GSTR-3B: Due Date, Late Fee, Format, Return Filing, Eligibility, Rules

- 24 Aug 24

- 9 mins

GSTR-3B: Due Date, Late Fee, Format, Return Filing, Eligibility, Rules

Key Takeaways

- Monthly Compliance: Filing GSTR-3B monthly is mandatory for all registered GST taxpayers to report sales, ITC, and tax liabilities.

- Strict Deadlines: The due date for filing GSTR-3B is the 20th of the following month for monthly filers, with penalties for late submissions.

- Detailed Reporting: GSTR-3B requires detailed information on outward and inward supplies, ITC, and tax payments for accurate GST compliance.

- Filing Options: Taxpayers can file GSTR-3B online through the GST portal or offline using the downloadable utility for ease and convenience.

- Penalty Avoidance: Timely filing of GSTR-3B helps businesses avoid hefty late fees and interest charges, ensuring smooth GST compliance.

The Goods and Services Tax (GST) is a comprehensive taxation system introduced in India to streamline and consolidate multiple indirect taxes previously imposed by central and state governments. GST aims to simplify tax procedures and enhance compliance by unifying all indirect taxes under a single umbrella. Businesses operating under the GST framework must file various returns, such as GSTR-3B, to declare their tax liabilities.

This article highlights what GSTR-3B is, its eligibility requirements, repercussions of non-compliance and the necessary documentation for submission.

What Is the GSTR-3B Form?

Along with the GSTR-1 and GSTR-2 forms, registered dealers also submit the GSTR-3B self-declaration on a monthly basis. The Government of India introduced it, which simplifies the declaration of GST liabilities by summarizing the inward and outward supply for a particular tax period.

Generally, GSTR-3B cannot be amended, and each dealer must file a separate return for each GSTIN. It is essential to settle the tax liability of GSTR-3B by the filing deadline each month.

Who Can File GSTR-3B?

Now that you know what GSTR-3B is, let us understand who can file this type of GST return. If you have a valid GSTIN and are a registered taxpayer, you must file GSTR-3B returns every month, even if you owe no GST for that period. However, you are exempt from filing GSTR-3B returns if you are:

- A taxpayer registered under the composition scheme

- An input service distributor

- A non-resident supplier of Online Information Database Access and Retrieval (OIDAR) services

- A non-resident taxable person

Even small taxpayers with an annual turnover of less than ₹5 crores must file GSTR-3B returns. They can file either monthly or quarterly if they opt for the Quarterly Returns Monthly Payment (QRMP) scheme.

When Is the Last Date to File GSTR-3B?

The deadline for filing form GSTR-3B returns for a particular month is the 20th of the next month. For instance, if you need to file GSTR-3B for April, you should do so by May 20th. If you are a taxpayer under the QRMP scheme, you can file GSTR-3B returns quarterly between the 22nd and 24th of the following month.

The exact due date depends on the state or union territory of your business. Additionally, ensure you make the tax payment by the deadline to avoid significant late fees.

Late Fee & Penalty for GSTR-3B

Following are the fees you need to pay for delay in filing GSTR-3B:

- ₹50 per day of delay if you are not liable for paying any tax for the month.

- ₹20 per day of delay if you have nil tax liability for the month.

- For any pending tax amount, you will be charged a late fee and interest of 18% per annum for that amount.

How Is GSTR-3B Structured?

The GSTR-3B structure consists of the following sections:

Section 1: Contains different questionnaires related to your business activities and the tax liabilities for the present tax month.

Section 2: Shows information related to GST returns along with the status of your tax return.

Section 3.1: In this section, you need to provide details related to the tax levied on outward and inward supplies on which a reverse charge is liable.

Section 3.2: Includes information concerning inter-state supplies that are made to composition taxable persons, unregistered persons and UIN holders.

Section 4: You will find details related to the input tax credit (ITC) that you are eligible to receive.

Section 5.1: Contains details regarding the GST-exempted inward supplies.

Section 5.2: Here you will find details of the late fees and applicable interest rate.

Section 6.1: Mentions all details related to the GST liabilities payment for the quarter or the month.

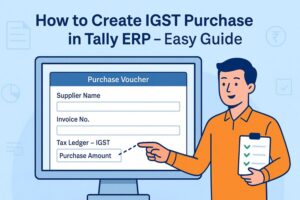

Step-by-Step Procedure for Online Filing of GSTR-3B

Here are the steps for filing returns of GSTR-3B online:

Step 1: Visit the official GST portal and log in to your account.

Step 2: Go to the ‘Services’ tab and tap on ‘Returns’.

Step 3: Choose the ‘Returns Dashboard’ option.

Step 4: You will be redirected to the ‘File Returns’ page. From the drop-down list, choose ‘Return Filing Period—Month or Quarter’, 'Quarter', or ‘Financial Year’.

Step 5: Tap on the ‘Search’ button.

Step 6: Choose ‘Monthly Return GSTR-3B’.

Step 7: Click on the ‘Prepare Online’ option and provide the required details.

Step 8: Select the ‘NEXT’ button. For filing ‘NIL’ returns, you need to choose ‘Yes’ for the first question and fill up the remaining ones.

Step 9: Provide the applicable values in each title and enter the applicable interest rate and late fees.

Step 10: Tap on the ‘Confirm’ button and choose ‘SAVE GSTR 3-B’.

Step 11: Upon verification and confirmation, tap on the ‘SUBMIT’ button.

Step 12: For viewing the draft of the GSTR-3B return, tap on ‘Preview Draft GSTR-3B’.

After successfully submitting the return, the ‘Payment of Tax’ option will be enabled. You can hit the ‘Check Balance’ button to look at your credit and cash balance.

Step 14: Select ‘Authorised Signatory’ from the drop-down list.

Step 15: Choose the ‘FILE GSTR-3B WITH EVC’ or ‘FILE GSTR-3B WITH DSC’ options.

Step 16: Press the ‘PROCEED’ button.

Once you complete all the above steps, you will receive a message about the successful completion of the form. Next, you need to tap ‘ok’ and the status will convert to ‘Filed’. Furthermore, you can tap on ‘View GSTR-3B’ to view the details of the returns.

GSTR-3B vs GSTR-2A & GSTR-2B: Comparison

The following table shows the comparison of GSTR-3B vs GSTR-2A and GSTR-2B:

| GSTR-3B | GSTR-2A | GSTR-2B |

| A self-declared monthly summary return that includes details of outward and inward GST supplies, tax liability, and input tax credit (ITC). | An auto-populated return that shows purchases based on suppliers' GSTR-1 filings, providing real-time ITC information. | A monthly static ITC statement that is generated independently of suppliers' activities, helps to reconcile the ITC claimed in GSTR-3B with the credits available. |

GSTR-3B vs GSTR-1: Comparison

Here is a table that gives a comparison of GSTR-3B vs GSTR-1:

| Parameters | GSTR-3B | GSTR-1 |

| Meaning | It is a summarised return that contains details about the purchases and expenses of both import and export supplies. | It contains details of outward supplies or turnover submitted by the taxpayer either monthly or quarterly. |

| Due date for filing | 20th of every month despite the company’s turnover. | 11th of every month, if the turnover exceeds ₹1.5 crore and the 30th or 31st of every month following the last quarter, if the turnover is less than ₹1.5 crore. |

| Tax Payment | Settle tax liability before filing a GSTR-3B return. | No tax payment is needed when filing a GSTR-1 return. |

| Penalty for late filing or not filing | ₹20 per day for nil return and ₹50 per day for any additional transaction. | ₹200 per day (₹100 for CGST and SGST). |

Recent Changes in GSTR 3B

The Central Board of Excise and Customs (CBIC) introduced several updates in the 26th GST Council meeting that every taxpayer needs to follow:

- Taxpayers must provide details about the supplies made by e-commerce operators (ECO) in a new table, Table 3.1.1.

- Changes have been made to Part B and Part D of Table 4 in GSTR 3B. Part B now includes information on ITC reversals, while Part D is for ITC reporting.

- Previously, taxpayers had to manually input the amount for input tax credit utilisation. Now, the Challan can be auto-generated with just a few clicks.

- Taxpayers have the option to download a draft of their returns at any point during the filing process.

- Before submitting returns, all details can now be reviewed in a single tab view for easier verification.

Conclusion

Knowing what GSTR-3B is and how to file it is crucial for all registered taxpayers under GST. GSTR-3B filing reduces time spent on filing by over 70%. This includes supplies purchased from a supplier under the Composition Scheme, purchase of items and/or services that are either exempt from GST (they attract 0% GST)

Following the updated rules and keeping accurate records ensures compliance and smooth business operations. Ensure you know the deadlines and complete the filing process accurately to stay on top of your tax responsibilities.

💡If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

FAQs

Is it compulsory to file GSTR-3B returns?

If I have no sales or purchases in a particular month, should I still file a GSTR-3B return?

What is the turnover limit for GSTR-3B filing?

I have two GST identification numbers in two different states. Can I file 1 GSTR-3B for both registrations?

Is the invoice matching part of GSTR-3B?

Can I revise or reset Form GSTR-3B?

How can I file a Nil GSTR-3B?

Access the Form GSTR-3B – Monthly Return page.

Review the Draft Form GSTR-3B.

Submit the Form GSTR-3B.

Download the submitted return.

By

By