetings often contain crucial policy changes or updates.

Automated IGST Refund Mechanism

The Indian government has further streamlined the integrated goods and services tax refund process, making it more automated. This automation reduces human intervention, thereby speeding up the refund process.

The system automatically validates the information between the GST returns and the shipping bills filed by exporters, ensuring faster processing of refunds.

- Refund SMS Services

To make the process more accessible, the Central Board of Indirect Taxes and Customs (CBIC) introduced a service allowing exporters to apply for refunds via SMS. This service is particularly beneficial for small and medium-sized exporters who may not have easy access to the GST portal for refund applications.

- Enhanced Tracking Mechanism

The GST portal and ICEGATE have enhanced tracking mechanisms that allow exporters to track the status of their refund claims in real-time. This transparency helps in identifying and rectifying any discrepancies or issues that may arise during the refund process.

- Resolution of Technical Glitches

The government has worked on resolving technical glitches and issues that previously hindered the refund process. Regular updates and patches have been applied to the GST and ICEGATE portals to ensure smoother operations and minimize errors that could delay refunds.

- Simplification of Documentation

The requirement for documentation has been simplified to ease the refund process. Now, with the automated matching of data between GST returns and shipping bills, the need for additional documents has been significantly reduced, thereby expediting the refund process.

- Outreach Programs for Exporters

The CBIC and other government bodies have initiated outreach programs to educate exporters about the integrated goods and services tax refund process. These programs aim to address common issues faced by exporters and provide guidance on how to ensure a hassle-free refund process.

- Streamlined Process for Rectifying Errors

A more streamlined process has been implemented for exporters to rectify errors in their filings, which previously could have led to delays or denials of refund claims. Exporters now have clearer guidelines and a defined window for correcting discrepancies in their GST returns or shipping bills.

- Focus on Exporter Grievances

Special attention has been given to addressing exporter grievances related to IGST refunds. Dedicated helpdesks and online portals have been set up to address and resolve issues that exporters face during the refund process.

- Ineligibility for IGST Refund

Not all entities are eligible for an IGST refund. Ineligibility can arise from non-compliance with GST or customs documentation requirements, discrepancies in filings, or failure to adhere to prescribed procedures and timelines.

| Reasons for Ineligibility | Description |

|---|---|

| Mismatch in Shipping Bill and GST Returns | Discrepancies between shipping bill and GST return details. |

| Incorrect Bank Account Details | Incorrect or not updated bank account details in GST portal. |

| Export under Bond or LUT without Paying IGST | No IGST paid at the time of export under bond or LUT. |

| Non-compliance with GST Provisions | Not adhering to compliance requirements under GST. |

| Goods Exempted from IGST | Exports of goods exempted from IGST do not qualify for a refund. |

| Input Tax Credit (ITC) Mismanagement | Incorrectly availed or utilized ITC affects IGST refund eligibility. |

| Failure to Realize Export Proceeds | Not realizing full value of exports within specified time limit. |

| Documentation and Record-Keeping Errors | Inadequate or improper export documentation and GST returns. |

| Fraudulent or Non-Genuine Transactions | Exports involved in fraudulent activities are ineligible for refunds. |

Reasons for Stuck IGST Refund Claims

Refund claims can get stuck due to various reasons, including data mismatch between GSTR-1 and the shipping bill, incorrect GSTIN numbers, or wrong port codes. Ensuring accuracy in these details is paramount to avoiding delays.

- Incomplete or Incorrect Filing of Returns: Claims can be delayed if the returns are filed with missing or incorrect information, leading to discrepancies that need resolution.

- Mismatch in Invoice Details: If there are discrepancies in invoice details between the shipping bill and the GST return, it may cause the refund claim to be questioned and delayed.

- Shipping Bill Errors: Errors in the shipping bill, such as incorrect GSTIN or invoice numbers, can lead to refund processing delays.

- GSTR-1 and GSTR-3B Mismatches: Differences in taxable value and tax amounts reported in GSTR-1 and GSTR-3B filings can cause complications in processing refunds.

- Incorrect Export Product Classification: Using the wrong HSN/SAC codes, leading to incorrect tax liability calculations, can affect the refund process.

- Non-reconciliation of Export Invoices: Failure to reconcile invoices submitted in GST returns with those in shipping bills can halt the refund process.

- Lack of Supporting Documentation: Missing necessary documents such as bank realization certificates or export orders can lead to refunds being stuck.

- Errors in the Refund Application: Mistakes in the refund application form itself can affect the processing and approval of claims.

- Unresolved Queries from Customs: If Customs has outstanding queries related to exports that remain unanswered by the taxpayer, it can delay the refund.

- Delay in Export Realization Documentation: Delays in submitting proof of export realization within the allowed timeframe can also cause refund claims to be stuck.

Conclusion

Navigating the IGST refund process requires a thorough understanding of GST laws, adherence to compliance requirements, and staying updated with the latest procedural changes.

For exporters, leveraging the automated processes and the available tracking services can significantly ease the refund process, ensuring timely refunds and optimal cash flow management. Compliance, accuracy in filing, and awareness of the latest updates are key to a smooth refund process.

Say goodbye to manual calculations and the risk of errors. Our app not only streamlines your tax payments but also keeps you updated with the latest GST regulations, ensuring you're always on the right side of compliance.

💡Download PICE, our GST Payment App, today and take the first step towards hassle-free tax management. Also, transform your GST payment experience now! Available on iOS and Android.

FAQs

What documents are required for claiming an IGST refund on exports?

Shipping bill(s) or bill of export with IGST payment details.

Export invoice(s) indicating the IGST amount paid.

Proof of realization of export proceeds, such as a bank realization certificate (BRC) or Foreign Inward Remittance Certificate (FIRC),.

How long does it take to receive an IGST refund after application?

Can an exporter claim an IGST refund on services as well as goods?

What should I do if my IGST refund claim is denied?

Rectify any discrepancies or submit any missing documents.

Reapply for the refund or appeal against the decision if you believe the claim was wrongly denied.

By

By